Showing cracks – why you shouldn’t rely on property alone to fund your retirement

With frequent declines in stock markets around the world this year, and seemingly persistent volatility, it’s only natural for investors to consider alternative options to fund their retirement. Investing in property is popular as it is an easily understood and tangible asset, but we should always be careful of putting all our eggs into one basket – especially if they are starting to show cracks.

The landscape is getting a lot tougher for buy-to-let investors. A recent analysis in The Telegraph – “Landlords will lose money by next year as buy-to-let Britain falls apart” – suggests an average landlord on the higher rate of tax will see their investment turn a loss if the Bank Rate hits 2.75%.

Homes & Property (in the Evening Standard) among others has also highlighted the difficulties for property, especially in a recession. Many of these fears surfaced even before the Bank of England raised interest rates in June to 1.25%, the highest since 2009 – with more hikes expected in 2022 as it battles inflation.

Property prices have held up remarkably well in the UK. Perhaps worryingly so. As evidenced in the run up to the Great Financial Crisis in 2007-08, the assumption they will keep rising is a dangerous one to make. And with UK inflation rising at its fastest rate in 40 years (to 9.4% in the year to June), there will be even more pressure on budgets and spending choices.

But even before we crunch the potential figures, it’s worth looking at the differences between investing in property and a pension.

Key differences between BTL property and pensions

To ensure your retirement fund is as efficient as possible you should consider the differences between property and pensions – and the trade-offs you may have to make to reach your objectives.

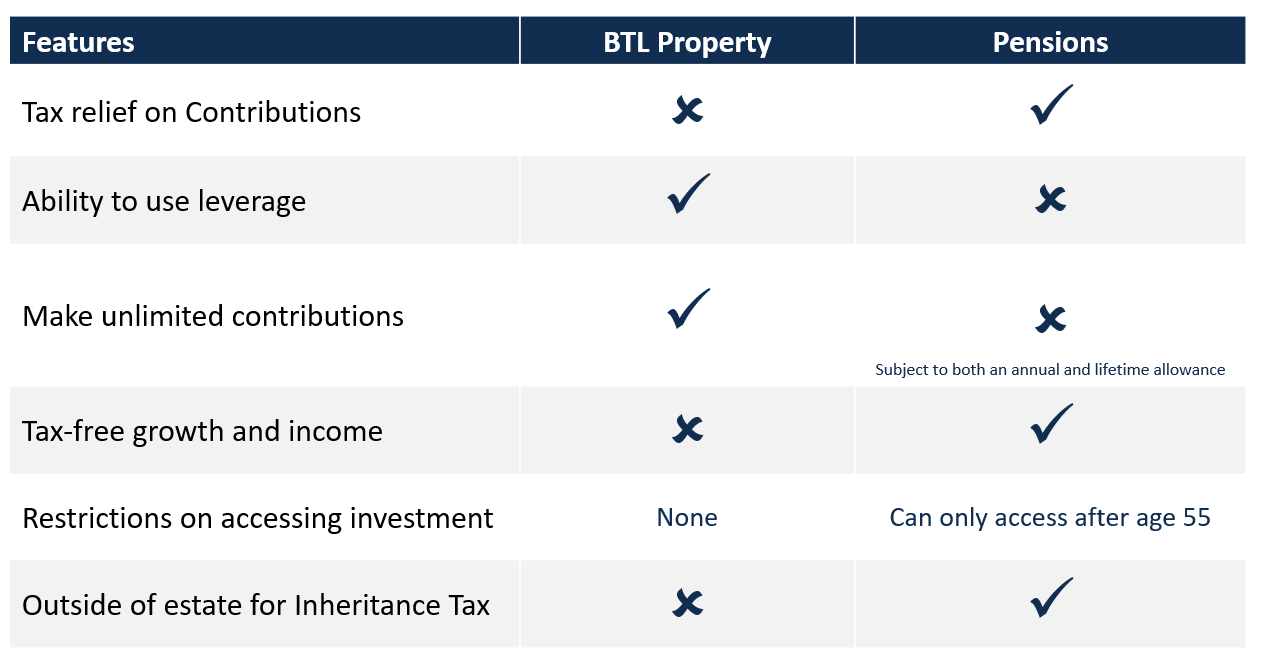

The table below covers the main differences between buy-to-let properties and investing in a pension. As you can see, property affords investors a great deal of freedom: they can use leverage, invest as much as they like and access their investment whenever they choose.

