Why Invest When the Future Is Uncertain?

We don’t need a crystal ball to tell us that the future is inscrutable. Whether we are talking about economic or market crises, social upheavals or so-called black-swan events, commentators seem to utter the words “We didn’t see that coming” with remarkable regularity. But if the future is so unknowable, should we embrace caution and not invest at all?

We may as well not play the prediction game

Failure to predict financial outcomes is nothing new, and unlikely to change.

For instance, an FT analysis looked at how many countries the IMF expected to be in recession for every year since 1991. It compared it with the number of economies that turned out to have actually contracted.

Over a 27-year period the IMF had predicted an average of five economies would succumb to recession each following year – in reality, an average of 26 countries a year contracted, highlighting how difficult it is for even one of the world’s most well-resourced financial organisations to make forecasts with confidence.

In the same article, a macro-economist at the IMF had to admit that despite an abundance of economic data, “the ability to predict downturns is dismal.”

This shortfall is not necessarily our fault. The sheer complexity of markets and economies, as described in Harvard Business Review, means there are “far too many variables to be predicted” by the human – and thus far, electronic – mind.

So we are constantly surprised. Property giants going bust. Trade flows going berserk. Energy supplies going south. Whether it is inflation figures coming in high, growth numbers coming in low, or even well-telegraphed failures (government and institutional) becoming reality – our ability to foresee events to our advantage is reliably dire.

Yet we can take steps to help us prepare for various macroeconomic and investment outcomes.

Predicting – no, preparing – yes

Our goal is not to predict the future, but to manage the uncertainty that comes with investing.

When we invest – as we describe in detail here – we take an approach that is based on Modern Portfolio Theory. We use historical data as a starting point for future risk and return behaviour from different assets, then adjust for the current market environment and how that may impact returns in the future.

Because we understand that a degree of uncertainty is baked into any of our assumptions, we frequently stress-test the expected characteristics and relationships between the assets we invest in. This helps us to be prepared if markets become more volatile, for whatever reason.

Risks are inherent in investing, which is why we pay so much attention to the various ways they can take hold. These can include risks associated with markets, events, specific instruments and liquidity. Each of these is carefully monitored and managed by our Investment Committee, who decide if any action needs to be taken.

Outside of the Investment Committee forum, we vigorously debate the potential effects of any economic, political or social risks and assess how they could potentially affect investments.

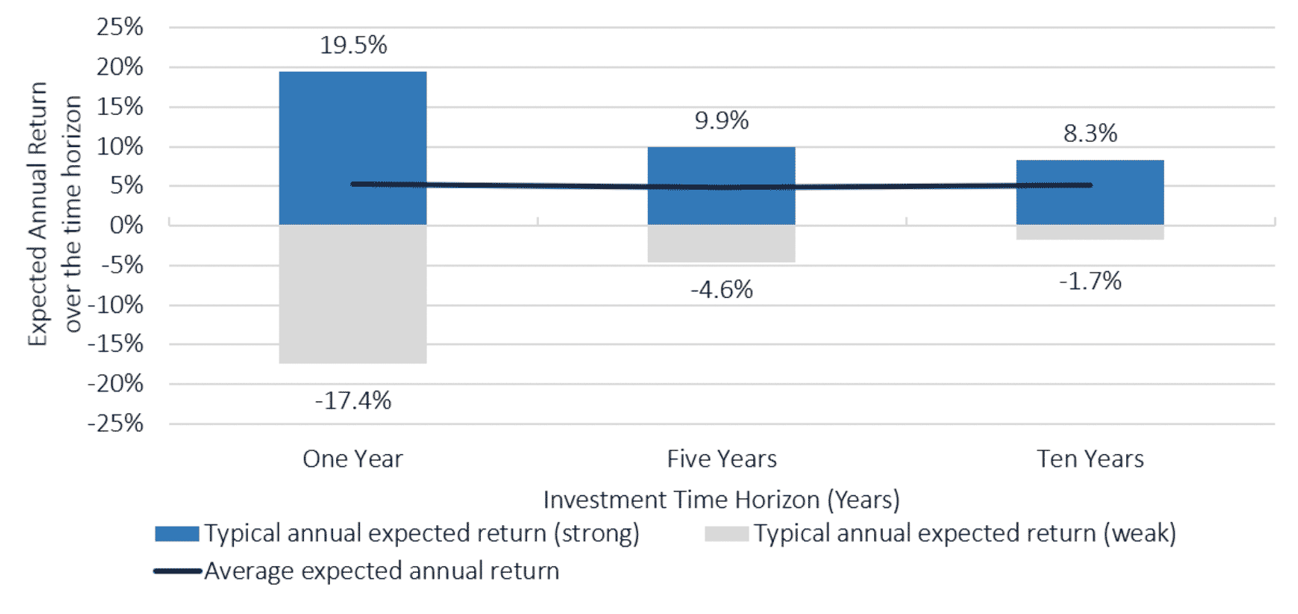

However, as the graphic below shows, we expect the extremes of market performance to diminish when viewed over time. So, the longer the time horizon an investor has, the more the effects of immediate risks are reduced. As long as an investor calibrates their investment horizon accurately, the shorter-term market rallies and falls become less important to the end outcome. We can monitor and manage portfolio risks, but we can’t negate market behaviour.

