What is a bare trust?

A bare trust – which can contain a Junior GIA (General Investment Account) – is a flexible way to invest on behalf of a child. They offer a distinct advantage over a Junior ISA as there is no limit to how much you can contribute to a Junior GIA. You can also open as many of these accounts as you like, if you wish to save for different purposes, for example.

The money held within a bare trust can also be accessed by the trustees any time for the benefit of the child. (Other providers may allow bank accounts and property to be held within a bare trust.)

What can they help save for?

A bare trust can be used for whatever purpose you think would benefit a child – yet the flexibility of a bare trust makes them especially popular for school fees, as the funds can be accessed as required.

Funding private school fees is also a frequent challenge. The latest figures from the Independent Schools Council show that school fees average just over £18,000 for day attendees, with some variation between primary and secondary levels and much more for boarding schools.

And these figures are before the widely telegraphed addition of VAT to these charges (now confirmed from January 2025), which could mean an extra 20% needs to be found to pay for private education.

Tax benefits for giving

Grandparents and others who wish to help a child can also likely improve their own tax situation. Assets placed in the trust are treated as potentially exempt transfers for IHT purposes. If the settlor (or trustor) – the person who puts assets into the trust – survives for seven years after the transfer, the assets become fully exempt from inheritance tax.

If it looks likely you will have assets remaining at the end of your lifetime, bare trusts are an effective way to reduce your estate now. You can keep control over these assets, and how you want them distributed. A trust deed could be set up in such a way that trustees have some flexibility in managing and distributing the assets even after the beneficiaries reach age 18.

Example of the tax impact for grandchildren

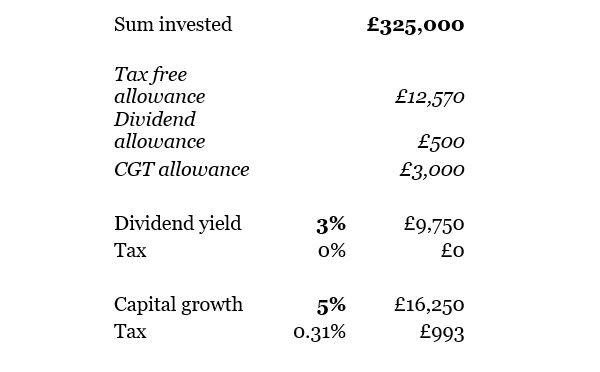

If £325,000 was put in a bare trust by grandparents for one child, the tax would be as follows (assuming 3% dividend yield and 5% capital growth):

If there were two grandkids (£175,000 each), they would effectively pay 0% tax, even on the capital growth. When a bare trust is set up by grandparents, income is taxed at the child’s marginal rate, meaning it is likely to be tax free.

Establish if you can afford to give to a child

You should first establish whether any gifting plans you have are within your means. Many clients find that the significant benefits of cash flow modelling really helps them to gain a clearer picture of their circumstances now – and how that could change over time.

Planning for your future, and those you care about, can be so much easier with visual projections, and a sharp analysis of your finances can help you to realise the potential you may not believe is even attainable.

No need for a lawyer, or to compromise on choice

While the concept of a bare trust may sound complicated we can set one up for you swiftly and without hassle. This also means there is no need to pay expensive lawyer fees.

Although they are typically set up for younger family members this does not mean the beneficiaries have to compromise on the quality or range of the investments. A bare trust with Netwealth (Junior GIA) offers the same choice of portfolios, investment approach and highly competitive fees that we provide for all our clients.

Benefits at a glance

- A trust gives you some control and flexibility over who benefits and when.

- Very easy to open and set up.

- Assets placed in the trust are free of IHT if the donor lives for seven years after transfer.

- If set up by grandparents, income is taxed at the child’s marginal rate, meaning it is likely to be tax free.

- Funds can be accessed before a child turns 18 – unlike a Junior ISA.

- No compromise on quality or range of investments.

- No expensive lawyer fees.

It’s better to be prepared

Apart from the pledged hike of private school fees, other government changes to the financial landscape are inevitable.

If opening an account for a child is within your means, it may be best to be proactive and have a plan in place. Using the tax breaks and investment vehicles available to you is prudent, and means you can take advantage of current tax efficiencies, investment opportunities and estate planning strategies that align with your goals.

With tailored cash flow planning and financial advice we can help you to make better decisions and safeguard and optimise financial outcomes for you now and for future generations. Please get in touch if you wish to discuss further.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions.