Junior Investing and Next Generation Planning at Netwealth

Designed to meet your family’s investment goals both now and in the future

Open your Junior Investment Account

Invest in your children's

future

Regular savings today could provide a financial boost in the future to help with the costs of further education or buying a home.

Protect the future of your

wealth

Our team of advisers are available to discuss how best to meet your goals and pass your wealth to the next generation.

Benefit from the Netwealth Network

to encourage whole family savings

Make investing a family affair with the Netwealth network where aggregating contributions helps to drive down annual fees.

Planning for the next generation

We can help you think about making financial plans for passing wealth to the next generation. Whether this be starting early with small, regular, tax-efficient savings, or considering larger gifting of surplus capital, there are sensible steps you can take to better prepare for transferring wealth and planning for future goals.

Junior Investment Accounts at Netwealth

At Netwealth we offer both Junior ISAs and Junior GIAs to enable you to start saving straightaway for your children's future. They are simple to set up and manage online.

As with a regular ISA, growth in a Junior ISA is tax free and proceeds are also eventually paid tax free. For the 2020/21 tax year, the Junior ISA allowance is £9,000 and as with all ISAs, the annual allowance should be used each year, or it is lost.

Junior GIAs (also known as Bare Trusts) offer a more flexible way to invest on behalf of your child with no limit on contributions. Money can be accessed by the trustees at any time for the benefit of the child.

Netwealth Junior Investing FAQs

Do you offer Junior ISAs?

Yes, we offer Junior Stocks and Shares ISAs. Only a parent or legal guardian can open a Junior ISA in the name of a child. The person opening the account will be the registered contact and will be responsible for how the money is invested. Although the Junior ISA must be opened by a parent or legal guardian, anyone can make a contribution as long as the total does not exceed the annual limit which currently stands at £9,000 per tax year.

Can I transfer existing Junior ISAs to Netwealth?

Yes, as a child can only hold one Stocks and Shares Junior ISA, any existing Stocks and Shares JISAs will need be transferred to Netwealth. Our client service team will send you a pre-filled form to complete and once received will take care of contacting your current provider.

Can I transfer Child Trust Funds to Netwealth?

Yes, as a child cannot cannot hold both a Child Trust Fund and a JISA, if they have a CTF this will need to be transferred to Netwealth where it will become a Stocks and Shares JISA. Our client service team will send you a pre-filled form to complete and once received will take care of contacting your current provider.

What happens when my child turns 18?

You cannot withdraw funds from a JISA. Once your child turns 18, we will invite them to open an ISA with Netwealth and their JISA will be converted into this adult ISA. They will then have full access to their ISA and may withdraw from it if they wish to.

Who can set up and contribute to a JISA?

JISAs must be set up by a parent or guardian of the child who are then termed the registered contact; however, anyone can contribute money to it.

Do you offer Junior SIPPs?

Not at present but it is something that we are looking to add to our product offering.

What is a Junior GIA or Bare Trust?

Junior GIAs offer a more flexible way to invest on behalf of your child than a Junior ISA. Unlike Junior ISAs, there is no limit to how much you can contribute to a Junior GIA or how many you can open on behalf of your child. The money held within a Junior GIA can also be accessed by the trustees at any time for the benefit of the child (e.g. to pay for school fees).

Are they taxable?

Although returns with a Junior GIA are taxable, you may be able to use the trust to make use of your child’s annual tax allowances for both income and capital gains. This is usually the case if the settlor of the trust is anyone other than the child’s parents, for example a grandparent.

As with a JISA, from an inheritance tax perspective, contributions to a Junior GIA could be counted as regular gifts out of excess income and so the capital would be outside your estate immediately.

What happens to the Junior GIA or Bare trust when my child turns 18?

At the age of 18, the Junior GIA can easily be converted into a regular GIA to ensure they remain invested. This can remain as a Bare Trust managed by the parent or trustees if the child agrees to this in writing once 18.

Can I withdraw funds from a Junior General Investment Account (Bare Trust)?

Yes, you can withdraw funds if you are the appointed trustee provided they are for the benefit of the child e.g. school fees.

Why choose the Netwealth Service

Expert financial planners to discuss your retirement and recommend the best approach.

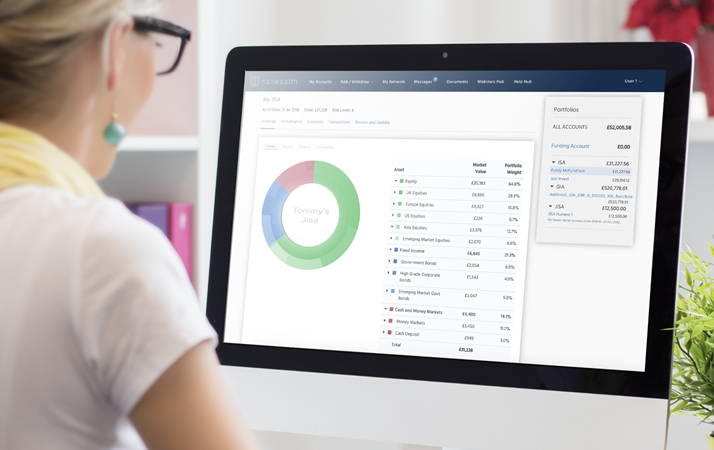

Powerful online service for you to plan for your children's accounts or other investments.

Seasoned investment team looking after your junior investment accounts.

Transparency - access and monitor all holdings in your portfolio 24/7.

Fully managed JISA and CTF transfers on your behalf and consolidation in one accessible place.

One off top ups and monthly direct debits available.

Opt for automated GIA to JISA transfers at the start of each tax year.

Institutional-grade security: all clients assets are separately custodied and ring-fenced.

I have been very impressed by the Netwealth service. It gives me greater transparency and at considerably lower fees than traditional providers, as well as the comfort of knowing that my SIPP funds are being professionally managed, with access to advisers if I need it.

Justin Rushbrooke

KC

The Netwealth service has provided me with financial peace of mind, with its very low charges and user friendly access to my account. I am extremely pleased with the switch.

Ina Machen

Retired Nurse