Why it is Essential for Investors to “Control the Controllables”

When taking investment risk there are several factors that are out of your control: market performance, inflation and even your individual time horizon (due to changes in life expectancy). However, while it is sensible to model for these factors where possible – the tools here can help – there are certain things you can influence that significantly impact your wealth:

Minimise fees

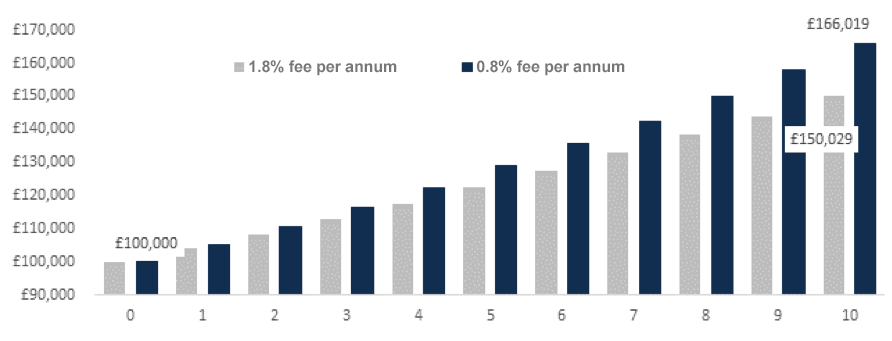

While paying fees to manage your money is unavoidable, these charges are controllable – and can make a big impact. Over 10 years, for example, you could be over £15,000 better off for every £100,000 invested if you saved 1% in fees by using a more competitive wealth manager like Netwealth (comparing all-in fees of 1.8% vs 0.8% per annum, assuming an annual gross investment return of 6%). Full details of our fees can be found here.

The Compounding Value of Saving 1% in Fees

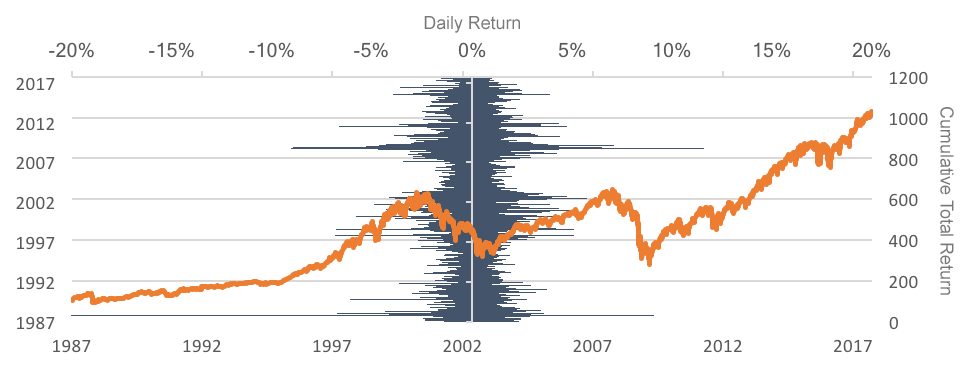

S&P 500 Daily returns since 31st December 1986

Source: Netwealth. Assumes gross investment returns of 6% per annum.

Make use of tax wrappers

Putting your savings in a tax-free wrapper such as an ISA can greatly improve your net returns. For example, £100,000 invested for 10 years could be worth £127,000 when subject to the higher rate of income and capital gains tax. Yet if this money is invested in an ISA – with no tax – it could be worth £153,000, nearly double the total return on investment. (Assumes long-term median expected returns investing in a Netwealth Risk Level 6 portfolio, with tax marginal rates of 40% on income and 20% on capital gains. Source: Netwealth.)

Spend time in the market

Spending time invested in the market and not trying to time the market is often touted as a golden rule of investing – for good reason. Timing when to be in or out of the markets is very difficult and can be extremely costly. Since the start of 1987 the S&P 500 has produced total returns in dollars of 933%. But if you missed the top 10 trading days over this period you would only be up 399%.

The chart below shows the benefit of staying invested over the long term and difficulty of getting in and out of the market. The orange line represents the long-term performance of US equities; the blue bars represent daily moves, highlighting how hard it is to know when is the right time to react, based on day-by-day changes. We advocate investing for the long term, in a risk level that you are comfortable with, so that you can ride out the day-to-day volatility of markets.

Markets can be volatile but generally trend up over time

S&P 500 Daily returns since 31st December 1986

Source: Bloomberg, Netwealth. Cumulative total returns and daily returns of the S%P500 since 31st December 1986.

Be suitably diversified

From year to year different assets deliver different levels of returns – but it’s almost impossible to predict which assets will perform well and when. The point of a diversified portfolio is that it reduces extremes and smooths the path of returns. Individuals may find it difficult to construct their own portfolios cost-effectively, or to find the time to do so – which is why so many are looking to firms like Netwealth to effectively diversify their money at the right cost.

While you may not be able to control the ‘uncontrollables’, they should be frequently assessed and stress-tested so action can be taken where necessary. It’s important to note, however, that the four factors listed above – fees, tax wrappers, staying invested, being diversified – are very much within your control and can have a huge impact on investor outcomes. To focus on these is time well spent.

Please remember that when investing your capital is at risk.