Financial MOT—A thorough check-up for your financial health

Get personalised insights and expert guidance to help your financial plans achieve success.

Sign Up HereWhat exactly is a Financial MOT?

Just like taking your car in for its annual check-up, a financial MOT checks your finances are running smoothly. Think of a Financial MOT like a financial health check, providing peace of mind that your finances are in good shape and your future is secure. And, unlike a car, Netwealth's Financial MOT doesn't come with any unexpected bills—just clear, actionable advice to help you stay on track.

Clarity, confidence, and control over your future

Financial planning can be daunting. Whether you haven’t started to think about it or you have a plan already, our Financial MOT helps you stay on track. This one-off service shouldn't be underestimated. A Netwealth financial adviser will give you highly tailored guidance—helping you build new skills, as well as improve and sense-check your plans for later life.

Key values and benefits

How Netwealth's Financial MOT works

- The first step is to enter information on any investments you hold (we’ll gather Netwealth account details if applicable)

- Include your current savings, investments, and goals in the online wealth planner

- We’ll bring this all together to help you get the clarity you need – and help you make the right decisions for your future

A Financial Planning 'MOT' costs £400 for an individual or £600 for a joint plan.

The power of joint financial planning

Understanding how your finances may look as a couple isn't always straightforward. A shared financial plan can help you align your goals, manage resources, and efficiently plan together. Our tools and technology – along with your guidance session with a Netwealth financial adviser – allow you to visualise this.

- Set common financial goals and have the confidence to achieve them

- Make the most of tax wrappers for a couple

- View a joint projection of your future savings and any planned withdrawals – and assess how likely you’ll achieve your joint objectives

- See how different variables, such as your combined risk level, may impact your financial future

- Ensure factors like critical illness cover and income protection align with your overall financial plan and provide adequate security.

What's included in your Financial MOT

Map out your finances

Consolidate and summarise your financial goals, current wealth and investments.

Target your goals

Guidance on the likelihood of achieving your goals with your current plan.

One-to-one session

30-minute video call with an expert adviser to discuss your plans.

Financial MOT report

Detailed report of key takeaways service as a reliable reference point for planning, decision making, and revisiting if circumstances change.

Sign Up HereWhat's not included in your Financial MOT

Specific recommendations on what to invest in or sell

Instead, we'll focus on where your current allocation and level of risk, and assess how these compare to your plan.

Personalised tax advice

Instead, we provide guidance on making the most of tax allowances and tax-efficient strategies. Our goal is to help you optimise your financial plan by effectively using tax wrappers within the context of your overall strategy.

Implementation of your plan

Alternatively, we'll give you clear next steps for you to apply. You can also work with our wider team to see how Netwealth could help you

Want a personal recommendation or for us to implement your plan? For an all-in low cost, our award-winning advice and investment management service can help with all your financial planning and investment needs.

More about our trusted servicesFully committed to your future security

At Netwealth, our chief goal is to maximise the long-term financial health of our clients. This is why we encourage taking proactive steps to keep your financial plans on track. By regularly consulting with a Netwealth financial advisor, you’ll gain a better understanding of your financial landscape, enabling you to make informed decisions that adapt to life’s changes.

Whether through our Financial MOT or ongoing advice, our seasoned experts are well-placed to help secure your financial future.

Insights

Frequently Asked Questions

What does Netwealth's Financial Planning MOT include?

The service includes:

- A detailed report summarizing your financial goals, current investments, and the likelihood of reaching those goals.

- A 30-minute guidance call with an expert adviser to discuss your financial situation and plans.

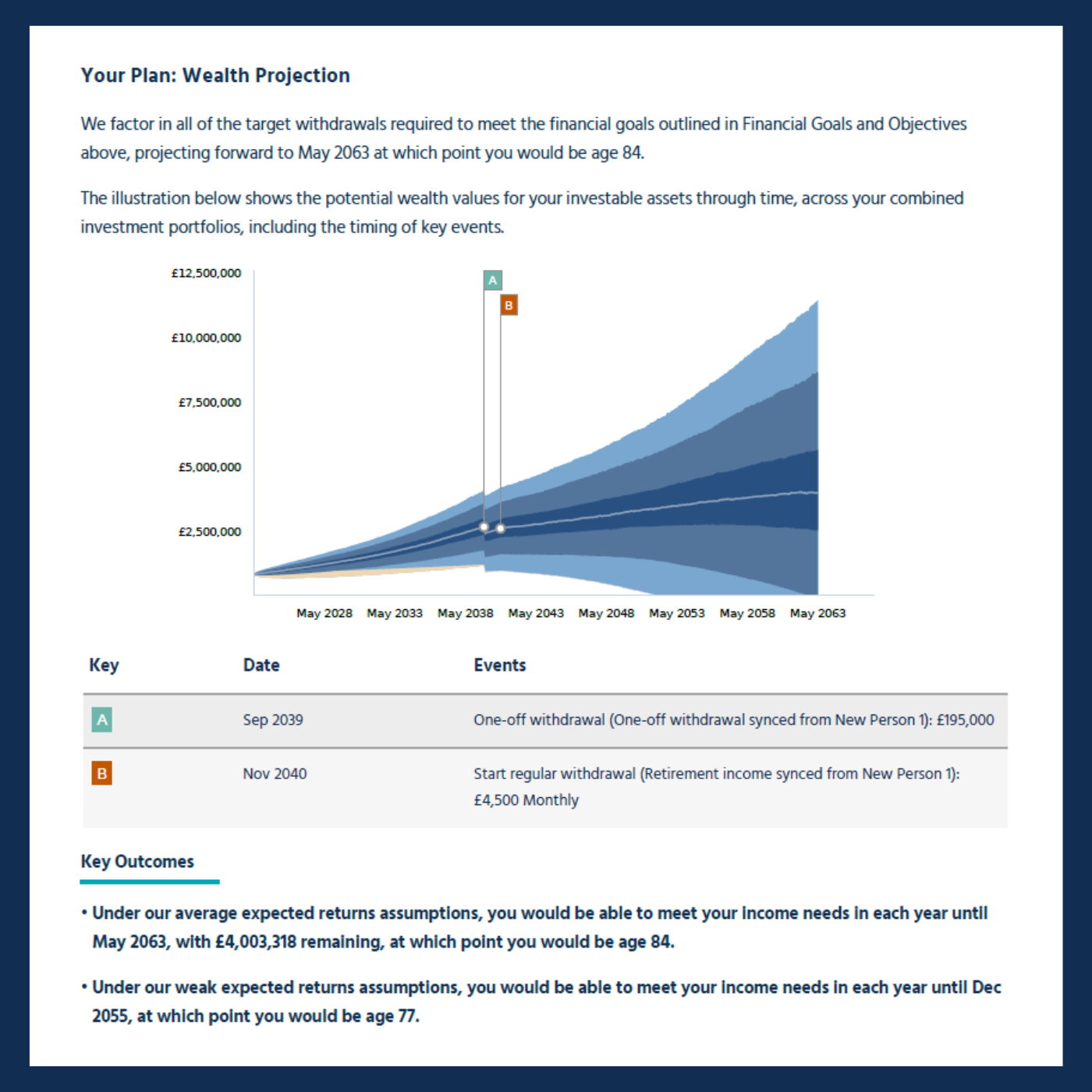

- Personalised projections using advanced planning tools to help you visualise how your wealth could grow based on different factors like contributions, withdrawals, and tax allowances.

How much does the Netwealth Financial Planning MOT cost?

The Financial Planning ‘MOT’ costs £400 for an individual plan or £600 for a joint plan (inclusive of VAT). This fixed fee includes all the services and tools offered within the package, including the personalised report and guidance session.

Can couples use the Financial Planning ‘MOT’?

Yes, couples can benefit from a joint Financial Planning ‘MOT’. The service helps couples align their financial goals, assess combined savings and tax allowances, and visualise a joint projection of their financial future, including planned withdrawals and investments.

What's NOT included in the Financial Planning ‘MOT’?

The service doesn't provide specific recommendations on what to invest in or detailed tax advice. Instead, it offers guidance on your current asset allocation and risk levels, as well as next steps you can take. You can opt for additional advice if you want Netwealth to implement your plan.

What are the benefits of a Financial Planning MOT?

The key benefits include gaining clarity on your financial future, confidence in your ability to meet your goals, and control over your financial decisions.

The service helps you map out your wealth, assess risk levels, and identify areas for improvement, ensuring that you are making the most of your tax allowances and investment options.

Is the Financial Planning MOT suitable if I don’t need ongoing financial advice?

Yes, the Financial Planning ‘MOT’ is ideal for those who want a one-time, thorough review of their finances without committing to continuous advice.

It offers guidance and recommendations that you can act on independently or with further Netwealth services if needed.

Can I access Netwealth’s financial planning tools after my MOT?

Yes, Netwealth’s online platform allows you to monitor your financial plan, make updates, and model different scenarios even after the initial MOT. You can also access further guidance or opt for more personalised advice whenever needed.