Let’s focus here on fiscal policy, particularly as in terms of future government spending and taxes it has moved even more to the fore in recent days. This follows the Chancellor’s attempt to manage expectations by claiming that the new government’s economic inheritance is worse than it is.

Also, it follows a pay body recommendation of a 5.5% pay increase for teachers and across the NHS. It is unclear if the government would pick up all the increased cost of the teachers’ awards and whether all the amounts will be paid in one go, or phased. Thus, there is some uncertainty about the total cost to the Exchequer, but it will be more than expected, adding to pressure on the public finances.

All this reinforces the perception that taxes are set to rise. While this may be the case, it is neither inevitable or necessary. Instead, it would be a policy choice, albeit one in line with many of recent years.

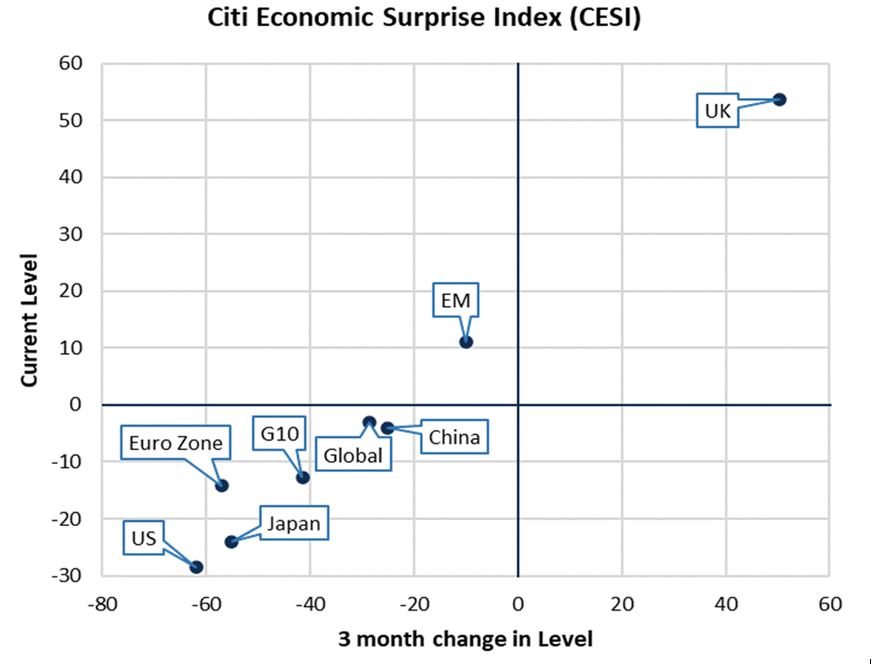

Recent economic data in the UK has turned out to be better than the market expected. Consider the chart below, which is based on the widely used, and publicly available Citibank Economic Surprise Index. If economic data proves better than financial markets expect then this is a positive surprise.

On the vertical axis, above zero means that data has been better than expected, below zero worse. Meanwhile, the horizontal axis shows the recent trend. To the right of zero is an improving trend, to the left, deteriorating. This gives a four-sector diagram.

The bottom left quadrant is worse than expected and deteriorating. This is where many economies are now, consistent with both a disinflationary global environment and pressure for interest rate cuts. Such weaker data also provides a note of caution about immediate global economic prospects. In contrast, the UK is in the top right – better than expected and improving.

Source: Citi, Bloomberg.

Obviously if expectations are low it might contribute to this position, and there may be some element of that. But in recent months, the market has become more optimistic about UK economic prospects, and the data is thus coming in better than expectations, which have improved. This has been evident in the shifting back of forecasts for interest rate cuts and also in a stronger pound. In the three months to May the UK economy grew 0.9% compared with the previous three months, so at an annualised rate of 3.6%.

It is possible that this growth could create more fiscal space, but it is not guaranteed. As I noted in the webinar, current fiscal plans are already predicated on an economic rebound. The Office for Budget Responsibility (OBR), in their March analysis which underpinned the Budget, had already factored in economic growth of 0.8% this year, followed by 1.9% in 2025 and 2% in 2026.

The positive take is that growth this year may even prove stronger, with 1.2% possible. Interest rates should also fall from 5.25%, in response to decelerating inflation, with inflation now at its 2% target in the last two months’ data.

Just as it is important to recognise that the economy is growing – and that immediate economic prospects are improving – it is also necessary to accept that the UK is a low growth, low productivity and low wage economy which has now become a high public spending and high tax economy, too. Thus, while necessary for the government to have economic growth as central to their policy, it is delivering this growth that is key.

The economic backdrop is not as favourable as that which Labour inherited when they last came to power in 1997, yet it is better on most measures than when the Coalition came to govern in 2010. One area, though, where things look poor – whether compared with 1997 or 2010 – is the public finances.

This, though, should not be a shock, particularly in the wake of the pandemic. It has been evident for some time, as the data on government spending and receipts is open and transparent, and has been widely discussed.

