Combating the riskiest situation for cash in over 40 years

We may be keenly familiar with the impact of inflation on our spending power this year, but we should also scrutinise the rapid negative effect it can have on our savings and investments. It’s crucial to recognise the value of taking action sooner, even if the easiest thing to do is to sit out challenging circumstances.

Inflation is surging

With the war in Ukraine, tightening supply chains and high energy prices causing surging UK inflation, now could be the best opportunity to reassess your savings in over 40 years.

UK consumer price inflation in the year to August came in at 9.9%, a slight dip from the 10.1% figure to July, and is now expected to peak at 11% in October. It is projected to remain above 10% for a few months and in double figures until the new year, before starting to come down. So for every £100,000 held in cash, with 10% inflation, it is worth £90,000 in spending terms 12 months later.

And with returns you get from a bank savings account not keeping pace with rising interest rates, is it really prudent to do nothing to minimise the impact of losing potentially thousands of pounds each year?

You can counter the impact of inflation

We often highlight the damage even 2% inflation can do to your investment or retirement portfolio if you don’t prepare for it.

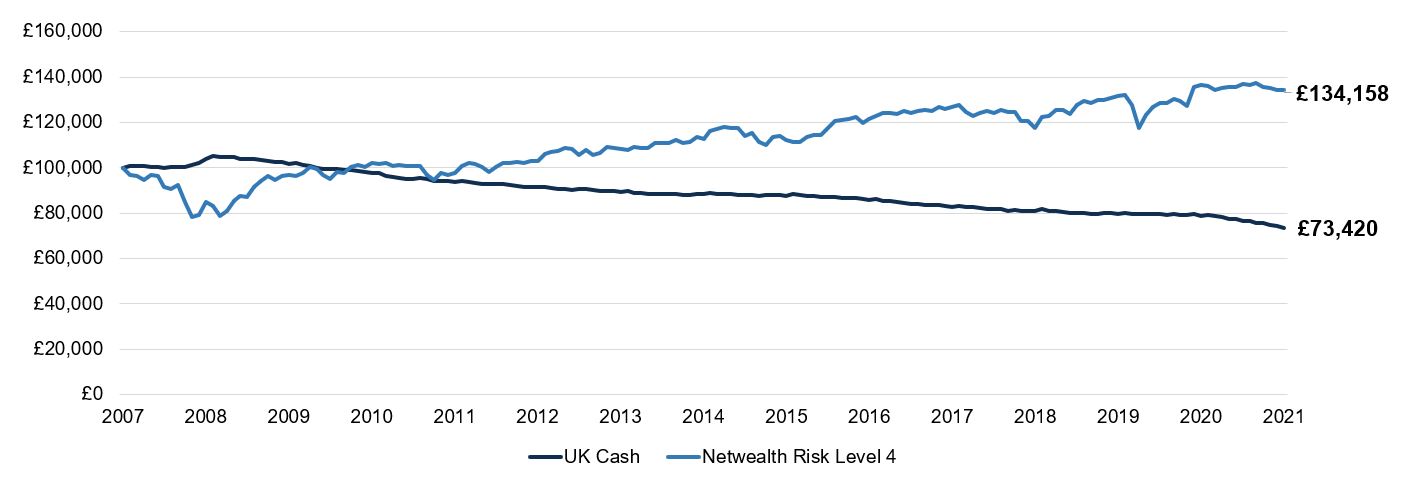

But you can see from the chart below how even a medium risk portfolio has historically countered the effect of inflation, and how doing nothing can do considerable harm to your cash holdings over time. This positive portfolio outperformance develops even allowing for the seismic downturn caused by the great financial crisis at the start of this timeframe.

Holding too much cash in the long run allows inflation

to erode the real value of your capital

Simulated historic performance is not a reliable indicator of future results.

Source: Netwealth and Bloomberg. The values represent £100k invested in 1 month Libor and an example Netwealth Risk Level 4 portfolio minus UK RPI.

Why and when you should invest

If you are planning to use a portion of your funds in the next three years, this money should probably be isolated from market movements and therefore held in cash or cash-like instruments – regardless of inflation or interest rates.

You can take a longer-term approach for funds which are needed beyond three years, and thus work your money harder by choosing assets that have a good chance of outpacing inflation – or at least diminishing its impact when it is as high as it is now.

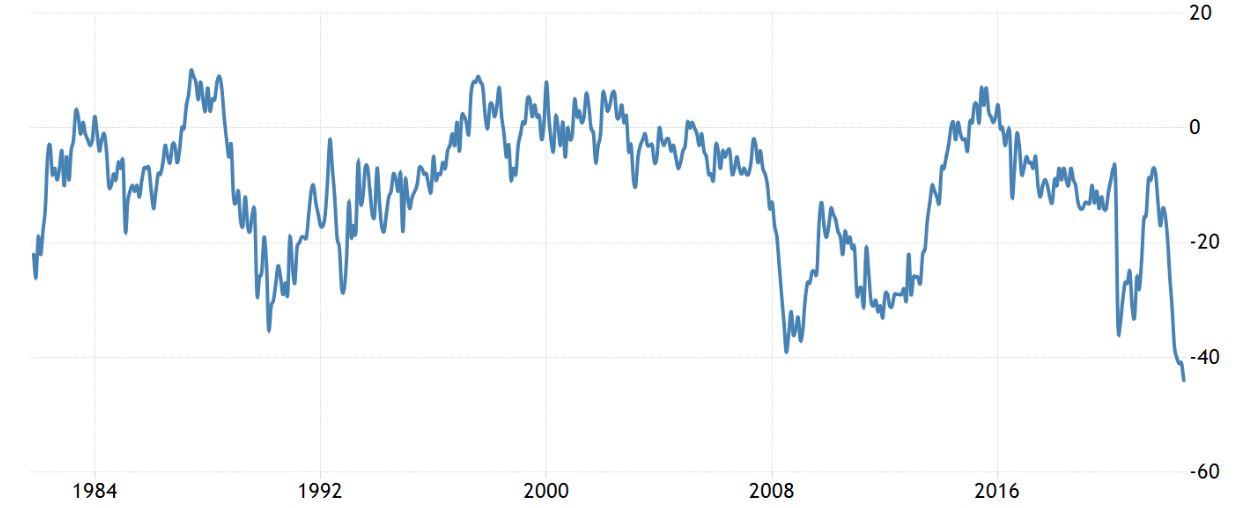

You shouldn’t necessarily wait for economic sentiment to improve before you act. The chart below shows UK consumer confidence (as measured by market insights provider GfK) hit the lowest ever level in August 2022, and (as events in the aftermath of the mini-Budget highlight) this could fall further. Yet inflation is likely to rise – and likely to hurt your savings even more.

As a result of the global financial crisis, consumer sentiment was also very negative in 2008 and 2009 (also shown below), but who could have predicted when sentiment (and markets) would start to turn? It’s almost impossible to time the markets, but it’s almost certain that high inflation will endure for the next year and into 2024.

UK consumer confidence

Source: Trading Economics, GfK.

There are many reasons to defer acting positively to combat inflation: a fear of taking risk, psychological factors can further embed inertia, and the persistence of negative media narratives can crush our ability to effectively cope when investing.

But as we have now hopefully made clear, this year, the riskiest thing you can do with your money is to leave it idling in savings, so why not put your capital to work? Please get in touch, without any obligation, and we’ll show you what we can do to help.

Please note, the value of your investments can go down as well as up.