A brisk recap

Interest rates have risen sharply in just over a year for many countries worldwide. But it is the activity in the US (where the federal funds target rate range soared from 0.0%-0.25% in March 2022 to 5.0%-5.25% in June 2023) which propels much of the global market sentiment.

Now, however, we have reached a point where the next move in the US is less sure. This week, the Federal Reserve left rates untouched. We don’t yet know if this is just a pause on the path to higher rates, if we have reached the peak or could policymakers soon pivot and actually begin to lower rates? The answers, as the Fed widely proclaims, are in the data (inflation, jobs, earnings) but much of this is open to interpretation – and, sometimes, miscommunication.

We know the picture for economic growth is mixed and bond markets are convinced that a weak outlook will force interest rates lower again soon. Financial conditions have tightened, initially thanks to historic interest rate increases, but bank lending is also expected to retrench because of volatility in the sector (which we explored here).

At face value, equity markets appear more sanguine about the outlook lately. Profits have remained quite resilient despite fears of consumers facing dramatically rising costs. However, a lot of uncertainty has been obscured by the striking performance of the large tech stocks that dominate regular indices and the clamour around their earnings potential driven by AI. Outside this narrow group and a surge of interest in the turnaround of Japanese stocks, returns have been modest.

Source: Bloomberg, with Netwealth calculations. Returns shown in GBP terms.

Emerging markets have been disappointing. There is concern over the cyclical recovery in China stalling and the knock-on effects from that, as signalled by the weakness in commodity prices, despite repeated interventions from OPEC+ countries to put a floor under oil prices. This inertia can also be seen in the way European markets (woven into global growth and facing local economies flirting with recession) have begun to underperform the US again.

So where do we go from here?

Frothy AI sentiment aside, the answers will be in the data. Key areas to watch include:

International divergence

The sequencing of decisions on everything from interest rates to energy policies has the potential to reintroduce volatility to quiet markets. For now, markets have bought into the idea that European policymakers can continue to lift rates even when the US may be reaching their peak. Communication skills will be tested by markets as the Bank of England and the European Central Bank may seem to be swimming against the tide.

The US labour market

The jobs market in the US is proving to be remarkably resilient. Unemployment remains at close to record lows, bolstering consumer spending power despite overtly weak sentiment. However, too much ‘good’ news here could provoke an unpleasant reaction from markets as they read across the implications of a tight labour market.

Inflation

Headline inflation has been falling in the US and Europe thanks in part to falling energy prices, but ‘core’ measures are proving stickier than expected due to the picture on jobs. Again, this may force the Fed to do more to curtail the impact of inflation, and raising interest rates further is one of their main tools to achieve that goal. Closer to home, the risk is more elevated, with core inflation shifting to a 30-year high in April of 6.8%. The risk at home and abroad is that hiking interest rates too high could damage the economy and cause a recession – it’s a fine balance, but central banks may be tempted to err in favour of a slowdown as combating inflation remains their priority for now.

In the UK

UK bond yields have spiked higher again recently, forcing another wave of mortgage offer cancellations to those needing to review their home financing. As signalled by sterling strength, the catalyst here has been rate expectations rather than the market’s policy scepticism. Nevertheless, the state of the UK consumer in the lead up to an election year is worth monitoring. Valuations in the UK remain cheap, but identifying a catalyst to 'unlock' value is still tricky.

Corporate profits

It remains to be seen whether equity markets are correctly anticipating better times ahead for corporate earnings, or whether they will need to readjust to the more challenging economic environment envisaged by bond markets. The picture for valuations differs across markets and sectors; any positive surprises on earnings could be well rewarded.

How we have responded

We have maintained our investment approach of broad diversification throughout these testing times, and indeed since our launch in May 2016.