Debt to GDP was 99.5% at the end of June, and was 91.6% excluding the Bank of England. What is key is not just the level of debt itself, but the future relationship between economic growth and the rate of interest paid on outstanding debt. This points to difficult policy choices, especially if borrowing rates are high, or if economic growth is low.

In June, public borrowing was £14.5 billion, the lowest June figure since 2019, pre-pandemic. Yet while borrowing was £3.2 billion lower (and thus better) than a year ago, it was still £2.9 billion higher (and thus worse) than the OBR has factored into their fiscal forecasts. The monthly figures can be volatile, but the same message is seen from the recent trend. In the first quarter of this fiscal year – in the three months to June – borrowing is £1.1 billion better than a year ago but £3.2 billion worse than the OBR expected.

There are a number of significant events to note, including a statement that the Chancellor will make to the House of Commons before the end of July. One would expect that this statement will paint a positive economic vision of what lies ahead, including the need for higher investment. But it is likely to reinforce the narrative the government is portraying of a poor economic inheritance.

Even though the peer group with which the UK is usually compared is the G7, it seems likely that to make her point the Chancellor will compare the UK’s growth performance since 2010 with the much broader Organisation for Economic Co-operation and Development (OECD).

Here the story seems to be to say that the UK has underperformed the average growth seen across the OECD and that this has contributed to a fiscal shortfall. Thus, tougher action will now have to be taken. Implicit in this will be the Chancellor’s desire to keep financial markets onside.

The fiscal options are (and they can be concurrent): economic growth; reform to public services to deliver productivity; a squeeze on spending; taxes; or borrow. Some might also cite inflating the debt away alongside financial repression.

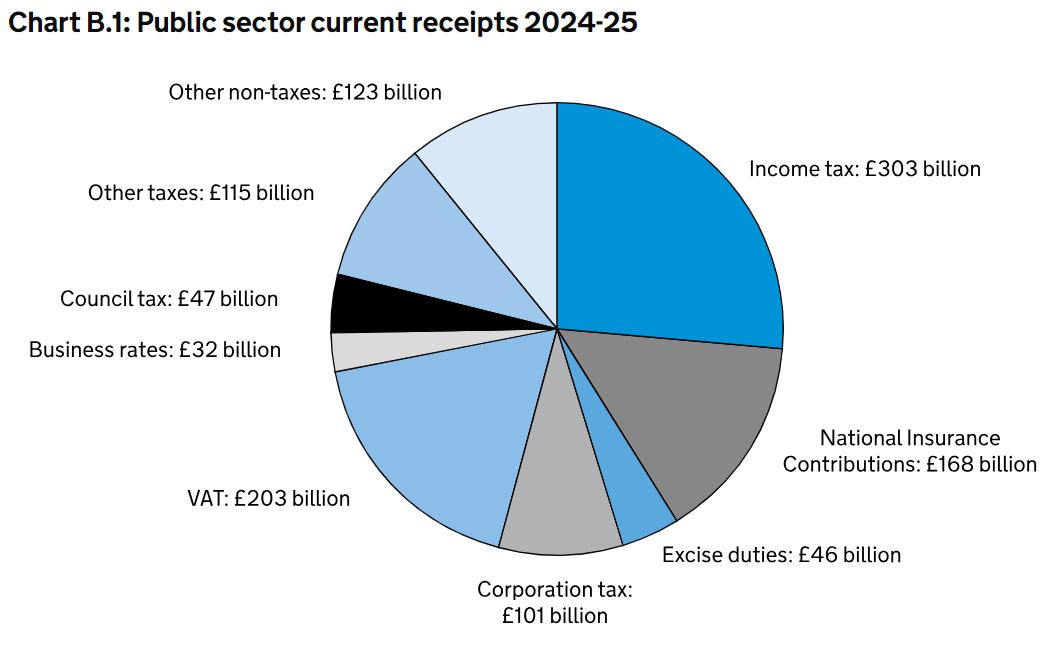

The following chart, from the March Budget shows the main receipts are income tax, VAT and national insurance. The government has committed to freezing these rates, and while allowances are not rising in line with inflation, this has focused attention on other revenue sources.

Other taxes includes capital taxes, stamp duties, vehicle excise duties, customs duties and other smaller tax receipts. Other non-taxes includes interest and dividends, gross operating surplus and other smaller non-tax receipts.

Source: Office for Budget Responsibility.

From an overall market perspective, the Chancellor is keen to embed her credibility – in similar respects to the way Gordon Brown did in 1997 when he stuck to tough fiscal plans. Now future plans are similarly tough, plus the government is sticking with fiscal rules that have been heavily criticised – as we have discussed before. The buffer in existing plans too, is small, and contingencies for other areas, such as payments linked to the recent blood scandal still must be factored in.

Ideally some flexibility should be shown on the rules but that won’t happen. Higher growth, as noted, will create some space. Crafting the narrative of higher investment boosting future growth should allow scope for borrowing, but this is already high. Beyond that it seems likely that spending and thus taxation will remain under upward pressure.

Please note, the value of your investments can go down as well as up.