What You Can and Should Control When Investing

We may worry about events outside of our control in our lives overall and the same feelings can apply when we fret about money. But focusing on the factors we can control means that we are being proactive and can also bring about considerable rewards through an improved financial outcome.

The power of being focused

To ‘control the controllables’ is a common refrain among top athletes and sports psychologists, but what does it actually mean? In a nutshell it advocates that a sportsperson has a better chance of succeeding if they try and ignore factors outside of their control – such as the skills of their opponent, the weather, crowd noise and so on. Instead, they should focus on what they can control: their own game, attitude, mental approach and more.

You can apply the same thinking when you invest. For example, you can’t control such things as inflation, market performance and your life expectancy (although you can model for them). Yet you can control other factors which have a meaningful effect on your future financial outcome, and you should pay great attention to these throughout your life.

Your fees – to boost growth potential

Paying more than you should in fees is an easy trap to fall into – because as a proportion of an overall investment portfolio, these charges seem negligible. Investors may also think that paying more in fees (to a ‘star’ fund manager, for example) can lead to better returns but consistently the evidence does not support this assumption. So while you can’t avoid paying fees to manage your money, these charges are controllable.

Over 10 years, for example, you could be over £17,000 better off for every £100,000 invested if you saved 1% in fees by using a more competitive wealth manager like Netwealth (comparing all-in fees of 1.65% vs 0.65% per annum, assuming an annual gross investment return of 5%). For a personalised assessment, choose the sums and timeframes that apply to you using our fee saving calculator.

Simulated historic and future performance numbers should not be relied upon as an indicator of future performance.

Your time in the market – to avoid missing out

To act on news or react to events after the market has adjusted is a natural instinct, and because many investors (like most people) are prone to cognitive and emotional biases, it’s easy to believe that you can make decisions that benefit from a timely intervention. This kind of thinking is typically a mistake.

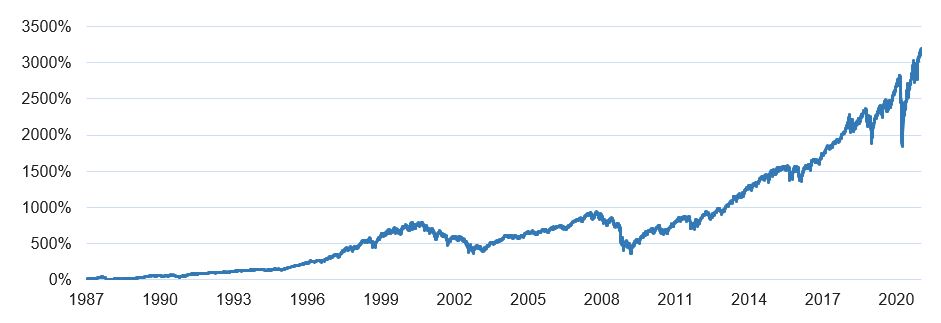

You may have heard the often-repeated wisdom of spending time invested in the market and not trying to time the market. Here is a good example of why. From the end of 1986 to the end of 2020 the S&P 500 produced total returns in dollars of 3,196%. But if you missed the top 10 trading days over this period you would only be up 1,372%.

Many of these top 10 days (including two in 2020 alone) occurred when investor sentiment was negative, therefore, trying to time when to be in or out of the markets is very difficult and can be extremely costly.

Markets can be volatile, but generally climb the wall of worry and trend up over time

Source: Bloomberg, Netwealth. S&P 500 Daily returns from 31st December 1986 to 31st December 2020.

Please note that past performance is not indicative of future performance.

Your portfolio diversification – because asset performance varies each year

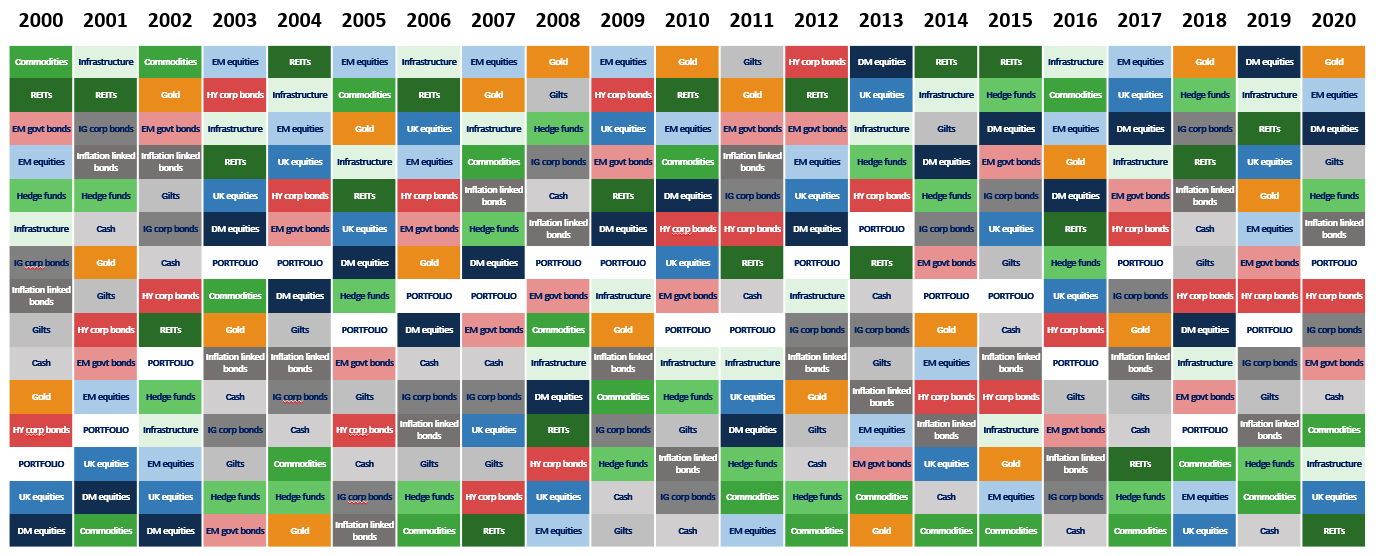

Why can’t you just hold the best performing growth stocks? Or focus on a fast-growing emerging market? Or stick with gold after it has been on a good run? Because from year to year different assets deliver different levels of returns – but it’s difficult to predict in the short term which assets will perform well and when.

A diversified portfolio reduces extremes and smooths the path of returns. Individuals may find it difficult to construct and continuously monitor their own portfolios cost-effectively, or to find the time to do so – which is why so many look to firms like Netwealth to judiciously diversify their money at the right cost.

The chart below shows just how varied asset returns can be over time, with the best performing assets (at the top) each year changing quite regularly.

It is hard to know which asset class will be the top performer in any given year

Source: Netwealth, Bloomberg. Market returns in GBP, some assets reflect currency hedging.

Please remember when investing your capital is at risk

Your use of tax wrappers – to make your money work even harder

Tax wrappers are designed to encourage people to invest, and they are often underused – but you shouldn’t neglect their value. Putting your savings in a tax-free wrapper such as an ISA can greatly improve your net returns.

For example, £100,000 invested for 10 years could be worth £127,000 when subject to the higher rate of income and capital gains tax. Yet if this money is invested in an ISA – paying no tax – it could be worth £153,000, nearly double the total return on investment. (Assumes long-term median expected returns investing in a Netwealth Risk Level 6 portfolio, with tax marginal rates of 40% on income and 20% on capital gains. Source: Netwealth.)

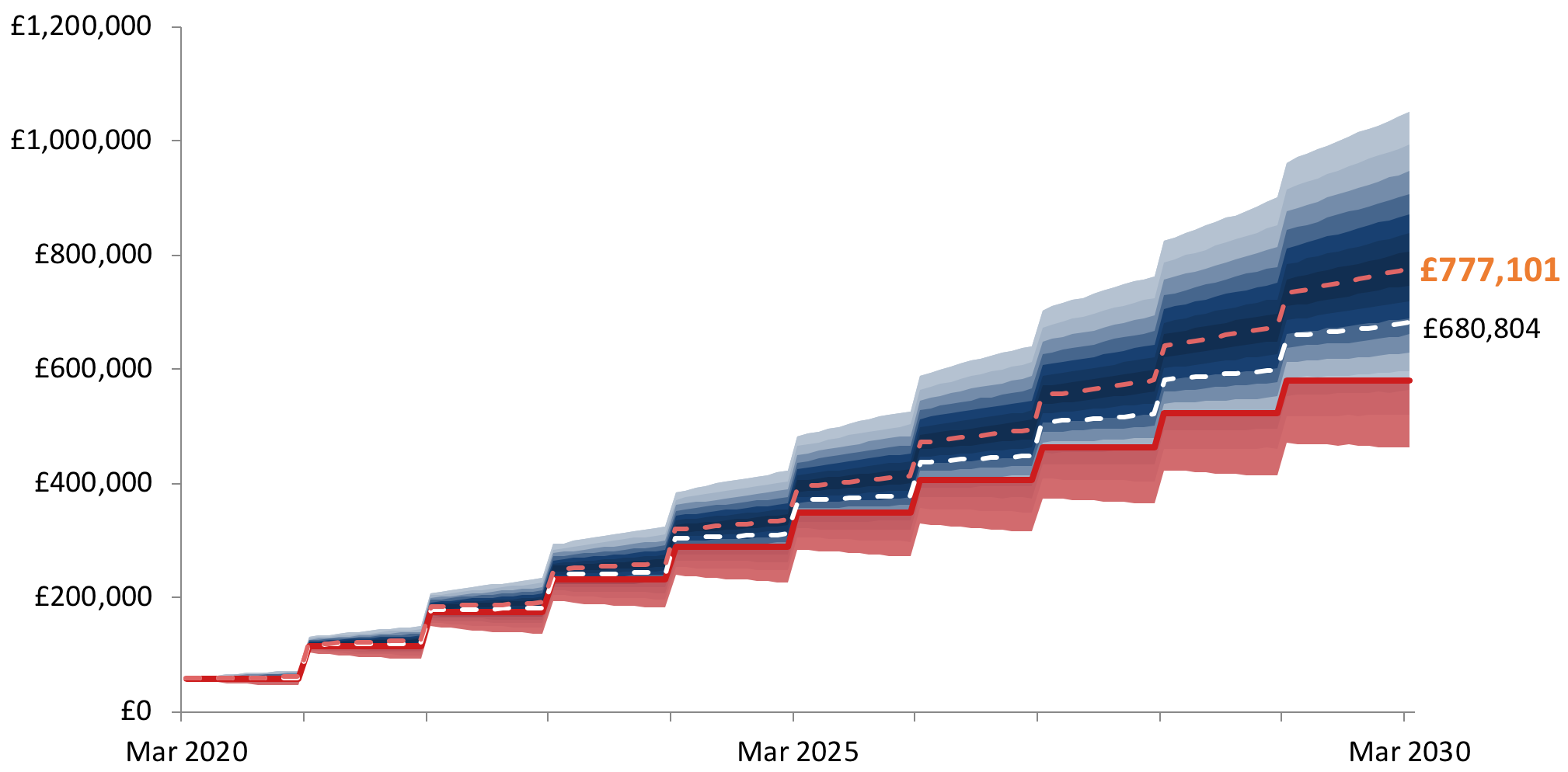

The boost that a family can get if they each use their tax allowances each year is quite remarkable. We show below, for instance, how much better off a family of four could be in only 10 years by using their allowances compared to investing the money outside of a tax wrapper.

Source: Netwealth

Simulated historic and future performance numbers should not be relied upon as an indicator of future performance.

This outperformance – of nearly £100,000 – is due to the fact that a family of four can shelter £58,000 each year from the taxman (£20,000 per adult and £9,000 per child in a JISA). (Assumption based on returns from a Netwealth Risk Level 7 portfolio and subject to higher-rate tax.)

Experience the benefits of taking control

The volatility of investing – and the commentary around it – can sometimes be troubling and cause us not to do the right thing with our money. Yet even the factors you can’t control should be frequently assessed and modelled (which you can do here) so action can be taken where necessary.

The four factors listed above – fees, investing and staying invested, being diversified, and using tax wrappers – are very much within your control and can have a huge impact on investor outcomes. To focus on these is time well spent and dramatically increases your chances of investment success.

Please note, the value of your investments can go down as well as up.