Inflation is high now – but even when it’s not you have to prepare

Inflation is surging and while its effects are most immediately evident in the rising cost of living, it’s also important to examine how much it can affect your financial plans. And it doesn’t have to be high – even relatively subdued inflation can have a significant impact on your future if you don’t prepare for it.

Even low inflation can have a high cost

Even fairly low inflation can be highly damaging over the long term: £1,000 at the start of 1990 was only worth £486.15 at the end of 2020 in terms of spending power (Source: ONS, Netwealth). And during this period the long-term inflation average was 2.41%, according to the ONS.

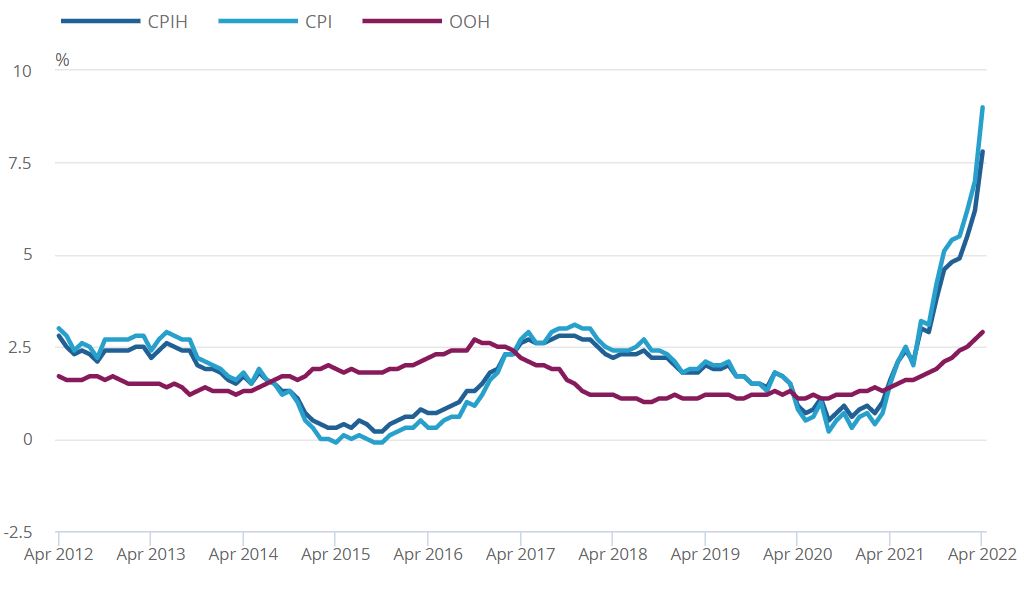

UK CPI inflation now is much higher – at 9% to the end of April – and it could rise further this year before being expected to come down closer to the long-term average. The chart below shows the CPI (Consumer Price Inflation) figure, plus the wider CPIH (Consumer Price Index with Housing) figure, as well as the costs associated with owning, maintaining and living in one's own home, known as owner occupiers' housing costs (OOH).

On every measure, inflation is highly challenging now.

UK inflation to 30 April 2022

Source: Office for National Statistics (ONS).

Yet even a relatively benign outlook will have a material impact on your savings and investments over time.

Why inflation is relevant to your financial plans

If you are thinking about generating a certain level of income from your pension and investments, you must factor inflation into your plans or risk running out of money.

For example, if you are thinking of drawing £3,000 per month from your investments starting in 10 years’ time, assuming 2% inflation this would require £3,657 when you start taking it. Assuming you plan to draw for 30 years, then the initial £3,000 would need to reach £6,624 in 40 years to achieve parity. (Source: Netwealth.)

