It depends – and is personal to your circumstances, needs and objectives. How much risk you should take when investing is usually determined by a number of interconnected factors.

At Netwealth, we conceptualise your risk profile by considering three factors, which will change over time as your circumstances develop and you encounter major life events. The three factors – which help you decide the most appropriate risk level to realise your investment objectives – are:

- Risk ability

Your ability to take risk is driven by your overall financial circumstances, how long you wish to invest and how much volatility and loss you can absorb (in the event of challenging market conditions) without your standard of living being negatively impacted.

- Risk willingness

Your willingness to take risk represents the level of fluctuations you are willing to accept in the value of your portfolios (how much they go up and down) and in the size of a potential short-term, medium-term and permanent loss.

- Risk need

Your risk need is the amount of risk you may need to take to achieve the returns required to meet your goals.

Let’s focus on your risk need, as this has a direct impact on how much investment returns you can expect to generate over time. It may sound counterintuitive but taking more risk can often be the preferred option – because to achieve higher returns you generally need to take more risk.

How does that work? And what are the downsides?

Taking more risk typically means you invest in the assets which have historically outperformed other assets, especially over a longer timeframe. For most purposes this means investing in equities – shares in companies quoted on stock exchanges around the world. Here you can see how much better off you could be by investing compared to leaving your money in a savings account.

Of course, some companies, assets and regions typically perform better than others, and it’s difficult to predict which will do so from year to year. This makes it sensible to hold diversified investments, accessed as cost effectively as possible, which is where passive investing (where you typically invest in a broad index of assets such as equities within a specific region such as the USA, UK or Japan or a more specific investment type such as gold or a broader set of commodities) can offer a distinct advantage.

The tangible impact of taking on more risk

It’s a well-proven rule, that the greater the return you would like to achieve, the more risk you will typically be required to take. And while taking more risk raises the potential of losing money, investing for longer gives you more time for your portfolio to recover from any possible losses – which again reinforces the benefits of staying invested.

But how does that look? We can show the potential outcomes of greater or lesser risk – variables you can choose depending on your willingness and ability to take risk, which should align with how much you may need to take to reach your objective.

To help you envisage what the different outcomes of more or less risk could be (all along the risk spectrum), you can use the powerful tools on MyNetwealth – which you can access for free when you register.

Let’s make some assumptions for an example that could apply to many investors. In this case, planning for their pension:

Age: 50

Retirement income target: £2,500 a month

Retirement target date: 70 (20 years from now)

To last for: 20 years

Initial pension sum: £200,000

Monthly contribution: £500 (net)

Inflation assumption: 2.3%

By putting this information into a modelling tool – where an investor chooses Netwealth’s risk level 1 (very low risk with a portfolio comprising of money market and fixed income assets) – this is how their projection could look:

Simulated forecasts are not a reliable indicator of future performance.

As you can see – although they are taking the lowest level of risk – they are unlikely to achieve their goal of being able to spend £2,500 a month in retirement until age 90. Their money would run out a few years beforehand.

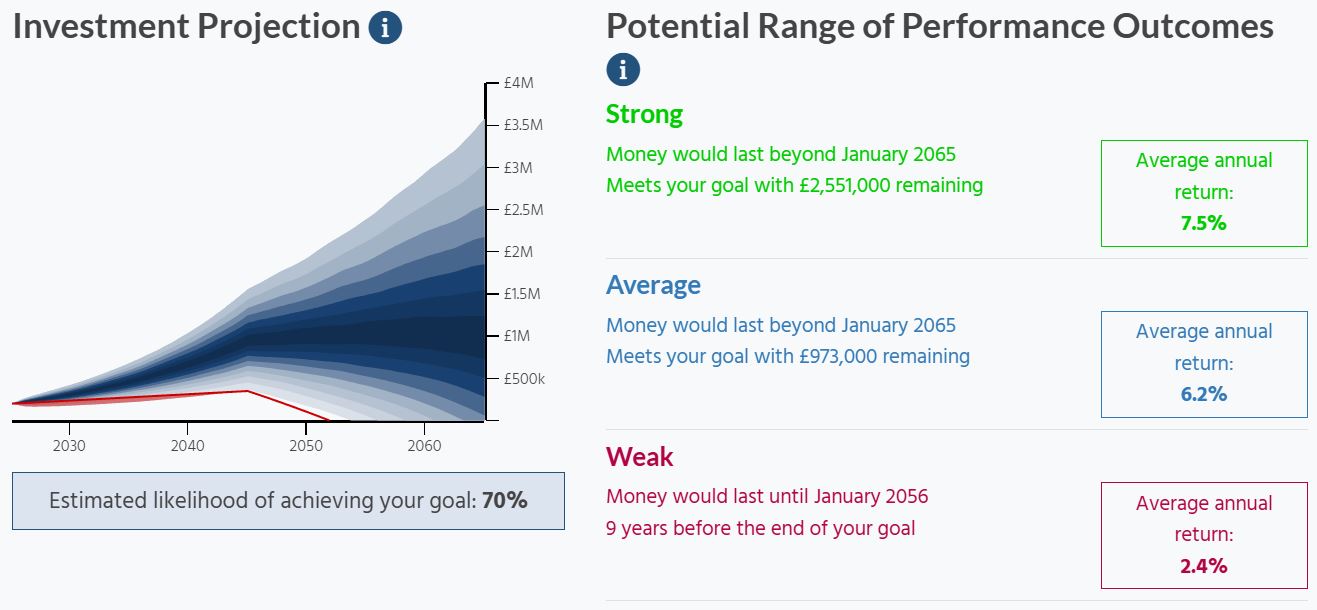

By contrast – and to highlight the potential outcome of the investor choosing Netwealth’s risk level 7 (the highest risk with a diversified portfolio of mostly equities) – this is a projection that also covers a potential range of outcomes:

Simulated forecasts are not a reliable indicator of future performance.

Tellingly, in this case, even with returns in line with the average outcome from thousands of simulations, the investor’s money is projected to last beyond their preferred timeframe of 90, and with quite a considerable sum left over.

Please note, these two examples are to highlight the difference between taking almost no risk and a typical higher risk portfolio at Netwealth. Other providers may offer higher levels of risk, with a greater chance of losing some or all of your money, especially in the short term.

What works for you may fall in between these two risk levels. It’s very much down to your individual constraints and a personal choice, and this decision can be made easier by working with a Netwealth adviser. However, it’s crucial to get a better understanding of the impact of your choices when it comes to risk – so you can assess whether you will likely have enough in your pot for when you need it.

Getting more clarity

Clients often ask us about when should they change how much risk they are taking when investing. In general we urge people not to change their risk level unless their circumstances change – for example, if you have a child, are getting divorced, or are facing retirement, which is typically the time when people reduce risk on the assets they will be drawing from.

Yet there are also times when you may clearly not be taking enough risk in the first place to achieve your goals, or you may be taking too much for what you are setting out to do. So it makes sense to assess your potential outcomes using the tools above, and you may also be able to get a clearer picture of your finances with a Financial Planning ‘MOT’ or by working closely with a financial adviser.

Book a no-obligation call with one of our team here.

You can choose either one-off or ongoing financial advice with various studies highlighting the boost to people’s wealth when they get the right advice to help them better understand their options, including risk.

Whatever your circumstances, if you have any queries, please get in touch.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted solely to our services. We do not consider the whole of the market, nor offer advice in relation to tax compliance, insurance products, or the transfer of defined benefit pensions.