How to Nail Cash Flow Modelling—and Achieve Your Most Important Goals

Effective cash flow modelling helps you to plan your financial future with more clarity. Understanding its power and finding out how it can help you achieve your goals may require a little thought and exploration – yet the outcome can be incredibly worth it.

People need all the help they can get. The Financial Times reported in 2022 that 61% of respondents to a survey aged under 66 had “no idea” what their retirement income would be. It suggested that people were ill prepared for retirement – with some tending to overestimate how much income they would have – and this was before the surge in inflation would have threatened many of their plans.

However, there is a way to better navigate the uncertainty.

What is cash flow modelling?

Cash flow modelling is building a model of your financial position over time, taking into account inflows and outflows – and factoring in variables such as inflation and investment returns – to assess how you can achieve your goals.

It can help you answer some of life’s most pressing questions. When can you retire? How much can you (and should you) save every month to achieve your objectives? Can you afford to buy your retirement dream cottage? Or fund a once-in-a-lifetime family holiday?

While it’s not feasible to fully anticipate your circumstances in 10, 20 or 30 years, you can gain some insights to help you meet your goals around those timeframes – or get a better idea if you are on track.

Cash flow modelling is central to financial planning. It helps advisers and clients to look into the future to see the potential impact of advice and to evaluate choices around spending and investment risk – with extensive benefits:

Greater clarity – By taking a variety of factors into account you can create projections that provide a much clearer picture of your future financial situation.

More control – Do more of the things you may not have expected. Better insights can help you maximise the money you have and give you more freedom.

Greater flexibility – You can better adapt to allow for multiple changes to your circumstances over time and prepare for other goals, such as gifting to children and grandchildren, or a large holiday or new car.

Empowering tangible outcomes – The insights and projections can be a remarkable aid to help you make better decisions at the right time – and to change course if you need to.

Crucially, the process allows financial advisers (and their clients) to gain a clear view of whether they are on the right track financially – and the opportunity to change their plans and behaviour if they are not.

The outputs of cash flow modelling are still a model and need to be regularly updated and reviewed in light of the actual investment performance and your changing circumstances – but they can really help you visualise your likely position over time, and highlight what is possible.

Why it matters so much to clients

Clients regularly rave about the impact of cash flow modelling, and it is often the most valuable aspect of our advice. Being able to compare their current position to how it could be if they implement our advice often provides a stark contrast to their expectations.

Investors are typically very enthusiastic about the chance to improve their circumstances by making better decisions – and with the peace of mind that this tailored approach generally makes for a better long-term situation.

Cash flow modelling is relatively simple to understand. Working with an adviser is crucial to ensure a model is correct (as these tools can be sophisticated and require expert input), but understanding the outputs is very intuitive.

Highlighting the benefits of cash flow modelling

I recently helped a client who works abroad for a higher salary but misses his family. One of his key goals is to save enough in a nest egg so he can come home as soon as possible while meeting their various income needs on a lower UK salary.

We were able to create a sophisticated cash flow model projecting the regular investments he can afford to make while abroad – establishing how long it would take to save enough to come home and still be able to meet their income needs and other long-term objectives.

The client was delighted with the result and gained the clarity and peace of mind of a long-term plan that gave a good estimate of when he could realistically return to the UK. It is then up to us at Netwealth (our advice and investment teams) to implement the plan and manage and grow his wealth effectively and efficiently.

For most clients, however, the type of modelling they need will focus on the build up to retirement and then projecting how much income they can generate throughout this period. They will also want to assess how much they can gift to their children (in the interests of estate planning and saving inheritance tax) without negatively impacting their ability to meet their own income needs.

Often, clients are pleasantly surprised by how much income they can generate or how much they can gift to others. Our goal is always the same: to help clients see what they can achieve from their hard-earned wealth.

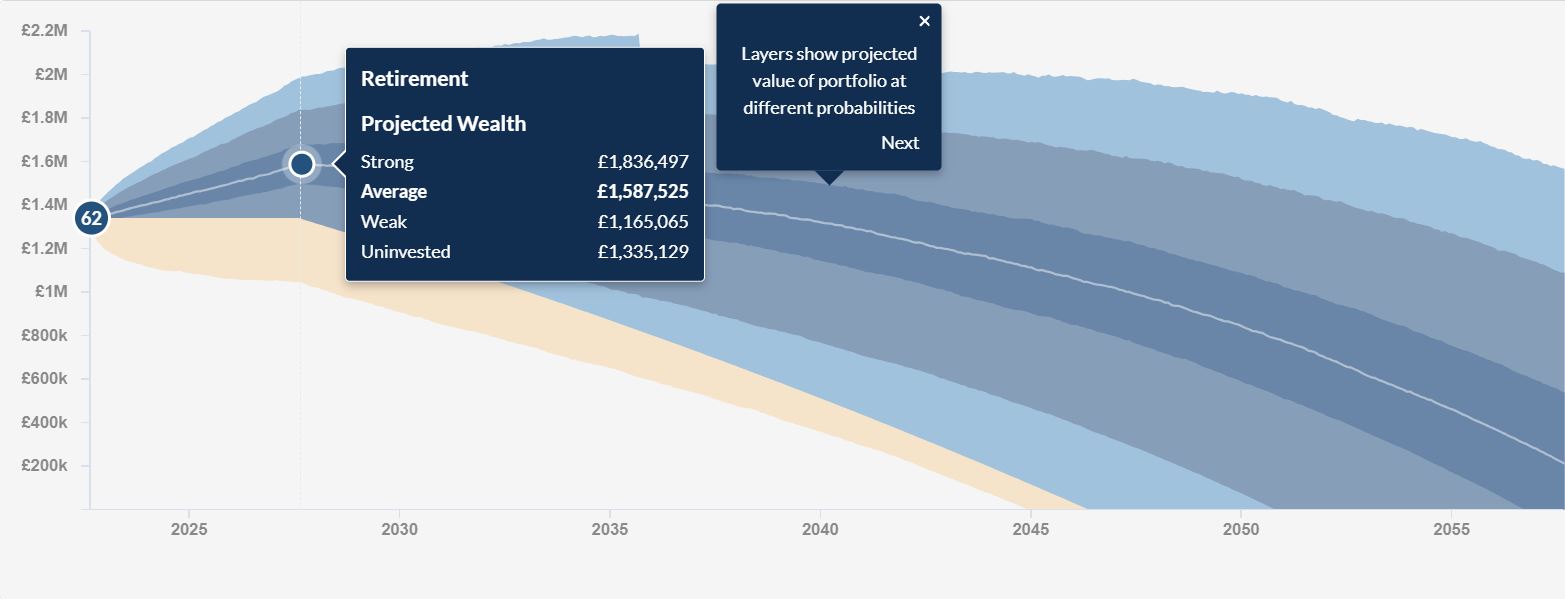

Example of how a wealth planner projection can give you more clarity

Source: MyNetwealth

The power to take control

It’s hard to underestimate the power of effective cash flow modelling. It can give you a great overview of your financial situation now, an understanding of where you could be over time, and provide valuable – and actionable – insights.

If you would like to work with us to see what you can achieve with your wealth and build a long-term financial plan, do get in touch.

We also have free tools that you can use as a starting point to build your own model and track and project your various investments and pensions. Our MyNetwealth service enables you to track your actual investments – whichever provider they are with – and you can then also add contributions, external income, your retirement date and withdrawal needs to generate your own projection.

You have more control than you may think over how your financial situation can develop. Being proactive and starting a plan now has the power to put you in a far better position for major life events and for when you do retire.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions.