5 Crucial Ways to Boost Your Pension Potential

Taking advantage of the tax benefits of a pension could be the boost you need to achieve your retirement goals. Yet it may be worth reassessing your pension to see if you can further improve on the benefits and its potential to help deliver a comfortable life later on.

It makes sense to ensure that you protect your efforts – especially if you have accumulated a meaningful pension pot over the years.

1. Use your full pension allowance – each year

While you can reap the tax benefits by contributing up to £60,000 a year into your pension now (it rose from £40,000 on April 6, 2023), pension annual allowances can be carried forward for up to three tax years. If you were relying on carrying forward your annual allowance from the 2021/22 tax year, you will need to do it by 5 April, 2025.

Therefore, up to £40,000 of pension annual allowance could be lost if not used by this time. This can attract tax relief at your highest marginal tax rate, which for some people could be 60% if they earn more than £125,140 – and thus making a contribution to bring your income to below £100,000 will also enable you to reclaim your personal tax allowance.

You can only carry forward from earlier years if you have fully utilised the current year’s allowance of £60,000. For individuals drawing upon their pension and subject to the Money Purchase Annual Allowance (currently £10,000), this cannot be carried forward at all into later tax years.

Utilising these allowances each year will help maximise the value of your pension pot.

If you are in any doubt as to the maximum amount you can contribute to your pension in the current tax year, our advisory team can help you to calculate this. For a one-off fixed fee of £400 (inclusive of VAT), we can perform a review of the maximum level of pension contributions you can make in a tax year.

This will include a calculation of your available annual allowances – after any applicable tapering for higher-earners – and factoring in available carry-forward allowances from previous tax years. It is a complicated area but one of great importance in the context of your financial plans. If you would like to find out more about this service, you can book a call with one of our advisers here.

2. Be mindful of fees

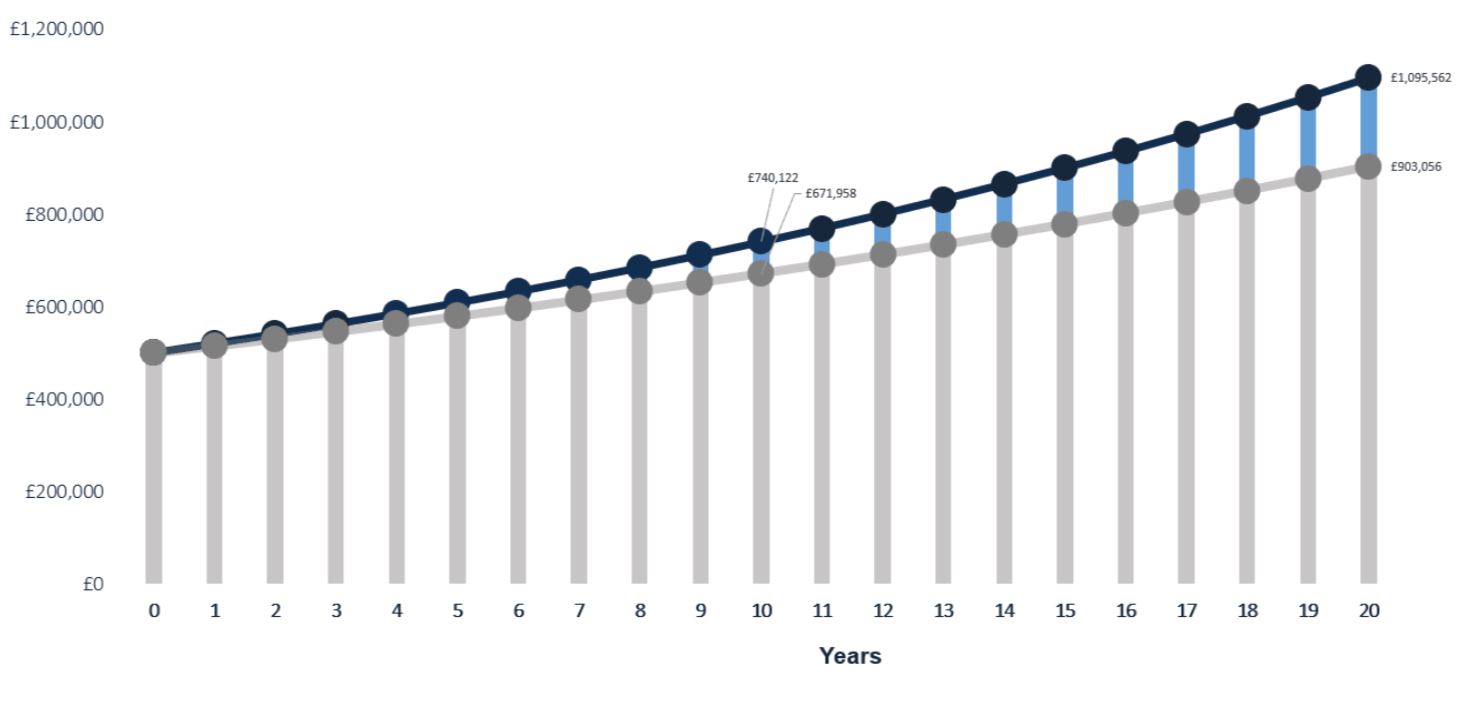

Fees can be highly erosive over time and can especially make a big difference to a pension accrued over a lifetime. For example, assuming growth of 5% a year, an investment worth £500,000 (with no further contributions) could be worth £740,122 after 10 years and £1,095,562 after 20 years when you pay 1% in fees a year.

