UK election 2024— Our views on Domestic Assets

UK investment assets are typically affected by local and global factors, often being particularly influenced by events in the US. As we now approach the UK general election, however, let’s examine the potential impact of this national event on UK asset prices.

Post-election economic and financial outlook

The UK is one of a number of countries facing elections in 2024. India, Mexico, and South Africa saw votes earlier in the year, while France is holding its own surprise National Assembly vote, with the first stage held this past weekend. Attention will turn in due course to the US in the lead up to the presidential election in early November.

There is always a little more focus on domestic assets when the political backdrop changes, although experience tells us that often it’s only truly seismic political events which have a significant bearing on market outcomes.

In an article entitled ‘Post-election economic and financial outlook’ our chief economic strategist Gerard Lyons outlined his views on the post-election economic landscape. He identified that the likely Labour incoming government is right to focus on the need for a pro-growth strategy. Investment will be a key feature, but the trend economic growth rate and the fiscal picture are very different to when Labour won the first of three elections in 1997.

In 2024, the domestic and global financial market backdrop is currently more subdued than it has been for much of the Conservatives’ period in office. We can note the asset market uncertainty and volatility prompted in succession by the global financial crisis, European sovereign debt crisis, the EU referendum and subsequent UK political crisis of 2016-2019, the Covid-19 pandemic, global inflation and war in Ukraine.

Now, however, alongside improving gauges of economic confidence and slowly tapering inflation fears, equity market volatility is low, many currency relationships are range-bound, and corporate bonds demonstrate scant concern for future defaults. Even interest rate traders believe the outlook is more predictable after the belated but sharp moves in borrowing costs which started in 2021.

The Labour party have held a commanding lead in election polls for some time, so this low volatility environment suggests any potential uncertainty from the likely change in government to a Labour administration is thought to be ‘in the price’ by markets.

So, if we don’t see the election as an immediate catalyst for dramatic change for markets, what is our view on the different aspects of the UK investment landscape?

Interest rates

The outlook for interest rates in light of high and persistent inflation has long been a focus for the UK and other developed markets. As we have mentioned before, we believe that future inflation and interest rates will be higher than the post global financial crisis period.

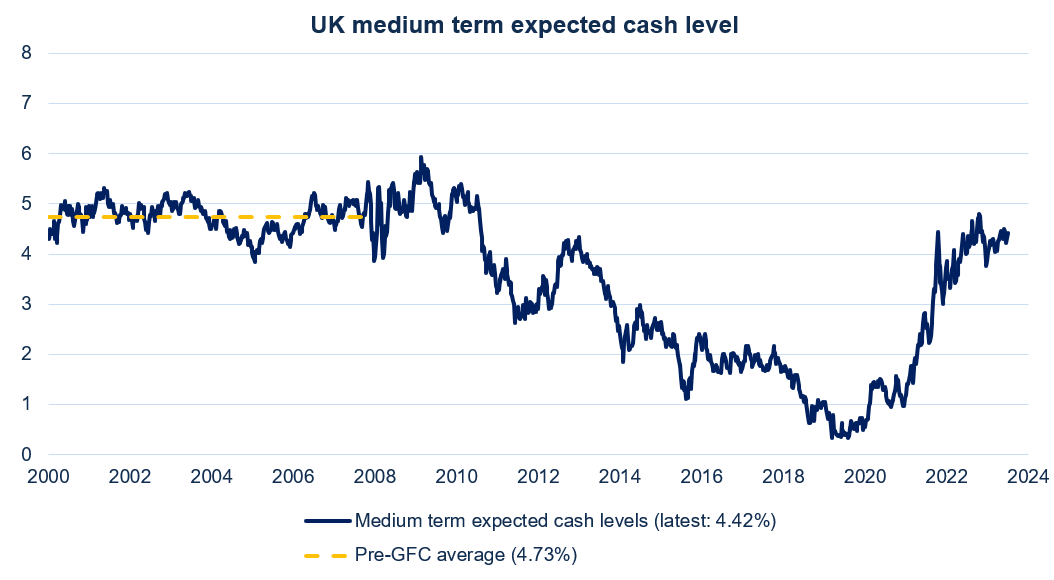

It helps to strip away the short-term twists and turns. By looking at the current market pricing for 5 years average cash rates in 5 years’ time, we can see that market expectations have finally reached pre-crisis levels for returns on cash.

We have written before about the long-term outlook for cash above inflation, known as “r-star”. We view a return to positive real cash rates as an attractive starting point for investment.

Source: Bloomberg, with Netwealth calculations. Expected medium term cash is calculated as the market rate for an annualised 5 year GBP interest rate, starting 5 years in the future.

Sterling

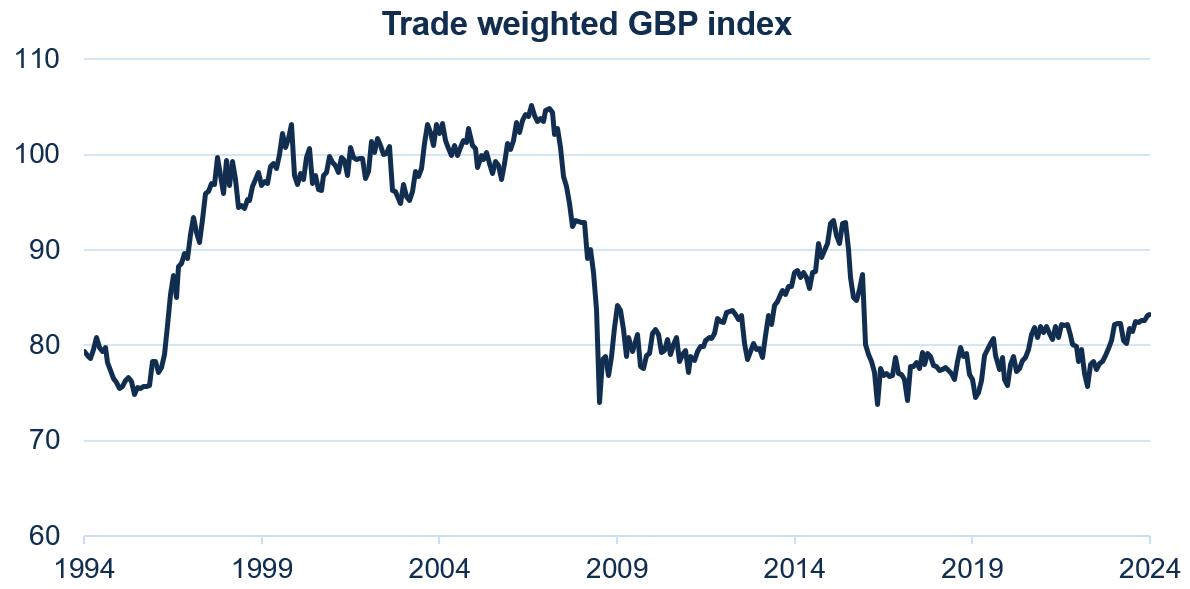

We see sterling traditionally as a ‘risk-on’ currency. That is to say that outside any UK-specific events (of which there have been plenty in recent years) and longer-term fundamentals, the value of sterling tends to increase when markets are optimistic about global growth trends, and depreciate when the path of growth is less clear.

As portfolio managers, the role of international currencies becomes extremely important, as we discuss in more detail here.

Our current view on sterling is that it is cheap on most metrics, but not outrageously so, given the UK’s large current account deficit and its growth and inflation profile. We don’t see the election as presenting an immediate political risk to sterling, if the consensus view of a solid Labour majority materialises (as opposed to a landslide victory which could drag future policy further from the centre).

If anything, there’s a role reversal from political risk hitting the euro this summer, rather than sterling being in markets’ crosshairs.

The key concern for sterling could, however, come from the tepid outlook for growth and a reacceleration of interest rate cuts. This is not our base case, but when seeking to hedge our Japanese yen exposure this year, we chose to allocate to US dollars rather than sterling on this basis.

Source: Bloomberg and Bank of England. Index is a calculation of value of Pound sterling against currencies weighted by national trade, as per Bank of England, 2005 = 100.

Bonds

We are more positive on UK government bonds (gilts) and have recently increased portfolios’ allocations. Strategically, real yields have reached higher, more attractive levels than has been the case for a long time. Gilts could be pressured further by more expansive fiscal policies than markets expect from Rachel Reeves as the likely Chancellor.

However, on a more cyclical (short-term) view, the outlook for government bonds will hang in the balance of the Bank of England’s reaction to new economic releases. For a while, our concern has been that the Bank is too focused on the current picture rather than managing monetary policy in anticipation of what the future impacts of existing policy will be.

However, we do believe that at current pricing, investing in gilts is more compelling for client portfolios compared to corporate bonds. Broadly we find the opportunities across the corporate bond spectrum unattractive, though there is little to suggest that this relates to the UK market specifically.

Tight yield spread levels mean that any diversion from the current benign backdrop for riskier assets will penalise investors in corporate bonds. This was evidenced by the volatility that crept into GBP corporate indices following President Macron’s unexpected announcement of French elections.

