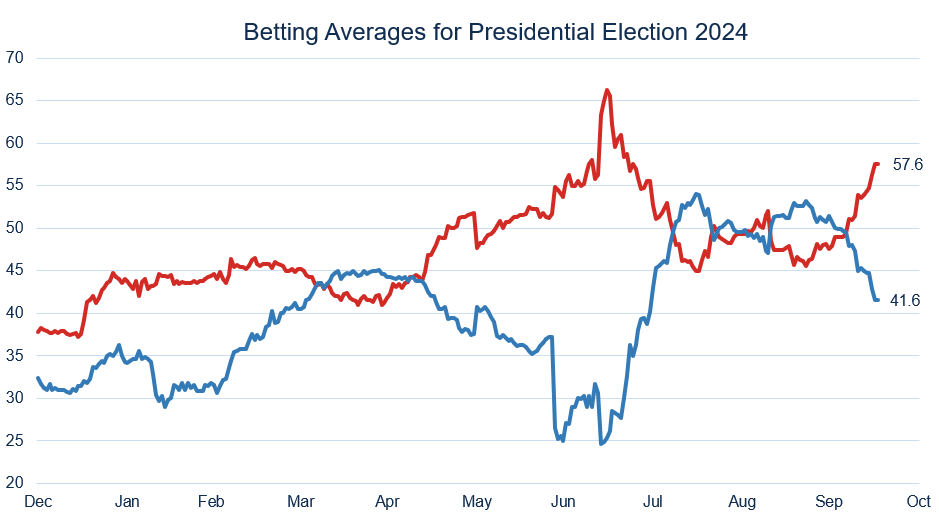

The nomination of vice-president Harris in July re-energised a flagging Democrat campaign. However, having maintained a small lead through most of August and September, many polls and betting markets have former president Trump opening a small lead in the past week, thanks to improving prospects in seven key swing states. A route to the threshold 270 electoral colleges is clearer for the Republicans.

Source: Bloomberg, realclearpolitics.com

There are various potential outcomes. One, there is a clear victory in the Presidential contest. Despite a sustained, tight contest, polls are not perfect and the vote may be more conclusive than it currently appears.

Two, victory could extend to a clean sweep, which appears more likely for Republicans than for the Democrats. If Republicans add presidential control and a majority in the Senate to its current majority in the House of Representatives, then the direction of travel for policy could be quite different compared to a backdrop where the executive and legislative branches of government are on opposite sides, acting as natural brakes.

Three, there may be uncertainty beyond election day. It may take some days to determine the outcome if the result is contested or requires recounts, such as in the 2000 election when Al Gore only conceded in mid-December. Any disputed outcomes won’t be well received by markets.

Differences in the two candidates’ intentions for fiscal, trade, and immigration policies all have the potential to impact markets and we examine each in turn below.

Fiscal

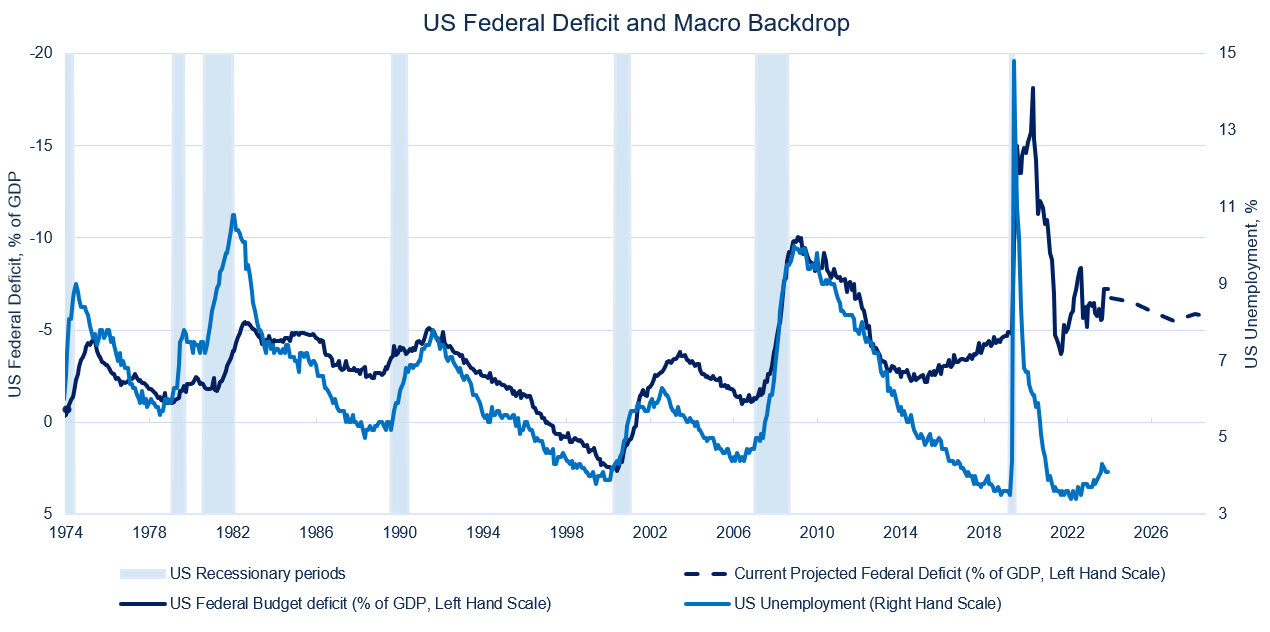

Theoretically, both parties will need to be fairly constrained from a fiscal point of view. The Federal deficit is running at more than 7% of GDP, at a time when unemployment is only 4%, so still very close to its cyclical low point. Historically, deficits only widened substantially at times of recession or war, but neither party is focused on reducing it now.