The risks of not factoring in inflation

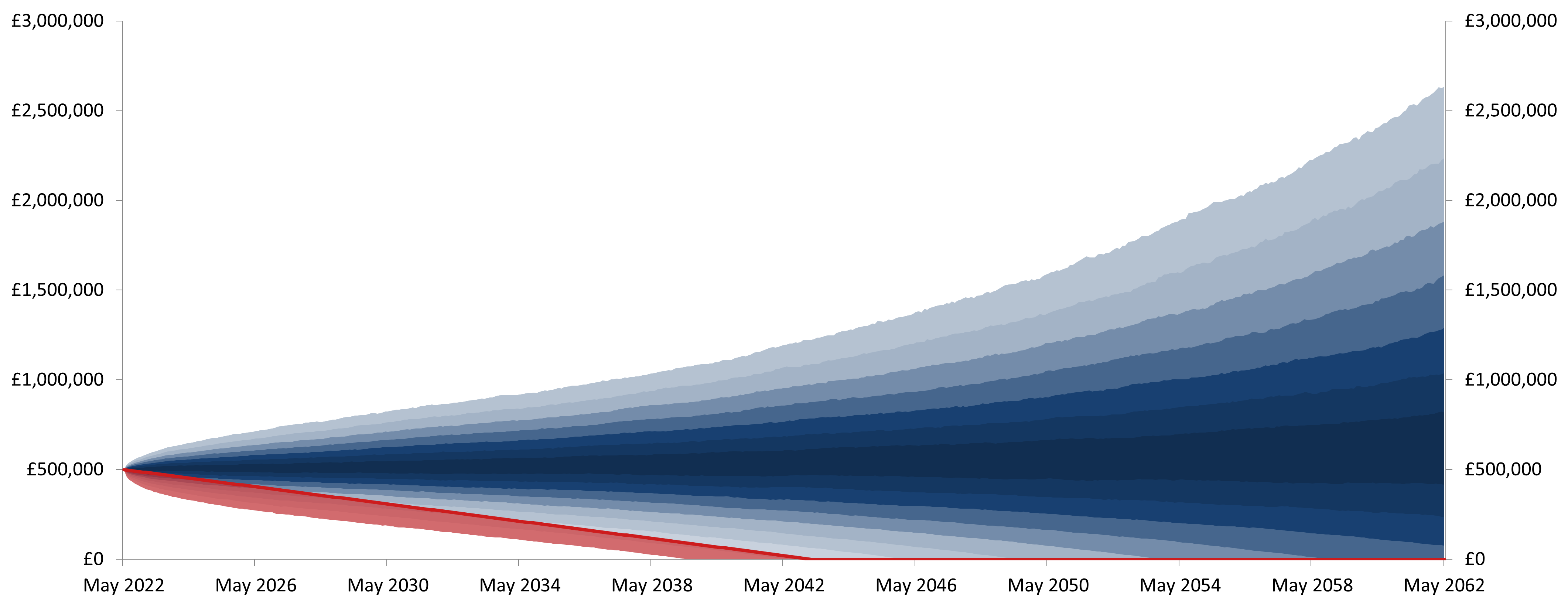

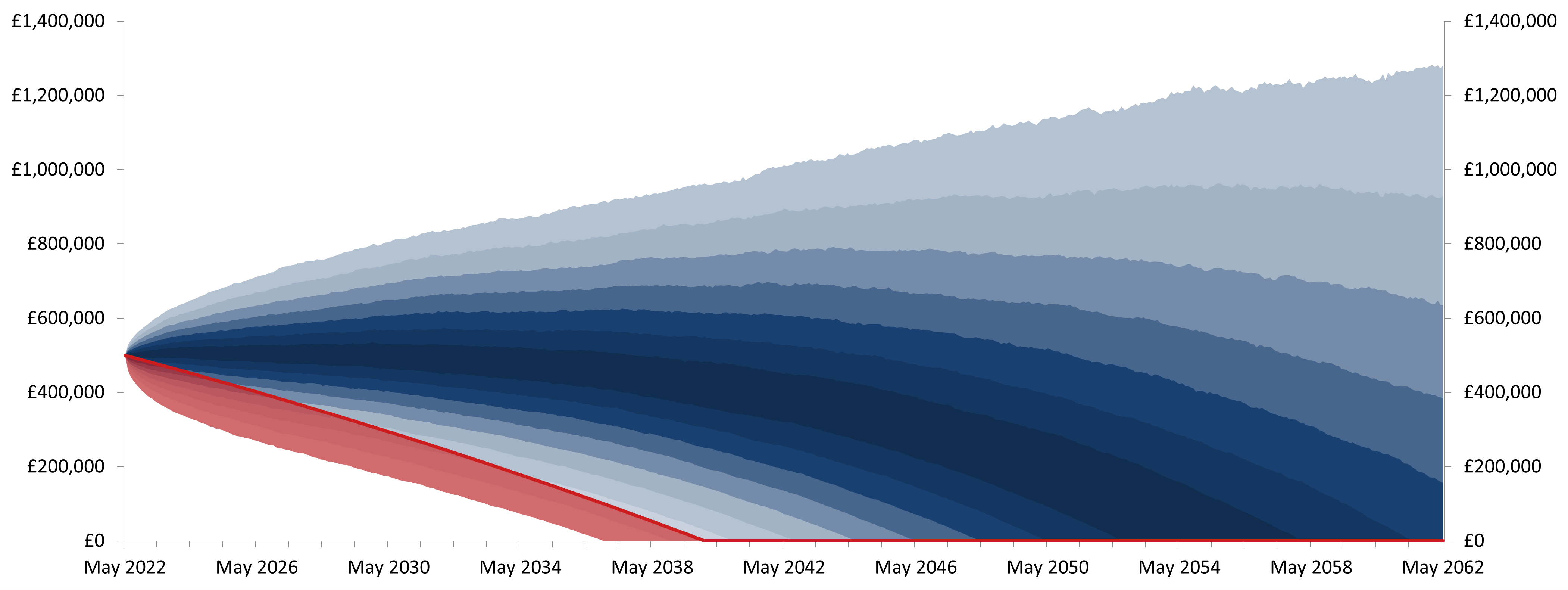

Many clients we see, while cognisant of price rises now, do not appreciate the enduring effect of inflation; they haven’t considered it in relation to how long their money may last. Take a look at the two projections below – the only difference is that one ignores inflation (assumes it is zero), and the other assumes 2% annual inflation on withdrawals.

Without inflation:

Simulated future performance numbers should not be relied upon as an indicator of future performance.

Calculation assumes £2,000 per month withdrawn over 40 years with no inflation, £500,000 invested in Netwealth Risk Level 7 portfolio through an ISA. The average expected end value would be £603,000 in May 2062.

With inflation:

Simulated future performance numbers should not be relied upon as an indicator of future performance.

Calculation assumes £2,000 per month inflated at 2% per annum and withdrawn over 40 years, £500,000 invested in Netwealth Risk Level 7 portfolio through an ISA. The portfolio on average would be expected to be exhausted by March 2055.

By not factoring in inflation it is easy to believe that the value of your assets will last your lifetime or longer. But when you do consider inflation’s effects, you can see the real outcome, and adapt to that new reality.

The implications – being forewarned is forearmed

Various factors affect investments and pensions over the long term. These can be split into two groups: those we can control and those which are outside of our influence. We examine why it is so important to control the controllables (such as fees and tax wrappers) here. And while uncontrollable elements like inflation, market returns and longevity are out of our hands, we can model for their effects.

By understanding the true impact of persistent inflation – and not just higher prices for this year – you can be better prepared. You can better understand your financial plans and prospects for the future, and make any adjustments to your saving and spending plans accordingly.

The visibility to give you greater confidence

Our aim is to make it easier for you to achieve your goals. With a focus on lower costs, an easy-to-use, transparent professional service and financial advice if required, we help discerning investors to plan ahead with more confidence.

Simply register and you can also use our useful online tools here for free, to model for your own financial plans and get a clearer picture of your individual outcome. This visibility could be very valuable to help you see if your objectives are achievable.

One of the factors that could hinder those objectives is inflation. And while the effects of higher inflation now are certainly troubling, we should also be aware of the long-term impact of even more moderate levels of inflation.

If you want to find out more about how you can be better prepared for your future, please get in touch.

Please note, the value of your investments can go down as well as up.