By paying a fee of just 1% more over this timeframe (2% in total; not uncommon among traditional wealth managers), the value of your pot would only be worth £903,056 over the 20 years – making you almost £200,000 better off by choosing to pay less in fees. See how low our fees are here.

The compounding value of saving 1% in fees

Please note that forward looking models are not a reliable indicator of future performance.

Source: Netwealth. Assumes an annual gross return of 5.0% on a sum of £500,000 and comparing 1% in fees compared to 2% for the purpose of this illustration.

3. Ensure your pension is diversified

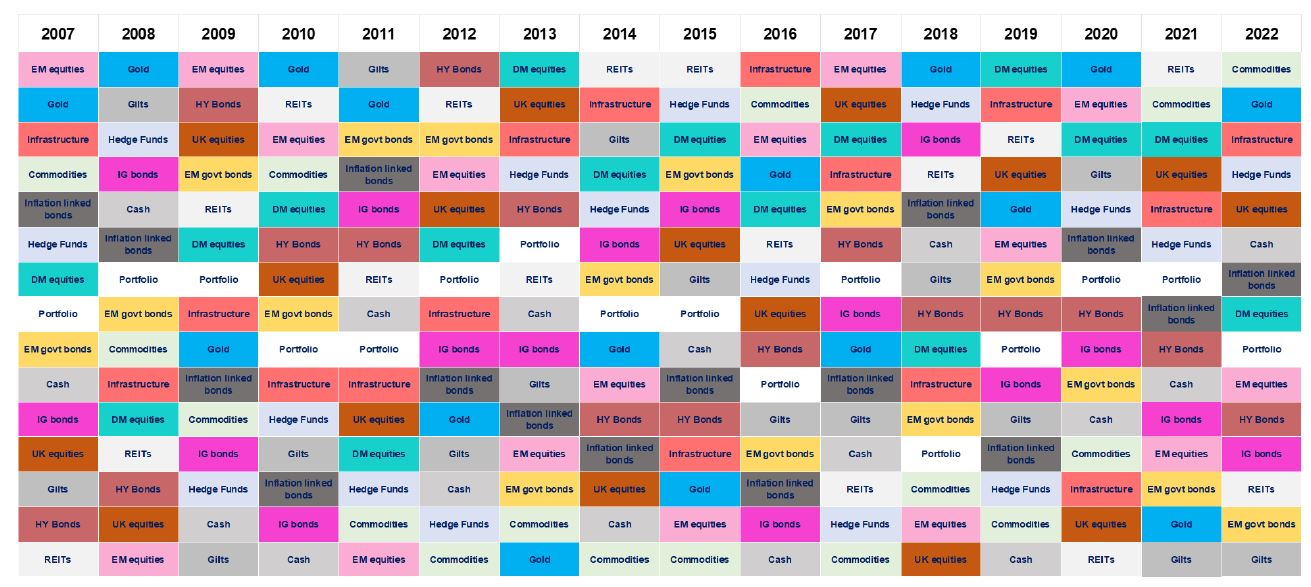

To be well diversified is a popular refrain and for good reason. Different assets perform better at different times: emerging market shares could outperform all other assets in one year, commodities could outshine the next and UK government bonds could be a highly useful asset the year after that. A diversified portfolio can help you to benefit from the gains and mitigate the losses from individual asset classes.

As the following chart shows, it is very difficult to predict which assets will do better or worse over a given period. The chart ranks asset classes according to which performed best each year.

It's hard to know which asset class will perform best in any given year…

Source: Netwealth, Bloomberg. Market returns in GBP, some assets reflect currency hedging.

4. Understand your risk tolerance – and how it could change

When you understand how much risk you are comfortable taking, you can see if this matches with the risk you are able to take. Younger investors may want to aim for higher growth – and therefore take more risk – knowing that in the event of a downturn there is plenty of time before they draw from their pension portfolio for asset prices to recover.

If you are approaching pension age, you may become more risk averse and prefer a portfolio with a higher percentage of fixed income (bond) assets, which are historically less volatile. Once you know what your risk tolerance is you can then choose investments that make the best use of your preference and review the potential impact of your selection using our powerful tools. You can register quickly and start using them for free at MyNetwealth.

5. Capture the benefits of investing earlier in the year

The earlier in the year you can contribute more to your pension, the better. This allows your pension to benefit from the potential of a full year of growth, although there is no guarantee that the value of your investment will rise. Even if you do not have the full amount you would like to invest you can invest monthly or regularly, to also take advantage of your money spending more time in the market.

The next step to boost your pension

The above aspects of investing are largely factors within your control. To ensure your pension is as robust as it could be, these valuable steps may be worth considering sooner rather than later.

If you would like the prospect of lower fees, effective diversification and a risk level that suits your goals better, please get in touch about transferring your pension to us.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions.