New Consumer Duty – what consumers should expect from financial providers

Looking after the evolving needs of consumers is a constant task for regulators, with many people not being appropriately served by financial services companies. A new initiative aims to help investors get the service they deserve, so it’s important to know whether your wealth manager is delivering on what they should – and doing what is right for you.

We think it’s slightly absurd that firms should be guided on how to behave appropriately, but shortfalls are still clearly endemic within the wealth management sector and beyond – and investors should know whether they are getting both the service and protections they need.

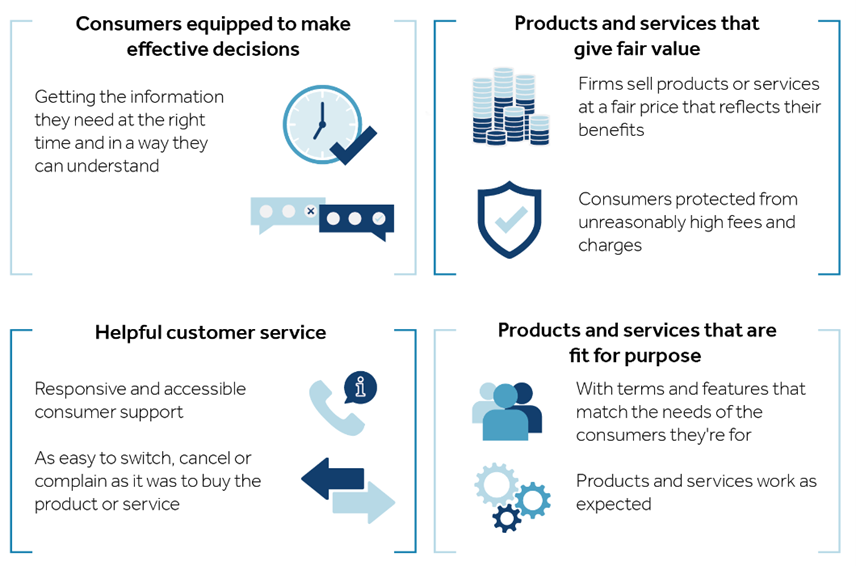

The Consumer Duty introduces a new FCA Principle for Business, that ‘A firm must act to deliver good outcomes for retail customers’ supported by new cross-cutting rules that seek to deliver four key outcomes:

Efforts have been made in this direction before. In 2006 the FCA introduced requirements for regulated firms to ‘Treat Customers Fairly (TCF)’ that also set out intended outcomes. These included designing products to meet consumer needs, ensuring they perform as expected and do not present post-sale barriers to switching provider.

However, consumers are still regularly paying for services and benefits they do not need – without fully understanding why they have been sold them in the first place – and which do not perform as expected.

We often encounter clients with very simple financial needs who have been convinced they require ongoing advice, for which they pay a hefty annual fee that significantly dampens their investment returns. Along with other poor practices identified by the FCA, this appears to have been a driver for replacing TCF with the new, more specific, Consumer Duty.

What does it mean for consumers?

In December 2020 we were asked to join a consultation with the FCA which aimed to make the consumer investment market work better. We highlighted a number of points where we believe the FCA should focus their efforts to help consumers make more effective investment decisions.

Our view is that too often the investment industry is stacked in favour of providers, rather than the consumer. This is due to poor transparency around the genuine total cost of investing, a lack of free no-obligation guidance and an associated lack of innovation around the provision of advice, leading to perceived cost and complexity. It appears, at least on the face of things, that the FCA has been listening.

The new Consumer Duty comes into effect from 31 July 2023 and will not only require firms to focus on supporting and empowering their customers – with clearer, more accessible information and support – but to also ensure companies deliver fair value and clients avoid foreseeable harm. It could mean the end of the disassociated, disaffected investor, who relies entirely on the strength of a particular brand to ensure they are getting the right product or service, with the right benefits, at a cost that is justified.

What does it mean for regulated firms?

In the coming months, the latter two outcomes in particular may present challenges for some traditional wealth management firms, which in the past have relied on consumer inertia and information asymmetries to ‘sell’ their products. Such firms will now have to consider (and importantly, demonstrate they are considering) the potential for avoidable harm throughout their client relationships, and whether they are truly delivering fair value.

Whether a product or service is ‘fit for purpose’ will rely heavily on the value it provides, considering returns net of all-in costs, but also complexity and opacity around the actual benefit to the end consumer. From July next year the onus and regulatory focus will very much be on firms to put the consumer at the heart of what they do, and to demonstrate that this is the case via governance, measurement, reflection and ongoing improvement. Where this is not the case, firms must adjust their business cultures accordingly.

For some, this will mean a great deal of work, but we hope it will encourage the development of innovative solutions around guidance and simplified advice. This will not only service a pressing market need, but also act to restore consumer confidence in the financial services industry.

What does it mean for Netwealth?

We will of course be joining all in-scope firms in reviewing our policies, governance and oversight framework to ensure that we comply fully with the new regulations. Fortunately for us, Netwealth was founded on the principle of putting clients first:

- Our investment model is simple and easily communicated, leveraging powerful technology plus a skilled team to provide expert investment management at a fraction of the industry cost

- Our powerful online financial planning tools (accessed quickly by registering) offer a free and easy to use way for consumers to better understand their needs and the potential impacts of their savings and investment decisions

- We provide no-obligation guidance services and low-cost financial advice, which can be taken on a one-off or ongoing bases, entirely at the client’s discretion

- Our articles and webinars provide regular, publicly accessible information on markets, financial planning considerations and how investors can better engage with their finances

- We communicate regularly with our clients, providing at least monthly updates on our investment approach given the prevailing market, macroeconomic and geopolitical climate

- Our dedicated client service team is available to provide information and support with the use of our online tools, when opening an account, making any necessary changes including switching provider and for whenever they need help as a client

In short, every facet of our service is aimed at improving consumer outcomes in precisely the manner the FCA appears to be seeking with this latest regulatory change. It is encouraging to see the regulator taking action in this direction and we look forward to the sea change that could, and should, result from it.

If you feel, however, that you are not being looked after in the manner that you should be – with the value, control and transparency you deserve – please get in touch.

Please note, the value of your investments can go down as well as up.