What are inflation-protected bonds and how do they work?

Inflation-protected bonds, such as Treasury Inflation-Protected Securities (TIPS) in the US and index-linked gilts in the UK, are designed to protect investors from the detrimental eroding effects of inflation. These bonds adjust the cashflows investors receive in line with inflation, as measured by the Consumer Price Index (CPI) in the US and the Retail Price Index (RPI) in the UK.

In simple terms, the principal (the initial sum invested in the bonds) changes in step with inflation. As inflation rises, the principal increases so that it ends up being a larger amount at the bond’s maturity when it is repaid to the investor. Since the periodic interest payments – usually known as coupons – are typically expressed as a percentage of the principal, they rise as well throughout the life of the bond. This attractive inflation-proofing feature differentiates them compared to regular bonds, whose payments are fixed and therefore eroded in real terms over time.

The ‘fixed’ nature of regular, or nominal bond cashflow structures explains the term ‘fixed income’ when describing the asset class. This is why bonds issued by reliable institutions are often seen as less risky investments than shares or property. However, it also means that the purchasing power of an investor’s capital is ultimately at risk.

In any investment market, current prices should always reflect the expectations for future conditions. For bonds, things like inflation, future interest rates and liquidity conditions are most important. It follows that the differences in future performance between inflation-protected and nominal bonds will only occur when the market has ‘mis-priced’ inflation risks. Simply put, TIPS will perform better than nominal bonds when inflation turns out to be higher than expected, and worse when it is lower.

The role of inflation-protected bonds in a multi-asset investment portfolio

In a well-diversified portfolio, inflation-protected bonds can play a crucial role in providing stability and mitigating inflation risk. These bonds are especially valuable during periods when the inflation rate is high, as they help to preserve the real value of an investor’s holdings. At times, they can be an additional, more effective tool for portfolio managers to use manage overall risk.

Current state and outlook for inflation

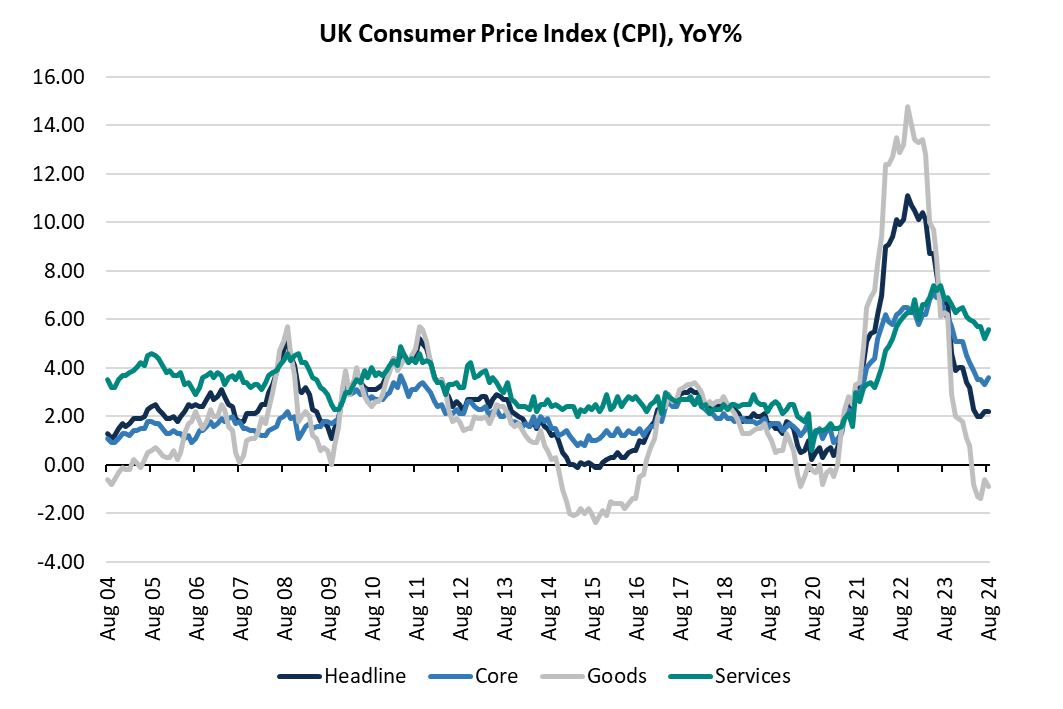

Inflation in the UK has moderated significantly over the past two years. After peaking at over 11% in late 2022, it has now dropped to around 2%, effectively at the Bank of England’s long-term 2% target. This decline can be attributed to a combination of easing supply chain issues and rising interest rates, which have helped to curb demand.

Source: Bloomberg

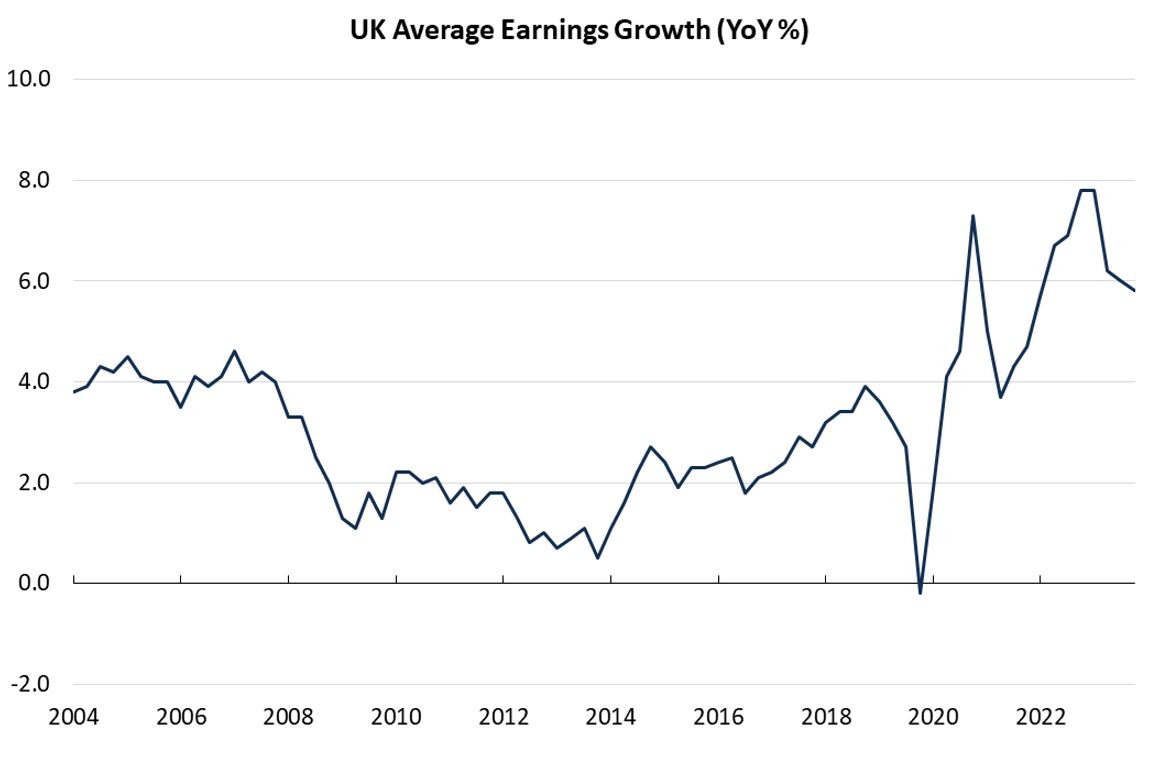

While the recent inflation shock appears to have passed, the future path of inflation remains uncertain. Currently, we are experiencing disinflation, rather than deflation, meaning prices are rising at a slower pace but not falling. This can be viewed as a positive development, as it suggests that the economy is cooling without experiencing a significant downturn. However, this means most items will still cost more than they did previously. The cost of living remains significantly higher than in previous years, and wage increases have not kept up with rising costs.

Looking forward, despite more modest growth, we expect to see the global economy avoid a recession as central banks in major developed markets embark on policy normalisation by cutting interest rates. This scenario is coupled with the fact that the ongoing cost of living crisis will likely see demands for increased wages to persist, and we are observing fragmenting global supply chains due to rising geopolitics. We therefore believe that inflation is likely to settle at a higher level than in the past.

Source: Bloomberg

What does this mean for investors?

For investors, the continued risk of inflation means that incorporating some protection into their portfolios may well be a prudent strategy. Inflation-protected bonds, like TIPS, offer a way to safeguard against unexpected spikes in inflation, preserving purchasing power over the long term with relatively low risk. While it depends on the time horizon, the cost of protecting against future inflation via inflation protected bonds, known as the breakeven rate of inflation, has been falling this year and complacency of the future may be creeping in.

Although predicting inflation’s exact path is challenging, having a portion of your investment portfolio in inflation-linked securities can provide both peace of mind and financial resilience. By understanding the mechanics of these bonds and their role within a diversified portfolio, investors can take steps to protect their wealth from the eroding impact of inflation.

If you have any questions please get in touch.

Please note, the value of your investments can go down as well as up.