Netwealth portfolios have benefited from having an outsized allocation compared with a naïve market-cap weighted benchmark global equity structure (i.e. allocation to region simply based on market size).

Recent outperformance of Japanese equities

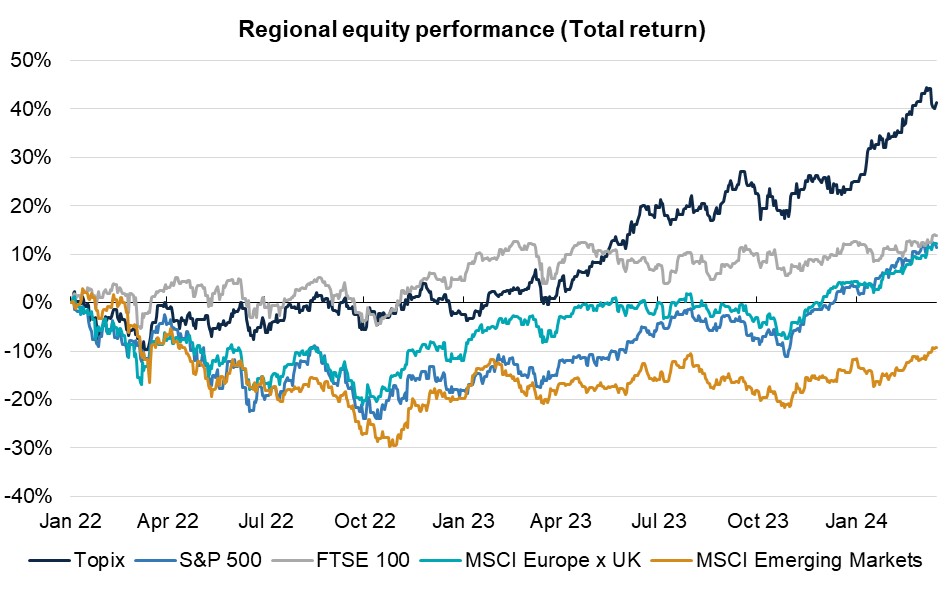

Chart 1: Japanese relative stock market performance. Total return in local currency from 01/01/2022. Source: Bloomberg, March 2024.

This strong performance can be attributed to a confluence of factors:

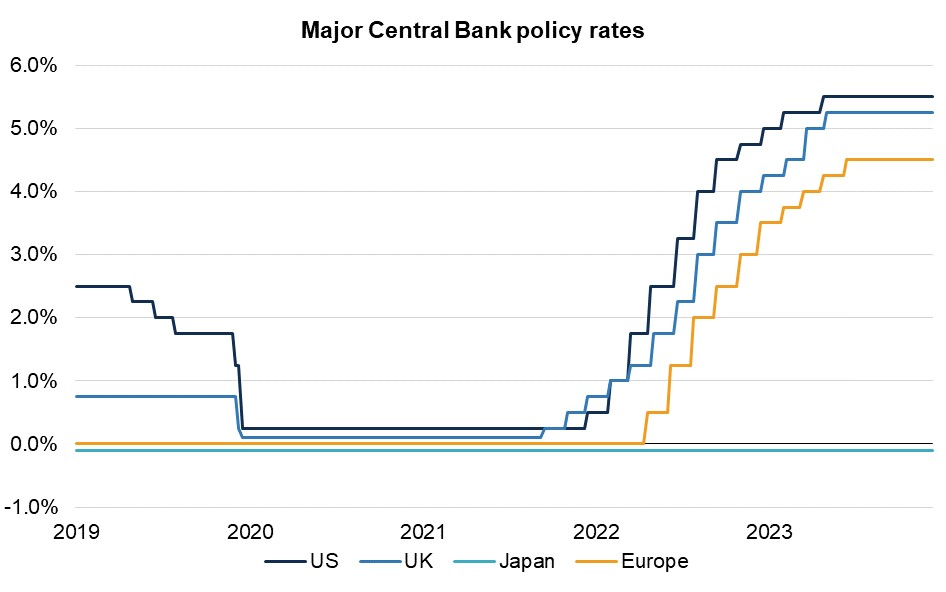

1. Tailwinds from ultra-loose policy and a weak yen: after Japan’s sustained decades of sluggish growth and non-existent inflation, the bout of elevated prices felt across the world in the aftermath of the pandemic was perhaps welcomed more so in Japan than elsewhere. While other central banks embarked on the fastest and most aggressive rate hikes in decades, the Bank of Japan (BoJ) remained an outlier, opting to maintain its accommodative stance, keeping policy rates unchanged.

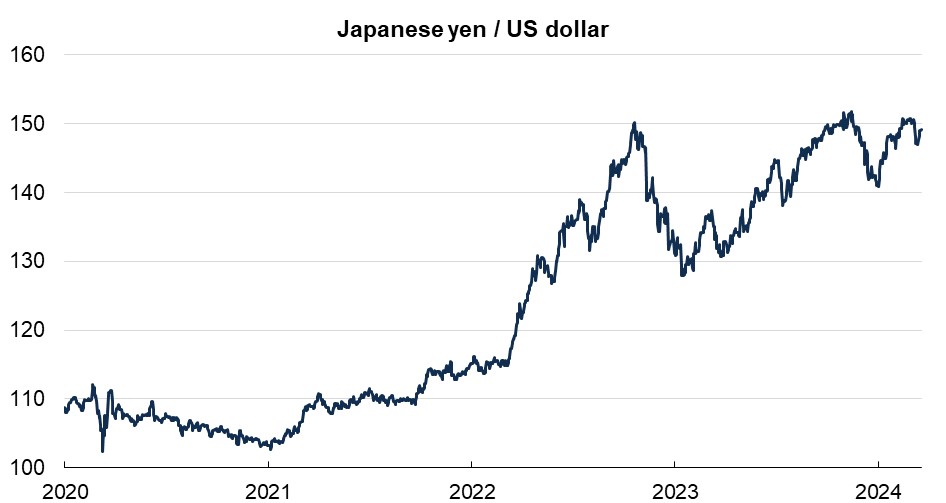

This stark contrast in monetary policy has led to a significant weakening of the yen, which is currently at very low valuations relative to history. Down over 30% against the US dollar since the start of 2021, this currency depreciation acts as a tailwind for Japan's export-heavy stock market. Cheaper exports make Japanese companies more competitive globally and boosts the value of their foreign revenues and subsequent profits.

Chart 2: Japanese yen vs US dollar. Source: Bloomberg, March 2024.

2. Economy emerging from stagnation: Following the bursting of Japan’s asset bubble in the early 1990s, the country has endured a period of anaemic growth and deflation dubbed the "Lost Decades". However, there are signs that these doldrums may finally be receding and that stimulative economic policies, largely rooted in the philosophy of “Abenomics”, may be working. Abenomics, the economic policy championed by former Japanese Prime Minister Shinzo Abe, is built on three key pillars known as the "Three Arrows" – aggressive monetary policy, flexible fiscal policy, and structural reforms.

Headline inflation in Japan has been above the BoJ’s 2% target for 22 consecutive months, and more recently there has been confirmation of meaningful – long absent – wage growth in the country. A potential end to the deflationary mindset that has discouraged consumer spending and corporate investment would be a welcome change that should stimulate growth and increase the value placed on Japanese assets.

3. Market reforms: boosting investor confidence: Beyond the before-mentioned broader economic reforms aimed at stimulating the wider economy, targeted changes aimed specifically at the Japanese stock market are further enhancing the appeal of Japanese equities. These reforms include:

- Reduction in unproductive corporate crossholdings: Traditionally, Japanese companies held significant shares in each other, limiting free float (the proportion of a company’s shares that are available for public trading on the stock market) and hindering corporate governance. Measures have been taken to encourage companies to unwind these holdings, promoting a more transparent and shareholder-centric market.

- Requirement for independent directors on boards: Designed to improve corporate governance and decision-making by bringing in external perspectives and expertise.

- Tokyo Stock Exchange (TSE) tackling the issue of low Price-to-Book (P/B): Enabled through a mix of public pressure, introduction of a three-tier market structure (Prime, Standard, and Growth) with stricter listing requirements for the top tier (Prime), and mandatory action plans for stocks with low P/B (which can signal to investors that a company’s stock may be undervalued). The TSE is pushing for increased transparency and capital efficiency. This is showing promising signs so far, with adhering companies seeing their stock prices rewarded.

- Nippon ISA: Offers tax advantaged investment in Japanese companies. This initiative aims to address the low investment rates in Japan.

Symbolic shift in policy direction but marginal magnitude of change

With indications of a resurging economy (including inflation consistently exceeding its 2% target and signs of meaningful wage growth), the BoJ is expected to embark on a policy tightening path by raising interest rates in the coming months. Japanese policy rates have been in negative territory since 2016 and this would be the first hike from the BoJ since 2007 – and therefore an optically monumental policy shift. This supports the argument for yen strength.

However, the expected changes are modest and have been long anticipated. The BoJ will likely proceed at a cautious pace, not to upset Japan’s fragile emergence from stagnation.

A large contribution to recent yen weakness can be attributed to its use in “Carry trades”, where investors borrow in low-interest-rate currencies like the yen to invest in higher-yielding assets. With significant interest rate differentials still set to be in place, there's scepticism about whether these marginal expected changes in policy rates will be enough to change investor preference in such strategies. This supports thinking that to see meaningful and sustained yen strength, a more significant shock is necessary.

Chart 3: Policy rate of major central banks. Source: Bloomberg, March 2024.

Our outlook - rationale for continued optimism

Despite the looming policy shift and strong performance in recent years, we remain relatively constructive on Japanese equities for several reasons:

- Strong fundamentals: Expected continuation of themes outlined above. The Japanese economy is exhibiting signs of improvement, and corporate governance reforms are gaining momentum, making it a more attractive investment destination.

- Valuations: Even after recent gains, at price-to-forward earnings multiple of around 16x, Japanese equities are not expensive relative to history or wider (US dominated) global equities.

- Accommodative policy: Even if Japan raises interest rates, monetary policy is likely to remain loose compared to other countries. This should continue to support economic activity and stock performance.

- Positioning: Though Japanese equities have had their fair share of limelight recently, positioning towards the country remains moderate and has room to grow as the fundamental story continues to gain traction.

In our longer-term strategic asset allocation, we prefer to take our exposure to Japanese equities on an unhedged basis. This means we consciously accept the currency risk, opting not to actively manage fluctuations in the yen's value. This preference is primarily due to the defensive characteristics the yen often provides in a portfolio context and its currently extremely low valuation.

Historically, the yen has acted as a “safe haven” asset, benefiting from inflows and strengthening when broader risk-assets face weakness, such as during periods of economic downturn. Foreign exchange valuations can notoriously stay expensive/cheap for an extended period but tend to revert to average valuations over a longer time horizon.

In the shorter term, however, we are cognisant that there's a compelling argument to be made for hedging yen exposure. Building on earlier discussion, hedging yen exposure offers potential carry trade benefits due to the wide interest rate differentials. This is a viable strategy if one believes there is a lack of a catalyst for sustained yen strength in the near future.

We will continue to monitor economic data from Japan and closely follow communication from the BoJ to assess the evolving situation.

Please note, the value of your investments can go down as well as up.