One thing seems certain in the year ahead: positive and negative newsflow will continue, and many of the economic challenges facing markets around the world will not disappear. But as policy starts to form in the US, we can look at where opportunities for investors may lie, and share how we are positioning portfolios to benefit.

Backdrop to our current outlook

Each year, we reassess our expectations for the returns that investors may see over the next 7 to 10 years across different asset classes. Historic norms provide strong guidelines as to how equity and fixed income markets will generate returns: everything boils down to a combination of the cashflows we expect to be generated, and how much value investors will place on those cashflows in light of the wider environment and other opportunities.

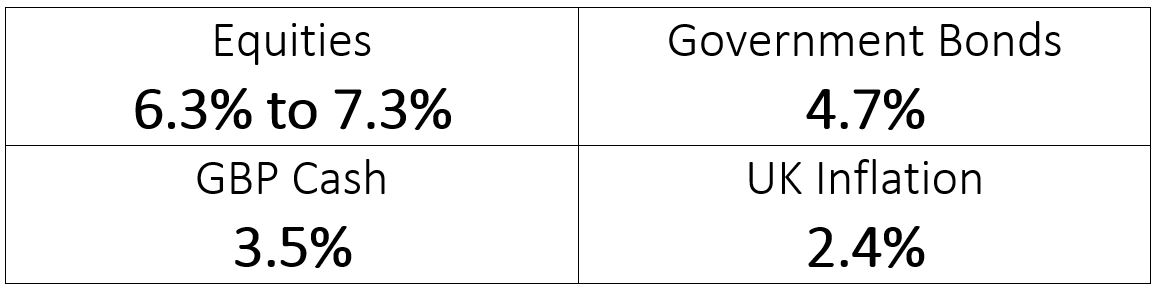

Our long-term forecasts (7-10 years) suggest that government bonds will return close to 4.7% per annum. Meanwhile, the major equity market blocks in which we invest will average between 6.3% and 7.3% per annum, with a wider band of uncertainty reflecting their more volatile nature. As a result, our starting assumption is that higher risk portfolios will continue to outperform more cautious strategies – but they will come at the cost of a more variable path.

Forecasts included are not guaranteed and should not be relied upon.

Source: Netwealth. Long-term performance forecasts.

These rates of return compare to a long-term forecast UK inflation rate of around 2.4% (thereby remaining above many of the leading central banks’ 2% target) and an average cash rate in the UK of just under 3.5% per annum.

Simply put, we expect that investors will continue to be rewarded for putting their money to work in the years to come, despite the expected and no-doubt unexpected risks that lie ahead.

Equity markets: more of the same?

The past 10 years have been very rewarding for investors in equity markets, even though we have seen meaningful, and well-founded corrections in 2015, 2018, 2020 and 2022. At the base level, we think investors can expect more of the same.

Currently elevated valuations in parts of the market, overly-optimistic sentiment and investor positioning combined with unpredictable political paths are the main risks to a solid picture around future profit growth. But seeing off volatile periods through a combination of patience and sensible portfolio construction is at the heart of multi-asset investment.

Bond markets: a better starting point

The biggest change in the market backdrop in recent years has been in government bond markets. Future returns will be built on a secure income stream which is above our expected rate of inflation. This is in sharp contrast to much of the past 15 years.

The risks to bonds are well known: it’s too early for central bankers to call victory in the battle against inflation, and weak government finances in the US and across Europe suggest caution around the levels of future bond issuance which could help to push yields higher. However, investors are being compensated with attractive yields, and bonds will offer value if the picture for global growth falters from the current levels.

US: more ordinarily exceptional

The US stock market has consistently proven to be the best home for investors’ capital in recent years, with strong economic growth supported by easy fiscal policies and a responsive central bank. Moreover, the uniquely strong profits growth of the largest stocks – all centred around technology – has provided reliable investment returns when the international environment has been much less clear.

The resulting market setup is a function of this historic success. We expect that the US market will benefit from fundamental economic strength as low unemployment rates and a stabilising inflation picture bolster the spending power of the US consumer. We discuss the Trump administration’s attitude to markets elsewhere, but a low tax and deregulation mindset should support markets.

However, valuations of the leading stocks remain a high hurdle: on 5 of our 7 preferred valuation metrics, the US stock market has only been cheaper a maximum 10% of the time through history. When markets are priced to perfection, any misstep on future profits delivery can be dangerous. That isn’t our base case for 2025, but the market has already had a few practice runs at testing conviction in names like Nvidia and Tesla.

We prefer to allocate more broadly within the US – avoiding the concentration of recent tech behemoth performance and finding room for the next level of great companies in the mid-cap space. Their earnings are also expected to grow well, if more variably, but pricing and the prevailing sentiment are less complacent. As the gap between the earnings growth of the largest stocks and all the others narrows, we expect to benefit from a more diversified US equity exposure.

UK: catalysts are hard to find

Investing in the UK stock market has been much more frustrating. We continue to be attracted to its high dividend yields, reasonable valuations and a defensive sector mix which helped differentiate our portfolio performance in the equity market drawdown of 2022.

However, the catalysts to unlocking clear value remain elusive; economic fundamentals look challenging and profit growth is expected to remain lacklustre. International and private buyers have been bargain hunting but UK capital markets are shrinking as a pool of opportunity for long-term investors. As a result, we are trimming our UK equity allocations in favour of other market coverage.

Changes to portfolios

We have made a series of changes to investment portfolios in recent weeks as we refocus on the outlook for the months and years ahead. Some of these are strategic in nature, based on our analysis of the longer-term prospects of different investment asset classes, while others are driven more by shorter-term, cyclical factors and regular rebalancing back to target levels after performance drift.

In summary, the changes include:

- Diverting UK equity allocation into the US market, but incrementally focusing away from the technology ‘mega-cap’ stocks which already represent a meaningful portion of portfolio risk.

- Cautiously increasing portfolios’ exposure to high quality, sovereign fixed income. Volatility in this market has opened up opportunities for patient investors – and any negative surprises on the outlook for economic growth will feed through into strong performance

- We have removed several instruments which targeted specific areas of fixed income markets. This includes the allocation to emerging market and inflation-protected bonds as well as the ETF which explicitly benefited from a ‘steepening’ of the bond yield curve (where yields between short-term and long-term bonds widen). In the context of overall portfolio returns, we think that taking broad exposure to gilts and US Treasuries is likely to be a more reliable source of future performance.

Where could the surprises come from?

As ever, it will be vital in the coming months and years to strip out the newsflow and noise from drivers of long-term investment performance, so our team is focused on filtering for real policy impact on asset class fundamentals.

We routinely consider a range of scenarios which could impact the behaviour of portfolio investments, and while it's always easy to paint a picture of concern from geopolitical risks, we are aware that a lot of bad news may already be priced by the market.

As always, if you want to find out more about how our investment approach can help you achieve your goals, please get in touch.

Please note, the value of your investments can go down as well as up.