Trump is likely to extend the temporary aspects of the 2017 Tax Cuts and Jobs Act (TCJA) which are scheduled to expire in 2025. This makes it more likely for the deficit to increase beyond the high but stable level currently forecast by the Congressional Budget Office, below.

Additional ideas which have been floated by the Trump camp include a reduction in corporate tax rates from 21% to 15% and eliminating personal taxes on income from social security and tips. In contrast, Harris has pledged to extend the TCJA provisions for those earning less than $400,000 and to supplement existing support for lower earners with a round of tax credits. This cost would likely be offset by higher corporate tax rates, resulting in lower expected deficit levels than under a Republican administration, but we believe this would only be possible in a “blue sweep” outcome.

Source: Bloomberg, Congressional Budget Office, with Netwealth calculations

Trade

The outlook for trade has been dominated by the likely breadth of tariffs that could be imposed by the US on imported goods. Harris recognises the widespread appeal for protectionist policies, having supported the Biden measures imposed on Chinese electric vehicles. However, she would likely stop well short of Trump’s mooted plans: a 60% levy on Chinese imports plus 10% on other imported goods.

If such an aggressive policy is passed into law, it would remain to be seen if the US consumer could withstand the higher implied prices or a presumed hit to growth. Yet confrontational trade policies look set to be a feature of the next four years whatever the outcome of the election.

Arguably, maintaining the political status quo could be the best outcome for those looking for a more stable environment for trade, given the implied challenges of passing new legislation.

Immigration

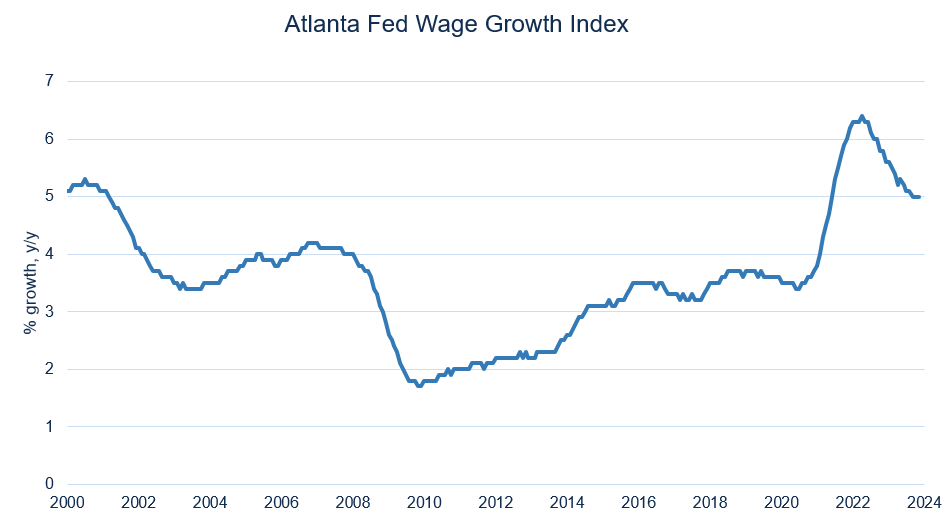

Immigration has been a key area of focus for both candidates, given how highly it ranks on voters’ concerns. Trump would likely take the tougher stance, but the extent to which immigration is limited or deportations delivered could depend on Congress and the courts. Alongside tight monetary policy, labour supply from immigration has been a key contributor to pushing wage growth back down from its post-pandemic highs, and is another area where Trump’s critics will see inflationary catalysts.

Source: Bloomberg

Market outlook

There are obvious risks to positioning portfolios based on picking potential winners to public votes. Not only does an investor need to be right about the outcome of the vote, but they also need to be right about the anticipated market reaction, blended in with all the regular non-political drivers of market returns. And that’s before we consider the likelihood of the successful candidate delivering on their promised policies!

Timing is even more crucial in a tight race: as soon as a winner looks likely, markets quickly re-price. Our preferred approach is to construct portfolios to withstand a range of outcomes, but we outline how we expect the main asset classes (US equities, bonds and the dollar) to perform below.

Equities

Lower corporate taxes combined with a lighter regulatory environment imply a market preference for a Trump victory. Investors using his last win in 2016 as a reference would expect higher markets after initial volatility, and led by smaller companies with their greater domestic focus.

Would a Trump 2.0 administration have the same effect? We doubt there would be the same level of initial volatility – but also less of a sustained tailwind for future returns. The change in prevailing corporate tax rates won’t be as significant, US equities trade on richer valuations now than eight years ago, and the market may also remember some of Trump’s unrealised promises on growth during his first term.

However, the outsized returns in recent years from US equities have repeatedly shown investors that valuations don’t matter in the short term – especially if there are no disruptions to earnings delivery, and lower taxes feed through quicker than the impact of disruptions to trade and growth.

Bonds

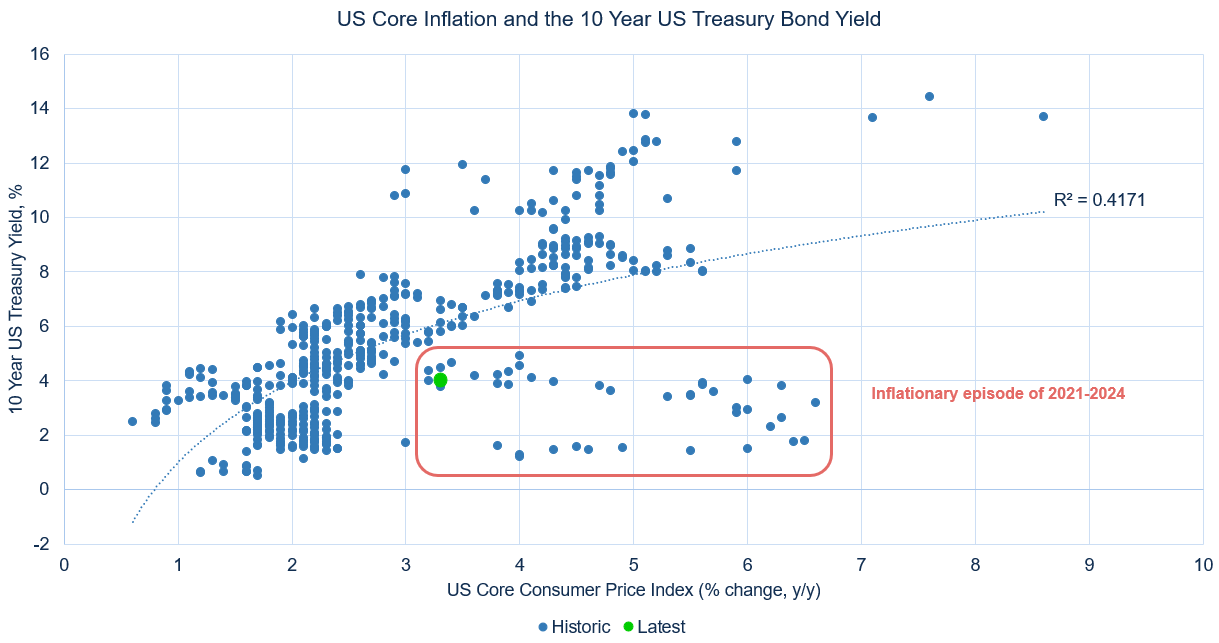

As ever, bond markets will be trying to pick apart the expected impact from policymakers on inflation, economic growth and debt levels. After the huge repricing of the past three years in response to higher global inflation, the backdrop for US Treasury bonds currently looks closer to normal, with a positive yield after inflation has been taken into account.

Aspects of both candidates’ policies look inflationary, led by tighter immigration controls pushing wage costs higher. This could keep a floor under interest rates in the coming years. As above, Trump’s tax cuts are expected to deliver higher economic growth, but aggressive tariffs will offset this and the higher debt profile is expected to push longer-term yields higher. We think this would lead to a steeper bond yield curve (with long-term yields rising at a faster rate than short-term yields) and portfolios are positioned to anticipate this.

Source: Bloomberg

The dollar

In a tight race, and with one candidate characterised as an incumbent, it’s difficult to say what is already priced into currency markets. As things stand, we expect a Harris victory would be treated as a continuation of the status quo and have little impact on the market.

The dollar initially responded positively to Trump’s election in 2016, and to the imposition of tariffs in 2018 (after a period of softness in 2017 prompted by strong global growth conditions). It is our expectation that trade and immigration policies would also drive a rally in the dollar with a 2024 Trump win, especially if there is a Republican sweep. This is at odds with Trump’s stated preference for a weaker currency to boost US manufacturing – and disregards the possibility of explicit manipulation from the Treasury.

The political backdrop only tells part of the story with the dollar, as we expect monetary policy to remain the most important factor. Markets are again walking back the number of interest rate cuts priced for the coming year, while the challenges of economic stagnation in Europe, uncertainty in Japan and monetary stimulus in China all make the case for further dollar strength.

International impact

International markets will also be affected by the outcome, with its ramifications for global trade, geo-politics and the follow-through from funding markets and movements of the dollar. Relations with China has been at the forefront of the campaign trail, but western European economies are also impacted by trade, foreign policy debate and what it means for energy markets.

Please note, the value of your investments can go down as well as up.