Netwealth Portfolio Performance—Our Five-Year Track Record

May 31st 2021 represented a milestone for the seven sterling Netwealth portfolios, as they reached their fifth anniversary since launch. Alongside other key aspects of our service, it feels like a good time to look back at what the investment experience has been like for our clients, as well as highlight some areas of interest for the future.

- After a volatile start to 2020, markets have rallied over the past 12 months

- Portfolio returns since launch have been ahead of expectations and peers

- Markets are still focused on the short- and medium-term impact of the pandemic and the fiscal response to it from around the world.

The latest year has seen strong performance from equity markets, thanks to the support of central banks, governments and vaccine rollouts in restoring confidence after the violent falls and sharp rebounds of the first quarter of last year. This led to leading returns from our most ambitious risk level portfolios, while the more cautious and balanced risk levels saw more muted performance due to the dampening impact of their fixed income exposure.

Netwealth portfolio performance May 2020 to May 2021

Source: Asset Risk Consultants and Netwealth* with data as of 31st May 2021.

Historic performance is not a reliable guide to future performance.

This is a very different picture to our experience of the previous year, when those same Risk Levels 3 and 4 delivered the best returns. This is true for the absolute numbers and relative to their appropriate peer groups of other UK wealth managers, as represented by the Asset Risk Consultants Private Client Indices.

Netwealth portfolio performance May 2019 to May 2020

Source: Asset Risk Consultants and Netwealth* with data as of 31st May 2020.

Historic performance is not a reliable guide to future performance.

The turnaround in market returns reminds us once again of how tricky it is to time investments, and our process of building sensibly diversified portfolios of liquid asset class exposures remains in place. This approach has served us well since launch in 2016, and the returns of last year have compounded the performance above the portfolios’ long-term inflation-relative comparators, as represented in the chart below.

Annualised portfolio returns against performance comparators

Source: Netwealth*, Bloomberg.

Historic performance is not a reliable guide to future performance.

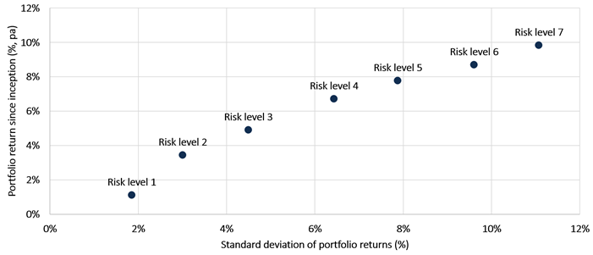

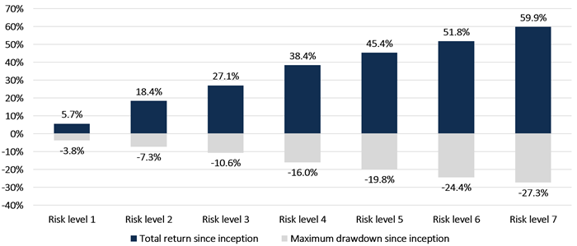

Capital market performance has certainly been positive since inception. However, as we always remind clients and prospects alike, potential performance often comes with the price of volatility of returns. We show this in two ways below, with both a greater general variation of returns (known as standard deviations) and in terms of the maximum drawdowns in performance incurred at a given time.

Netwealth portfolios: historic risk and returns

Source: Netwealth*

Historic performance is not a reliable guide to future performance.

We are pleased with the way that the different risk level portfolios have performed in relation to each other. Over time, there has been a clear incremental improvement in returns generated for each additional increase in portfolio risk.

Total returns vs drawdowns

Source: Netwealth*

Historic performance is not a reliable guide to future performance.

Strong performance vs peers

To gauge whether our portfolios have delivered competitive returns, we compare results to the Asset Risk Consultants Private Client Indices (ARC PCI). We are pleased to be able to say that performance has continued to be strong, compounding the historic performance delivered previously. Overall, portfolios have beaten their peer aggregates by 0.4% to 1.4% per annum on an absolute basis.

Netwealth 5-year portfolio performance against peers

Source: Asset Risk Consultants and Netwealth with data as of 31st May 2021*

Historic performance is not a reliable guide to future performance.

Past Performance Detail

![]()

Source: Asset Risk Consultants and Netwealth with data as of 31st May 2021*

Historic performance is not a reliable guide to future performance.

Portfolio changes and looking further ahead

The experience of 2020 and 2021 so far has shown us two things. Firstly, diversified portfolio construction is vital, as investors can rarely anticipate what events will disrupt market behaviour. Secondly, not over-reacting during periods of volatility is often the best way to ensure that portfolios see the best longer-term returns.

However, we still need to be watchful. Recent economic data has continued to have a positive tone. Huge fiscal stimulus packages, easy monetary policy and vaccine deployment have supported all risk assets, but now markets are trying to price for a wider range of future growth and inflation scenarios than previously imagined.

The Netwealth portfolios were repositioned earlier this year to reflect this uncertainty which was felt acutely in the bond markets. We sought greater diversification across different asset classes by introducing allocations to broad commodities and gold.

Where relevant, more targeted exposure was taken late in the quarter to fixed income assets where a higher level of inflation risk is already reflected in pricing. In equities, our focus has been to balance between areas with apparent attractive valuations and shorter-term, more cyclical drivers of returns.

An investment approach reflected in performance

By sticking to sensible, calculated combinations of diversified, liquid assets, we believe our clients are protected from many of the behavioural pitfalls that can meaningfully impact long-term investment performance targets.

The benefits of this strategy have been reflected in our performance. Coupled with a rigorous adherence to lower costs and our focus on compounding incremental gains for portfolio returns, we consider our portfolios to be well positioned to help clients continue to achieve their investment goals.

To find out more about our investment approach, please click here.

* Netwealth portfolio returns are shown in GBP. Returns are based on indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place, net of all charges associated with the underlying fund investments, and a Netwealth fee of 0.35% per annum which covers management, trading, custody and administration charges. Netwealth’s fees range from 0.65% – 0.35% pa depending on account size.

This article was amended on 4th August 2021 to reflect the confirmed performance numbers from the Asset Risk Consultant Private Client Indices.

Please note, the value of your investments can go down as well as up.