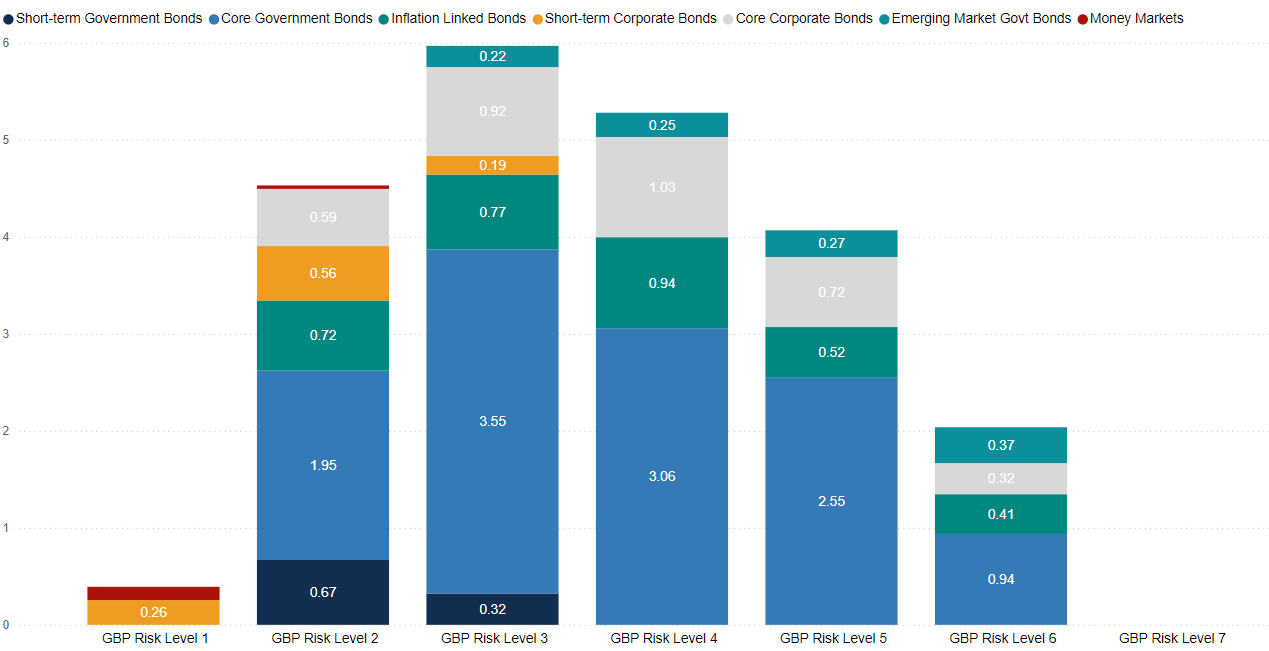

Our portfolios are now heavily weighted to government issuance, split between gilts and inflation-protected US Treasury bonds.

Duration profile of Netwealth GBP Portfolios

Source: Netwealth. Data as of 26th June 2024.

Portfolio duration, measured in years, reflects the sensitivity to changes in bond yield levels. A duration of one year implies that a portfolio will lose 1% of value from bond yields increasing by 1%, all other things being equal.

UK equities

We believe UK equities offer good opportunities for investors relative to global markets. This is based on their standalone characteristics of attractive valuations and the potential for improving domestic conditions. On a sector-neutral basis, the UK’s discount to global markets rests at 25% when using next year’s expected profits numbers. Unlike gilts and corporate bonds, the domestic equity market is not being given the benefit of the doubt, and does not reflect the possibility of economic recovery.

This negative view of the market’s prospects is thanks to disappointing historic earnings delivery, an uninspiring sector mix, and political turbulence. Structural factors such as outflows from specialist UK equity funds and defined benefit pension fund ‘de-risking’ have helped fuel negative performance momentum in the past.

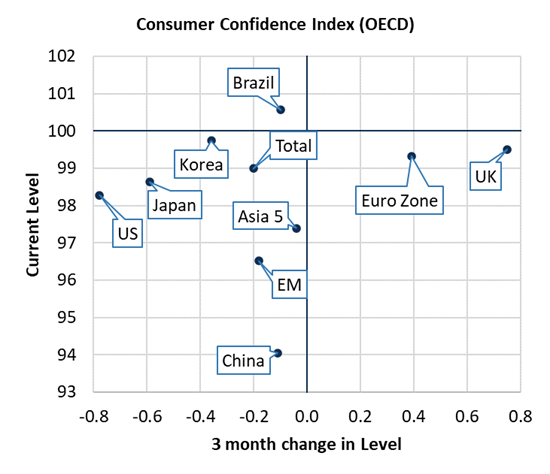

Source: Bloomberg and OECD, with Netwealth calculations.

Identifying what could change perception around different markets is always difficult. However, we think there are three key reasons for less pessimism:

- A more predictable inflation picture that prompts the Bank of England to reduce interest rates.

- Improving consumer sentiment.

- Better earnings momentum.