Potential range of performance outcomes based

on Netwealth Portfolio Risk Level 7

Simulated future performance numbers should not be relied upon as an indicator of future performance.

Why you should invest, irrespective of what you can know

There are many things we can’t know but can prepare for. We can also refer to certain reliable assumptions to help us make informed judgements.

We can state with reasonable certainty that inflation will meaningfully erode the value of your capital over the long term and that investing has been proven to offer a strong buffer against that decline over time. Frankly, there is little alternative to investing – and staying invested – if you want to preserve and grow your wealth over time.

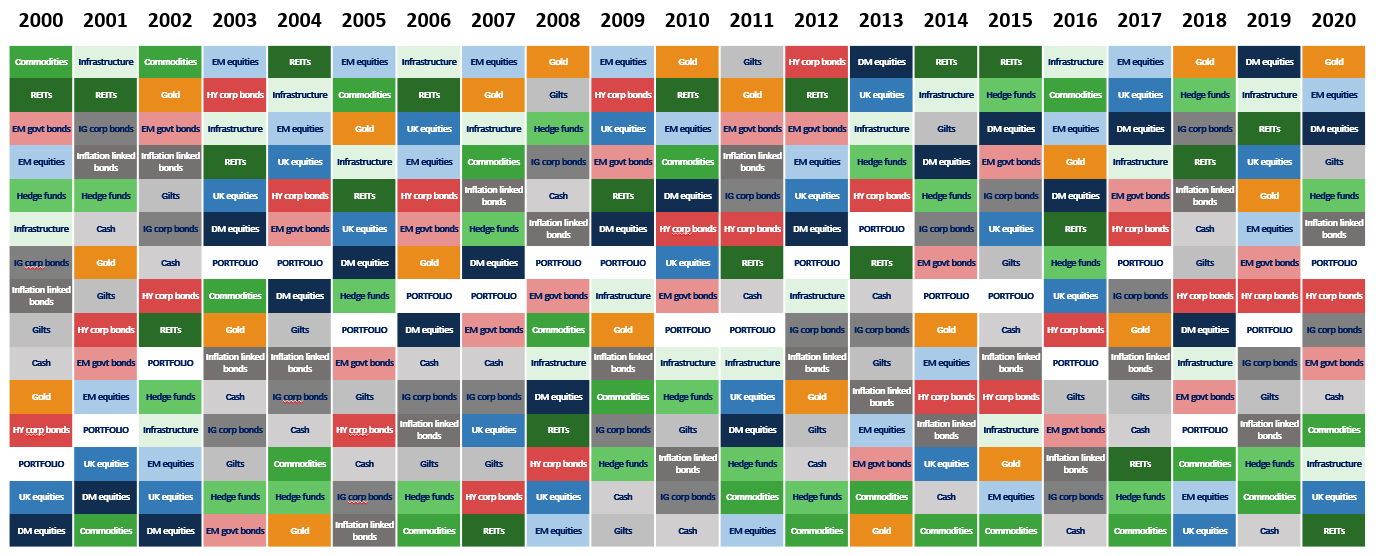

To further prepare against the unknowable – whether supranational discord, natural disasters, or one of the many countries facing recession each year – we can also assert that it is much better to invest in a diversified portfolio. Again, it’s impossible to foresee which assets, and where, will perform best each year, as this chart below shows rather conclusively.

It therefore makes sense to spread risk widely, and the sources of potential positive returns.

Managing worry

We don’t know whether inflation will persist or be transitory, we can’t predict exactly how markets will respond to unplanned events or whether local issues will reverberate internationally. Apart from death and taxes, we really have no notion what lies ahead.

Yet just because the future is unknowable, doesn’t mean it’s uninvestable. It’s only natural to think that troubling news will affect our financial outcomes, but it’s useful to understand that these fears may be amplified.

Despite external factors being beyond our control, we can broadly stay on track to achieve our goals, and it may therefore be in our best interests not to worry so much about what we cannot know.

Please note, the value of your investments can go down as well as up.