Invest Ethically with Netwealth Without Compromising Value

Socially responsible investing (SRI) allows investors to better align their investment focus with any social or ethical beliefs they have. Historically, this way of investing has led some to question whether they are getting their money’s worth – but a modern wealth manager like Netwealth can help ensure you invest according to your values, without compromising on value.

Investing with purpose

We explain what socially responsible investing is here, and answer some questions about our approach, but at its heart, socially responsible investing aims to produce financial returns while considering the impact of social and environmental factors.

These attributes are not mutually exclusive: you can strive for favourable returns while also being a responsible investor. And when it comes to planning for your future, we don’t look at the rationale of our SRI portfolios as being any different to those of our core portfolios. We help you reach your objectives with seasoned investment and advisory teams, powerful technology and compelling low SRI fees.

The purpose of our SRI approach is to give you the ability to align your investments in accordance with the ethical beliefs you may have.

Your long-term plan

Because planning for the future, is in essence, taking a long-term view, you can plan your individual finances while reflecting on the kind of future you would like everyone to experience. You can aim to make a meaningful difference to your own life – and for others.

One of the main advantages of our pioneering technology is the extraordinary view you can experience of your potential financial outcome. Our powerful tools are now recalibrated to give you the same clarity for an SRI approach.

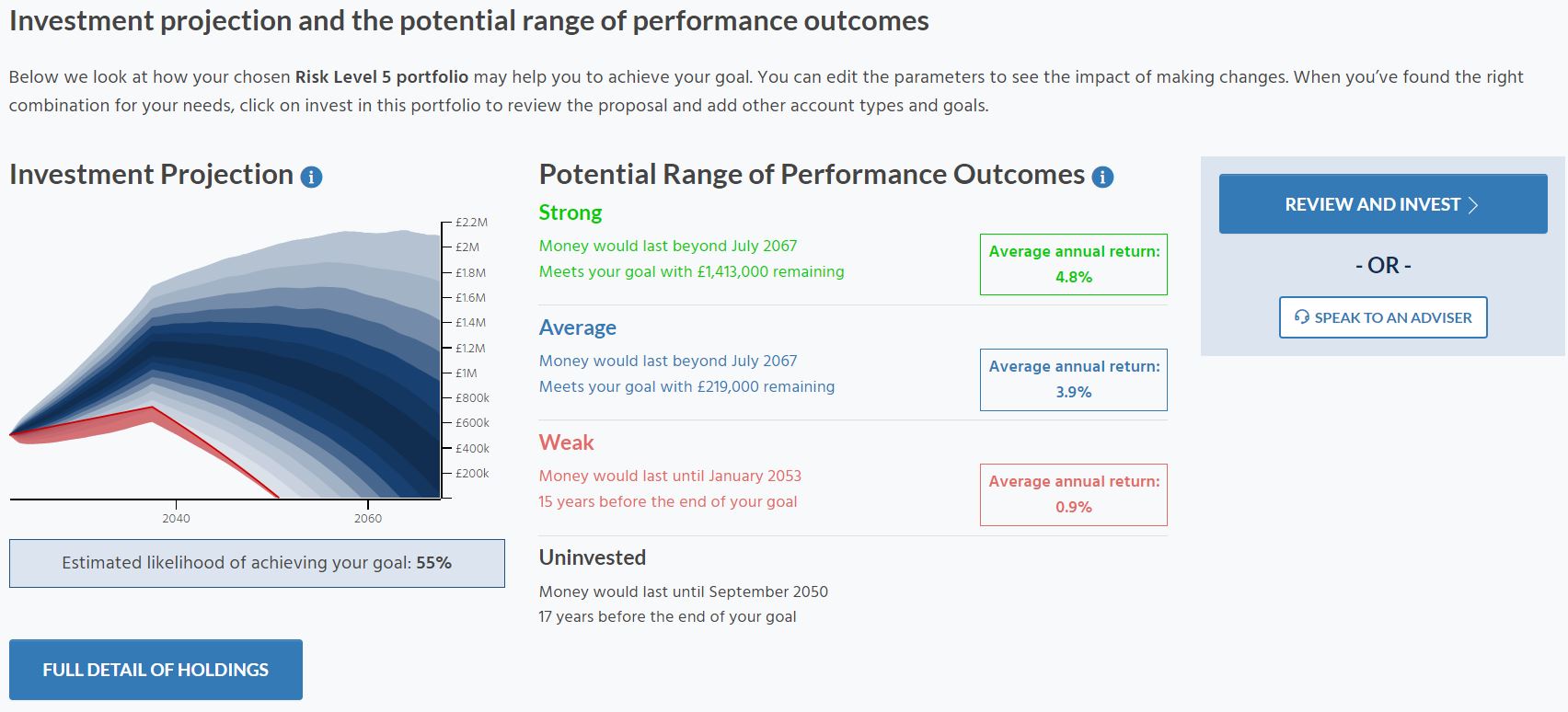

For example, when you register for free and choose the SRI option (when you model for your goals), you can see how your investments could grow over time by modelling for a number of assumptions such as your preferred timeframe, level of risk, inflation and how much you are investing.

Below, for example, we assume:

- a target monthly pension income of £3,000

- to start in 15 years and last for 30 years

- long-term inflation of 2%

- an initial pot of £500,000 and contributions of £1,000 a month

- a risk level 5 portfolio

This will produce a potential range of performance outcomes that looks like this:

Simulated future performance numbers should not be relied upon as an indicator of future performance.

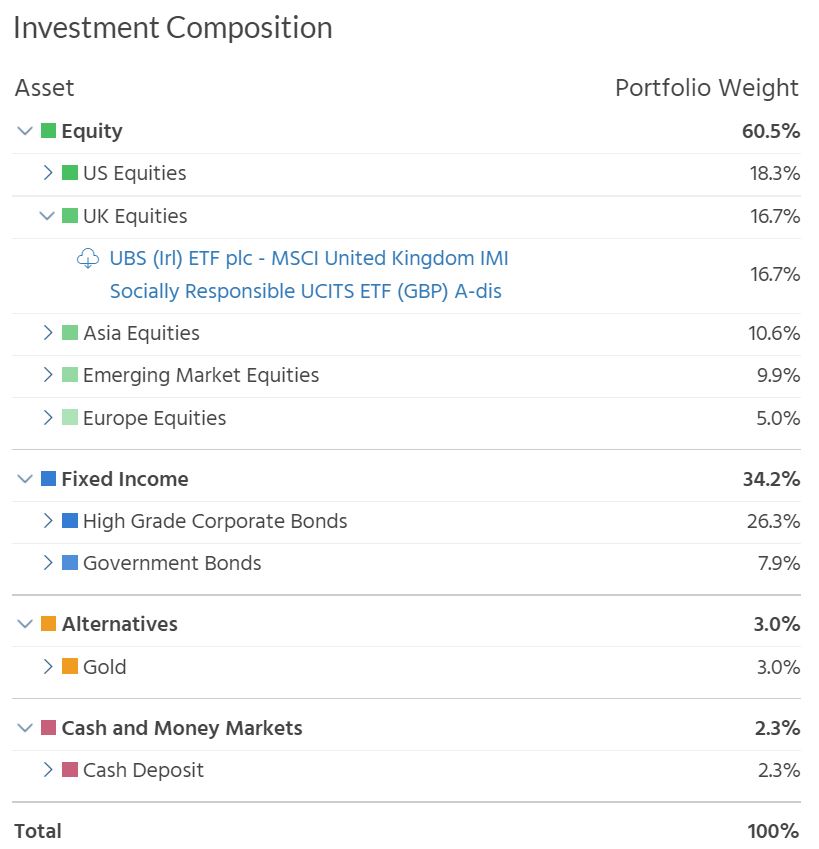

You can also then drill down to a level (Full Detail Of Holdings) where you can see exactly how well diversified your SRI portfolio is – with UK equities highlighted in the example below – and what percentages are attributed to each asset class and region.

Supporting your values, through long-term value

You don’t have to overpay to maintain the values that matter to you. Unlike many SRI providers we don’t charge more for you to invest responsibly (only the indirect costs of investing are expected to be slightly higher due to different instruments held) – we believe your heart shouldn’t be in conflict with your head.

This matters because, as we have mentioned many times before, the level of fees you pay can make a transformative difference to your financial outcome – whether that allows you to retire earlier, have more to spend in retirement or leave a bigger inheritance to loved ones. And even if you appear to be getting good returns from your financial provider, you should also analyse whether you are getting good value.

Of course, there are differences at the investment level (SRI portfolios naturally have a different composition) but as always, we recommend controlling the factors you can control to better help you reach your investment objectives. If you want to know more about the values – and the value – we can bring to your investments, please get in touch.

Please note, the value of your investments can go down as well as up.