These factors could all help to unlock the latent value, especially in the small and medium sized companies of the FTSE 250 Index. Sympathetic regulatory reform from an incoming Labour government to encourage domestic market ownership is more of a long shot – but it could provide longer-term market support, and give sentiment a useful boost.

It is possible that there could be changes to encourage UK pension funds to invest more in UK assets, but it is unclear what format this might take, although likely linked to Labour’s new National Wealth Fund, the aim of which is to boost longer-term investment in infrastructure rather than listed equities.

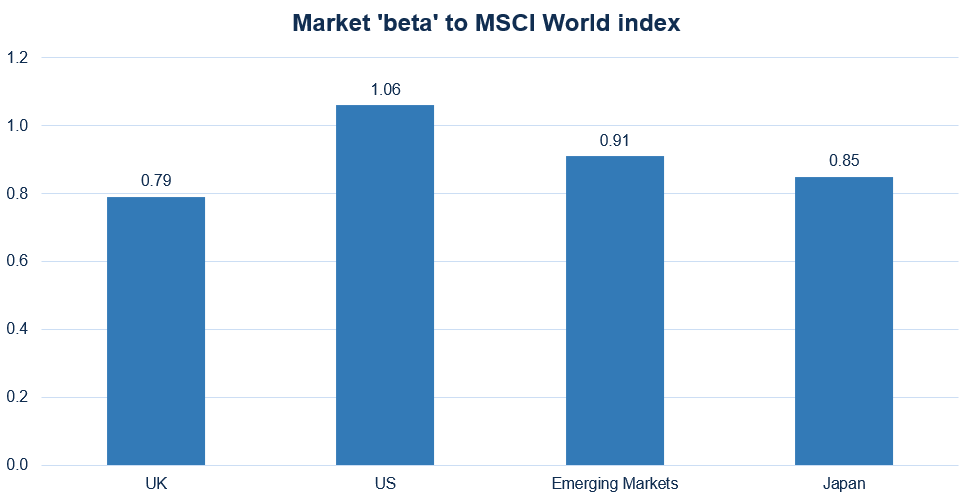

Equally importantly, the expected contribution of the UK market to wider portfolio performance characteristics is also appealing. The sector composition of the FTSE 100, with its bias to commodity assets and more defensive areas such as consumer staples, means that it often performs well when global markets are struggling, seen most recently in 2022.

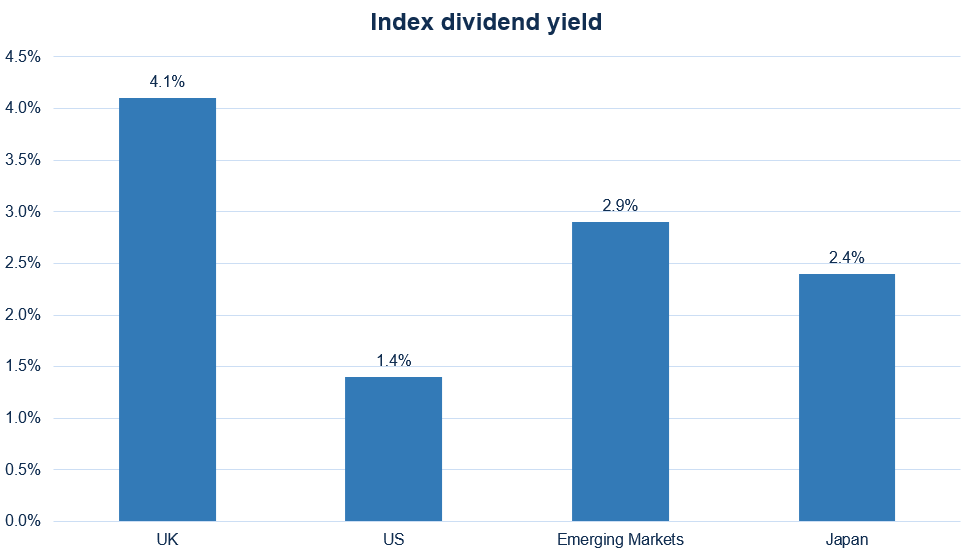

Coupled with the highest dividend yields of all the major markets, this gives the UK a returns profile which has trailed global indices in recent years, but is helpful when constructing portfolios to navigate through changing market backdrops.

Source: Bloomberg. Data as of June 2024.

Source: JP Morgan. ‘Beta’ is an expression of sensitivity to global market moves. Data as of June 2024.

Particularly with the year of elections in mind, the UK could find itself in the unfamiliar position of offering lower levels of political uncertainty than many other markets. Certainly, the perception of a moderate, Starmer-led Labour administration could be attractive relative to the more extreme political backdrop in the eurozone.

Please note, the value of your investments can go down as well as up.