While you have the freedom to populate your pension with a wide variety of assets it is the tax advantages of pensions that are compelling: tax relief when you pay in, tax-free growth and income, and the assets accrued are not subject to inheritance tax.

Yet there are constraints for both assets – you can only contribute so much to a pension and while you can sell a property whenever you wish, it might be impractical to do so quickly and for the right price.

So to make the most of your retirement fund, understanding the intricacies of each asset and the interplay between them will help you to maximise the opportunities from both.

Tax rates and rules to be aware of

Regulations continually evolve. It is therefore crucial for those who are planning for retirement to be aware of the rules which could have a material effect on their future. Knowing about the changes can also help you to be more agile and adapt – to explore your options, and to maximise the benefits from both property and pensions.

Pension rules and tax rates

- The annual allowance is the amount you can contribute to a pension each year and receive tax relief. It is currently set at a maximum of £40,000, if you have sufficient earnings, and for higher earners this can be tapered down to as low as £4,000.

- The lifetime allowance (LTA) is the overall limit of pension funds you can accrue over your lifetime before an additional tax charge could apply. It is currently set at £1,073,100 and has been frozen at this level until 2026. Each time you take benefits from your pension the amount crystallised will be tested against your LTA. There is then a final test at age 75.

- Pension freedoms have given you lots of flexibility in how you access your retirement savings after age 55. You can crystallise benefits in tranches, take tax-free lump sums, variable income amounts or leave them to grow for the future.

- Pensions are outside of your estate for inheritance tax (IHT) and can be accessed by your beneficiaries completely tax-free if you pass away before age 75, or at their marginal income tax rate after 75.

This is not financial advice. Tax rules are subject to changes and you should consult a tax adviser before acting on any information in this article.

Tax and rules for second properties

- 8% of additional Capital Gains Tax (CGT)on top of your marginal rate taking the top rate of CGT to 28%.

- 3% of additional Stamp Duty Land Tax (SDLT).

- Transition from mortgage interest deduction to Mortgage Interest Relief. Relief tapered down to only 20% in 2020/21.

- Furnished Holiday Lets are treated as a business and so can be eligible for full mortgage interest deductions and can benefit from entrepreneur’s relief on any capital gains, potentially reducing the tax rate to 10%. However, there are strict rules on how a property qualifies as a furnished holiday let which you will need to keep in mind.

This is not financial advice. Tax rules are subject to changes and you should consult a tax adviser before acting on any information in this article.

Saving for retirement head-to-head – property vs pensions

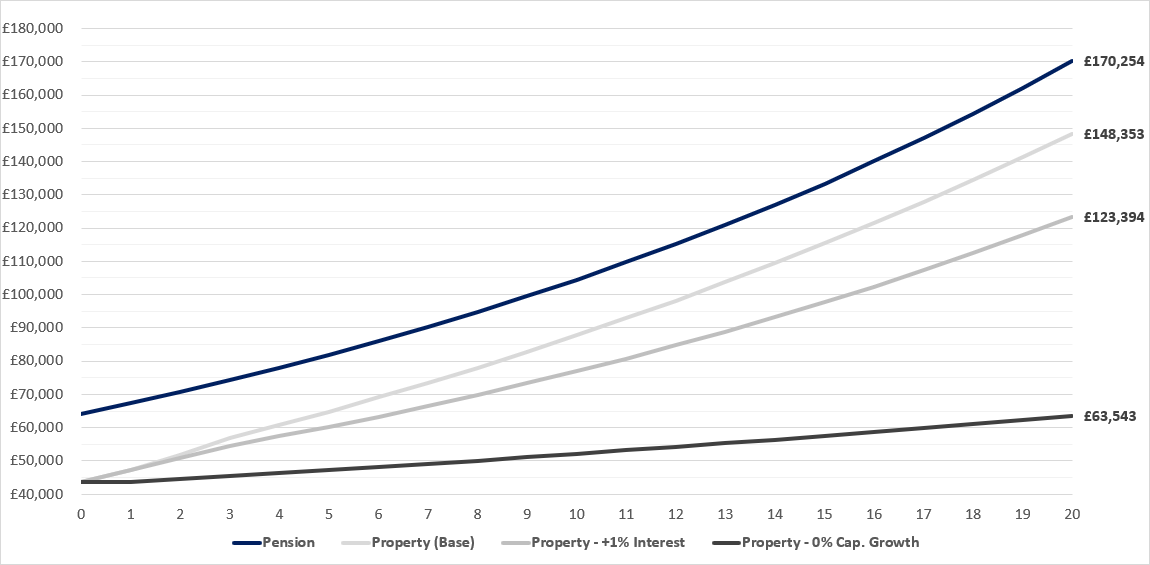

The example below shows how unless capital growth on property is high, it is unlikely to do as well as a pension (the top two lines on the chart). It also shows the impact a 1% interest rate rise can make, or if property capital growth dropped to 0%.

Assumptions:

Pension

- £55,000 net contribution means a gross contribution of £91,667

- Growth in the pension of 5.0% net per annum.

- On the final winding up of pension, 25% is tax-free, and the remaining 75% is taxed at 40%.

Buy-to-let property

- £55,000 is used as follows:

- £46,371 for deposit (25% of property worth £185,485)

- £6,774 for stamp duty

- £1,855 (1%) for purchase fees (solicitors, surveys, furniture)

- Gross rental yield – 4.4% (as per the Telegraph article above)

- Mortgage interest rate – 2.5% (current best buy figure)

- Letting costs – 15% of rent (letting agent, maintenance, insurance, void periods etc)

- Capital growth on property – 2%

- Cost of selling property – 1.5% (estate agents and solicitors)

- Income tax rate on rent – 40%

- Capital gains tax rate on sale proceeds – 28%

Source: Netwealth. Values shown assume that relevant taxes are paid to crystallise the investment.

What the numbers above don’t cover are the differences in ongoing administration required for properties and pensions. Properties will normally require more active management even if you have a letting agent in place as you take on new tenants, carry out maintenance and re-mortgage over time.

The implications upon death can also be quite different. For a property investment you will benefit from an uplift to the base cost for the property at death so no CGT will be due.

However, the property will fall within your estate and so potentially be subject to IHT at 40%. The money in a pension would go to the beneficiaries without them having to pay inheritance tax and depending on their age at death, there could be no tax to pay when taking the funds from the pension.

Working out how long your pension could last

How much can I draw from my pension is one of the most common questions we get asked. People generally understand they need to be invested for their future, but it can be difficult to assess how much an investment portfolio will generate. How long will it last? What happens if my circumstances change? Can I see the effects of different permutations and how that might affect my outcome?

Our powerful online tools give investors a clearer view of how their future might unfold. You can make projections based on your target monthly income (eg, £2,000), while also taking into account inflation (eg, 3%) and for how long you may need your money to last (eg, 25 years).

The tools can help you to model various scenarios to see if your planned contributions could help you to reach your goals. You can change variables such as tax rates, risk level, contributions and withdrawals to help you decide if you need to adjust your plans, or whether your objectives are realistic.

In summary

Choosing property or a pension to fund your retirement is not as straightforward as it may appear. And your individual circumstances and preferences will always have a big part to play in your selection.

Yet the case for property alone to pay for your extra years is looking increasingly shaky. We know that both property and equity investments tend to trend up over time, but at what cost? We often talk about how just a 1% difference in fees when investing can significantly affect your outcome, a fact that is even more relevant now as the higher cost of living bites.

Whatever you choose, the path you take will often require some thoughtful analysis and examination of the various permutations – but given enough time, the effort could make a meaningful difference to your future.

Please get in touch with us at any time and let our experts guide you or give you the specific advice you need – with a tailored analysis of your situation – to help you and your family make the most of your retirement.

Please note, the value of your investments can go down as well as up.