Top Investment Topics in 2023

While 2022 was undeniably challenging, there are many opportunities this year and beyond if investors are prepared to be patient and discerning. A few themes and topics stand out as being potential key drivers of returns in 2023.

Better valuations are a source of optimism

Poor market performance in 2022 has created better opportunities for patient investors in the coming years. This can be seen in the US, where share prices were more than 20% lower than where they started the year, and where the 10 year government bond yields adjusted for long-term inflation expectations have moved from -1% to almost +1.5%.

At face value, some of the most visible opportunities lie elsewhere, however. Equity markets in western Europe, Japan and emerging markets are all reasonably priced, and corporate bond yield spreads also compensate for greater levels of cyclical default risk.

Of course, this cheapening of assets happened for a reason. The world faced significant challenges last year, and there is plenty of uncertainty ahead still to manage. However, improved valuations should provide more of a buffer to any future worries, whether they are driven by economics, financial markets or political instability.

Growth is set to slow, but by how much and for how long?

When we think of what 2023 might hold for markets and investors, one thing seems certain – economic growth is set to slow in different regions. Recently, the OECD projected that global growth will be +2.2% in 2023, compared to +3.1% in 2022, before a modest improvement to +2.7% in 2024.

Some countries are likely to see recessions – indeed the IMF says one-third of countries could be in recession this year. This could include the US, where interest rate increases have led to much tighter financial conditions. As our chief economic strategist Gerard Lyons pointed out, the UK economy will also be weak and could be in – or close to – recession during the first half of this year, alongside much of western Europe. Although as the year progresses and inflation decelerates, spending and growth might recover.

Meanwhile China’s economy, which has trailed behind some of its Asian neighbours over the last year, could start to recover as the year progresses, helped by reopening from Covid-19 provoked controls.

Inflation is peaking

Better news is that the persistent inflationary pressure which has hit consumers so hard is finally showing signs of fading. This could encourage central bankers to relent in the pace of interest rate hikes which have been acting as the brakes on economic activity.

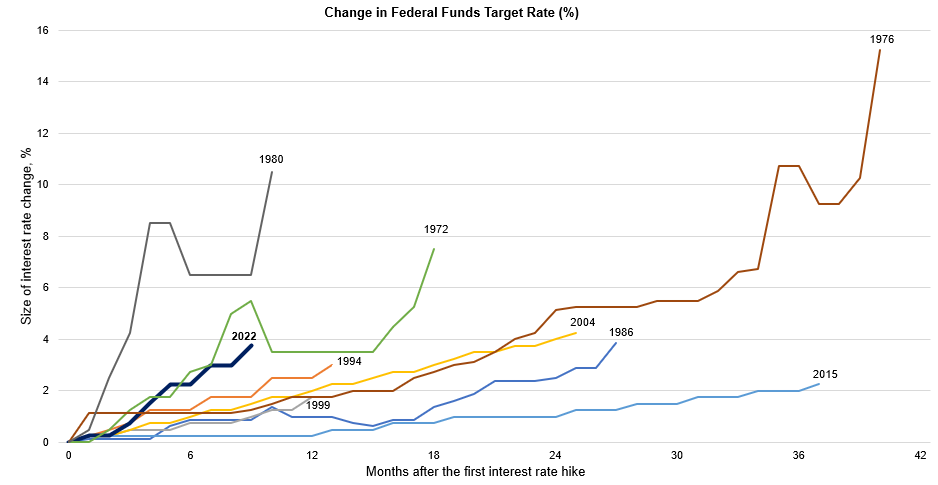

Timing is everything, however; every central banker will be wary of the mistakes made in previous cycles, and hoping they also don’t need to become increasingly aggressive to break inflationary cycles as per the 1970s.

Source: Bloomberg, with Netwealth calculations.

Bond markets will remain in the spotlight

Higher starting yields will give bond investors more confidence that the sharp underperformance of 2022 will not be repeated in the year ahead, even if central bankers adjust their longer-term objectives for inflation, and despite the wide range of economic possibilities making the outlook feel more uncertain than usual.

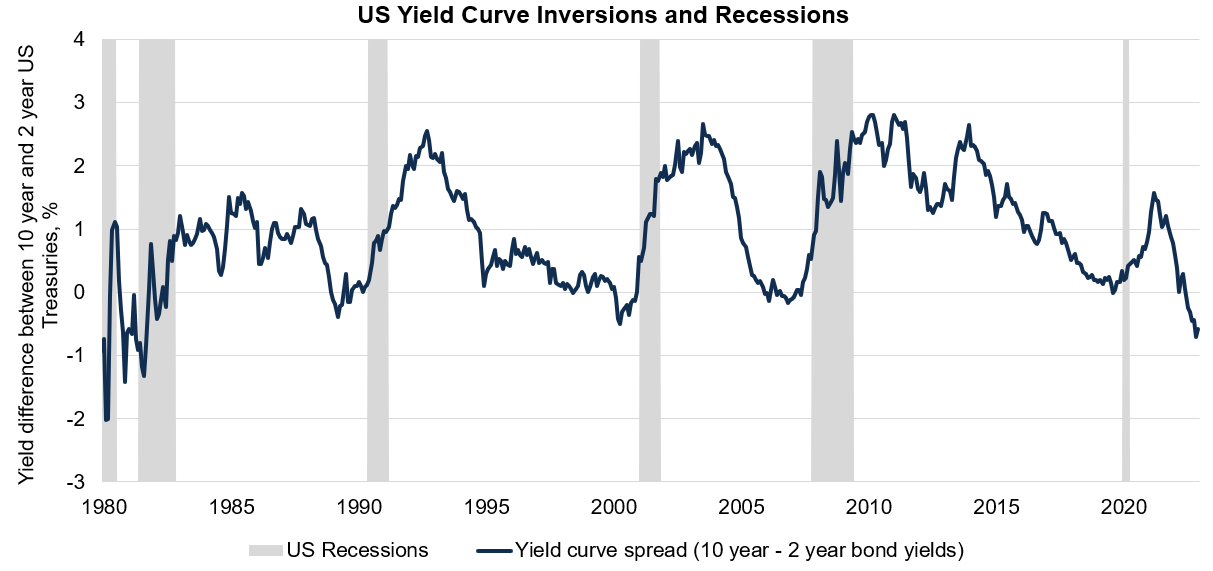

Permanently higher inflation is not our base case, and financial markets have long taken recessionary risk on board. US Treasury bonds have been signalling a pronounced slowdown by demanding higher yields for bonds with shorter maturities than for longer ones.

This unusual ‘inversion’ is as extreme as it has been for forty years, potentially creating opportunities for attractive returns in short-term bonds, and with less volatility. As the economic cycle matures, we expect that this relationship will begin to normalise, and portfolios are positioned to benefit.

Source: Bloomberg, with Netwealth calculations.

Changing leadership in stock markets

2022 was an extraordinary year in many ways. For investors in US equities, it could be remembered as the year when the dominance of the large consumer technology and communication shares over market returns was finally broken.

Expensive valuations, tighter liquidity conditions in the form of higher borrowing costs, and a narrowing gap of expected profit margins over other sectors were all contributors to the weakest relative performance of high growth stocks in 15 years.

We caution that corporate profits everywhere could be further tested in all but the most benign scenarios this year – and it will be the companies who are able to pass on the higher input costs such as labour to their customers who will be best rewarded.

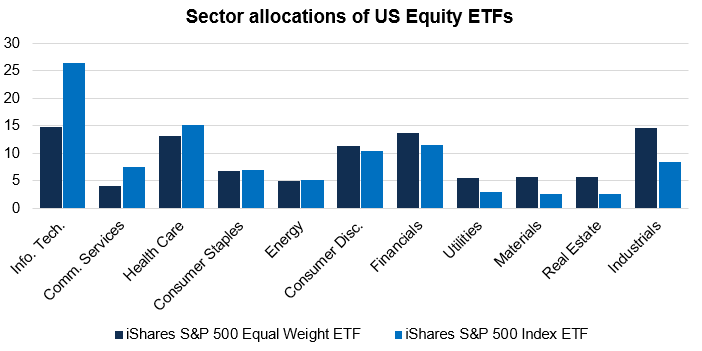

Relative to the entrenched optimism on Tech and Communications, a more diversified allocation such as our equal-weighted US equity ETF could prove more resilient than a regular, size-weighted index as investors adjust their expectations.

Source: iShares, as of 22nd December 2022.

More opportunities at home?

The UK stock market outperformed global markets meaningfully in 2022, but this was driven by the sector mix of companies in the FTSE 100 rather than reflecting market confidence in the domestic outlook. Most of the UK remains cheap and unloved by international investors.

The outlook is challenging to say the least, with many domestic-focused small and medium-sized companies facing higher interest rates and at least some costs elevated by a weaker pound, while selling to consumers who are themselves cutting back on spending. The commercial property sector has also been hit hard, with concerns over empty offices, struggling retail and what looks like a deflating bubble in warehouses and storage.

Although catalysts for better performance from smaller companies are hard to find against such a gloomy backdrop, a lot of the negativity is priced in: returns of the FTSE 250 Index have rarely been so weak compared to the FTSE 100. From such starting points future returns have usually been impressive.

Dividend streams will offer support to income investors, whereas the strength of some structural growth themes will begin to be valued more highly. We have rightly been very wary on property to date, but the potential for attractive rental yields that can be marked higher with any inflationary surprises could also be an interesting small addition to portfolios should the UK outlook begin to improve.

Please note, the value of your investments can go down as well as up.