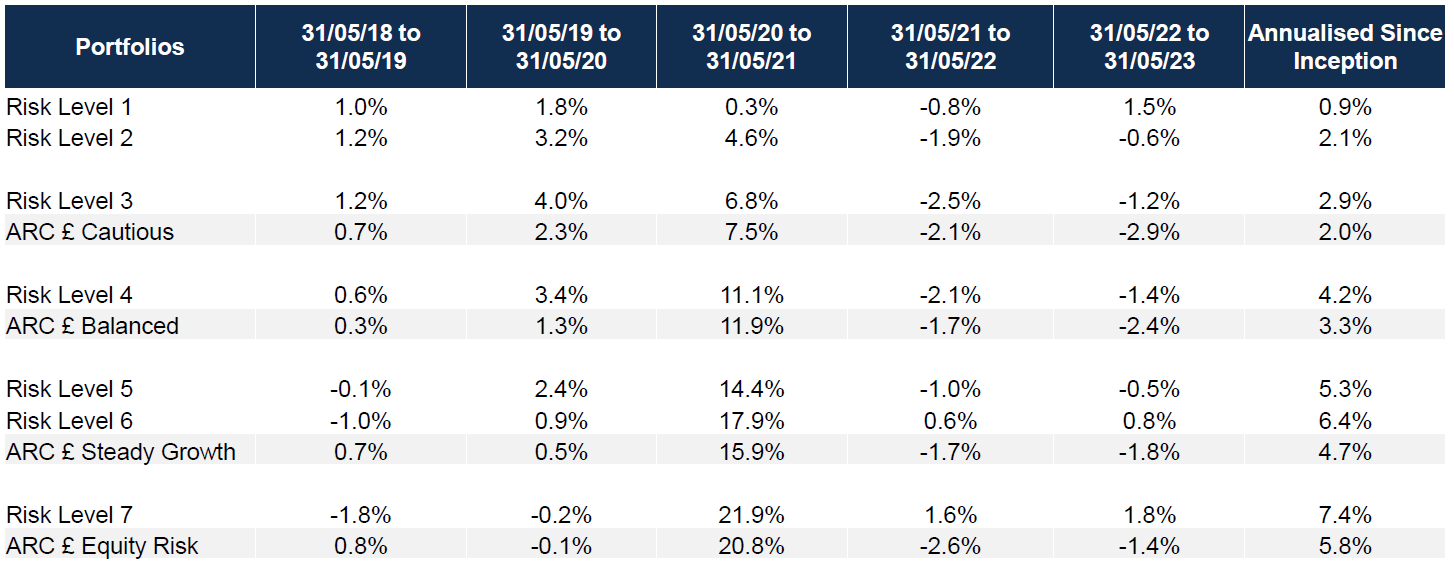

Over the past year, the continued progression to higher interest rates has meant that conditions remained tougher in fixed income markets than in equities. While the investment landscape has unsurprisingly been challenging, with muted returns across our GBP portfolios, we are pleased to say that relative performance has been strong.

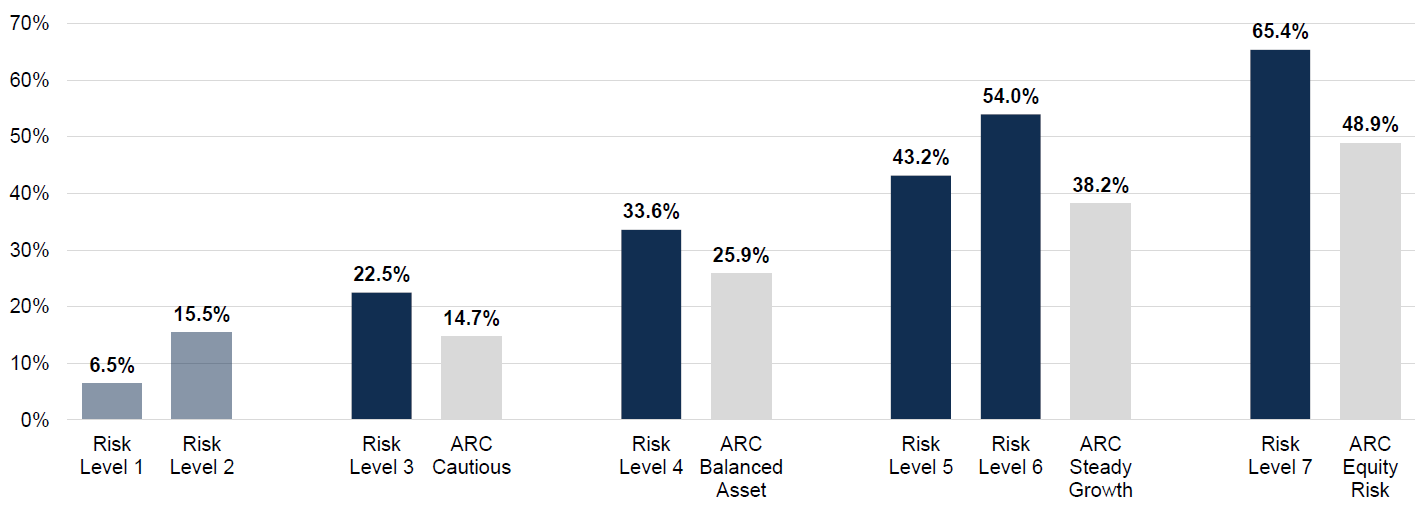

This has ranged from between 1% outperformance in our Risk Level 4 portfolio, to 3% in our Risk Level 7 portfolio compared to the peer group of leading wealth managers compiled by Asset Risk Consultants (ARC).

We can attribute these results to a combination of decisions. Regional preferences, reduced exposure to interest rate sensitive assets, currency management and the allocation to gold all played a role. Active choices like these are among the things we think about deeply as we invest. Consistently implementing this approach since we were founded seven years ago has helped us to deliver for clients.

Lower fees are also making a big difference. The performance tailwind from the efficient and scalable processes that enable lower costs is becoming increasingly visible over time, with a sustained advantage of up to 1.5% per annum in higher risk strategies. You can see what this has meant for our outperformance in the charts below, or you can read more details in our historical performance booklet.

Relative performance since inception

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg, Asset Risk Consultants & Netwealth Investments. Returns are of indicative live portfolios and are shown net of (i) all charges associated with the underlying investments and (ii) a Netwealth management fee of 0.35% per annum covering management, trading, custody and administration up to 30/04/2023 and 0.40% from 01/05/2023. Netwealth fees range from 0.70% - 0.40% pa depending on account size. ARC data can contain up to 3 months of performance estimates.

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg, Asset Risk Consultants & Netwealth Investments. Returns are of indicative live portfolios and are shown net of (i) all charges associated with the underlying investments and (ii) a Netwealth management fee of 0.35% per annum covering management, trading, custody and administration up to 30/04/2023 and 0.40% from 01/05/2023. Netwealth fees range from 0.70% - 0.40% pa depending on account size. ARC data can contain up to 3 months of performance estimates.

If you want to find out more about how our investment approach could help you achieve your long-term goals, please get in touch.

Please note, the value of your investments can go down as well as up.