How Our Key Beliefs Shape Our Investment Approach

Successfully managing modern investment portfolios means expertly navigating an evolving set of challenges. Our key beliefs help to guide us when volatility is elevated, when the impact of policy actions is uncertain and give us the agility to respond as the fundamentals change.

Being adaptive, and focused on costs

Delivering efficiently diversified portfolios is a vital component of our investment approach. Different elements contribute to the process, and it goes far beyond being inertly invested across geographic markets. Because the market outlook changes with the global macroeconomic backdrop and asset class-specific issues, portfolios must have the right balance between structure and flexibility to adapt.

Continually appraising our portfolios’ instrument selection gives us the confidence that we hold the right fund or ETF to help us maintain our investment targets.

Once our portfolio strategy is set, our attention turns to implementation and execution, ensuring there is no disconnect between the returns generated from investing and the performance clients see in their portfolios. Our laser focus on market pricing and operational processes helps to maximise efficiency, while a reluctance to second-guess our positioning by over-trading manages the risk of being caught out in a volatile environment.

Volatility is the entry price for investing

When markets are volatile it can make investors uncomfortable, and questioning whether their investment approach (and mix) is still appropriate to enable them to achieve their goals. Whether the catalyst for uncertainty is from economic, political or more likely market-oriented issues, the temptation is to withdraw from risks and seek the safety of watching from the sidelines.

When positioning each of our Risk Level portfolios, we always have two key risks in mind, which can often conflict with each other: the potential for short-term falls in value and the risk of not being placed for clients’ long-term performance goals.

This evaluation reminds us that positioning to avoid all risks means reducing the chance of longer-term success. Taking some risk when investing is necessary to achieve a meaningful level of return over time.

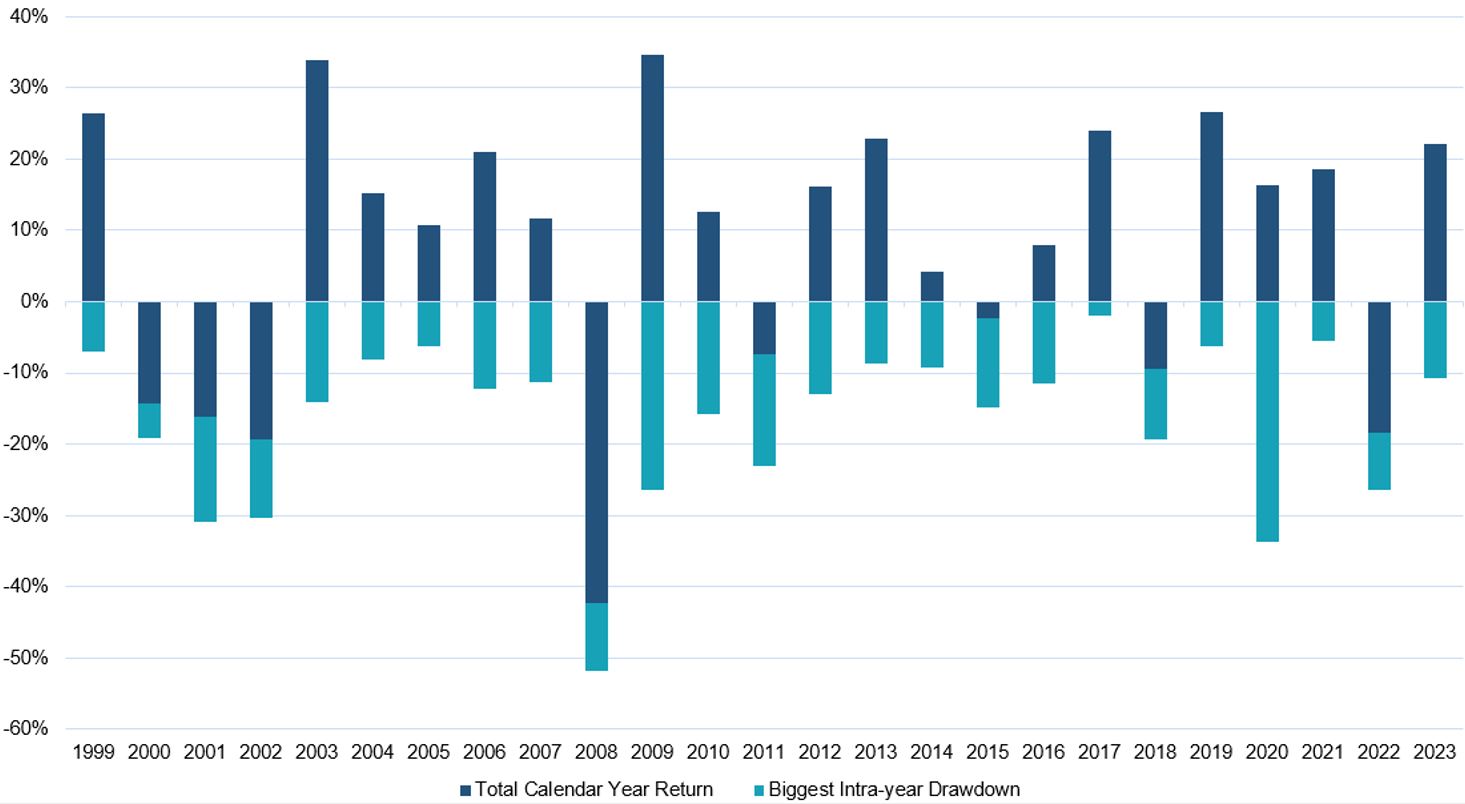

We see this most clearly in equity markets. Global equity markets have delivered compounded returns of around 300% over the past 25 years. Investors made positive returns in 17 of those 25 years, but equally as importantly, there were also 17 years when they witnessed peak-to-trough falls of more than 10%. So while overall yearly returns were largely positive, worrying moments would occur during many of these years when markets suffered a sizeable drop. Yet investors would generally be rewarded for holding their nerve and staying invested.

We therefore believe that accepting a degree of market volatility is the entry price for meeting longer-term goals.

MSCI All Country World Index historical annual returns

Source: Bloomberg, with Netwealth calculations. Total returns of the MSCI All Country World Index shown in US dollars.

Economic fundamentals and policy matter

We keep fully on top of the economic and policy outlook, both here in the UK and globally.

In terms of the economic fundamentals, we analyse current developments and forecast what lies ahead. It is important to understand what financial markets have discounted, and the balance of risks that lie ahead and how this should impact our thinking. As a result, Netwealth’s portfolios are positioned to benefit. The key is to get it right and at times our views may be in line with market thinking, but on occasions our views are different to the consensus.

Inflation has played a huge part in impacting economies and financial markets in recent years. In our view, markets are shifting from a focus on inflation to that of growth, and in turn this may be followed by a focus on debt, as globally debt levels are high. Currently the focus is on growth, and whether a soft landing (where an economy’s growth slows, but avoids recession) is achievable in the US. A key focus for markets is on the likely pace of easing of monetary policy. Rates have already fallen in the UK and euro area and look set to fall in the US, too. In contrast, Japan is raising interest rates, and this has already triggered market turbulence.

Our economic assessment can be followed on the ‘Our Views’ section of our website.

Valuations are key, as is paying attention to underlying shifts

Investing in assets which are attractively valued is the cornerstone of any successful investment process. Valuations form a vital component both when defining our strategic allocations (where we invest with a longer-term outlook) and in making more cyclical (short-term) adjustments through time. Strategically, investing in inflation-linked US Treasury bonds with a positive 2% real yield is a lot more attractive now than a couple of years ago when these yields were negative.

However, the difficulty comes when valuation metrics using historical data are confronted with changing forward-looking information – the outlook for the future frequently shifts. The US equity market has been a case in point: by many historical gauges, the S&P 500 Index of leading US companies has not been cheap for a long time. Investors are happy to look past this while corporate fundamentals are strong.

Confidence on the outlook for future profit growth and low levels of debt in an uncertain world have convinced investors that the US market is expensive for a reason. Heightened expectations can be a risk in themselves, so any signs of the fundamentals sliding may make the marginal buyer of US equities look further afield.

Market winners and losers can change before fundamental reasons are clear

Recency bias is one of the biggest behavioural pitfalls that investors fall prey to: being overly influenced by recent or current events when assessing how markets will behave in the future.

Momentum in both corporate earnings and share price performance are well-documented signals for future performance when managed in a structured and disciplined way. But generic over-confidence in a repeated pattern can be misguided, so we work hard to understand the interactions between economics, policy responses, fundamentals, valuations and sentiment on all our investments.

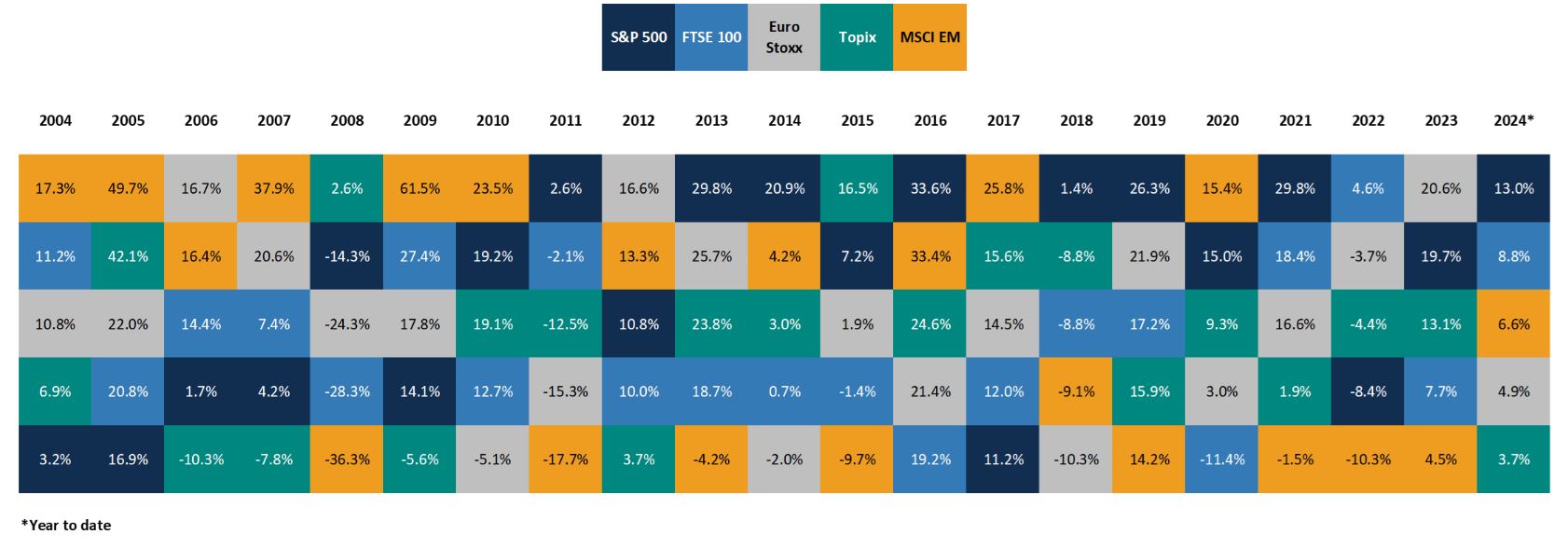

Broadly speaking, the five regional markets we focus on have quite different characteristics – notwithstanding the economic situation in the region itself.

We expect the US market performance to be driven by sentiment towards the powerful technology sector which has provided dependable profits when other opportunities are scarce. European and Japanese markets are more attuned to views on global economic demand thanks to their depth of manufacturing and exporters. Emerging markets have more idiosyncratic features, but do well when confidence in India, China and other Asian markets is growing. Finally, the UK market is valued when investors prioritise dividend income or during periods of rising energy prices.

These different characteristics come in and out of favour, with patterns and performance often changing before the underlying reasons are clear. But the underlying theme is always that relative preference can change faster than imagined.

Table of regional market performance in GBP terms over time

Source: Bloomberg with Netwealth calculations. 2024 returns reflect the year to date up to 12 August.

Being adaptive, therefore, is crucial to enable us to respond to a changing market, macroeconomic and policy environment. At the heart of our approach, too, is being efficient, and tightly managing costs when we make decisions – empowered through sharp analysis and close collaboration as we proactively seek the right outcomes for our clients.

Find out more about how our investment approach can help you to meet your long-term goals.

Please note, the value of your investments can go down as well as up.