The challenges and opportunities for bond investors

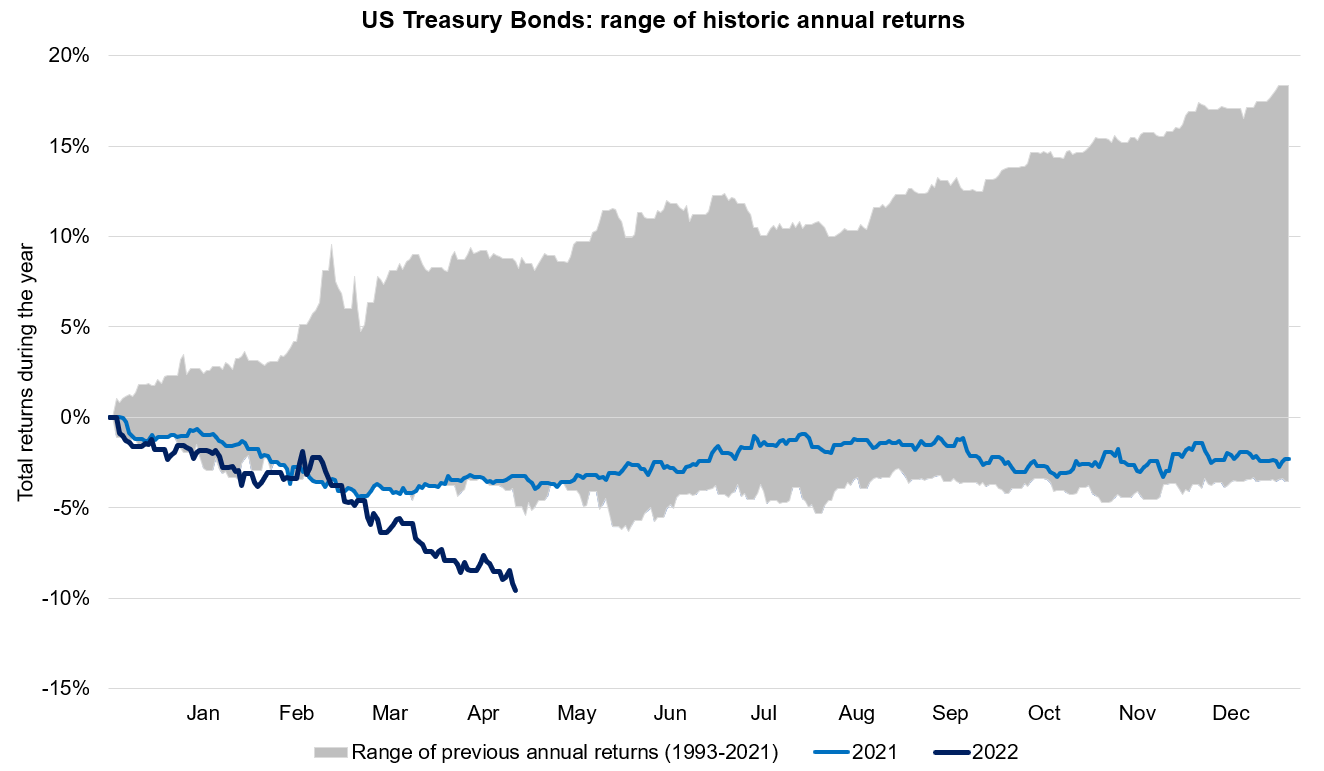

US Treasury bonds (the US equivalent of UK government bonds) have had their worst start to the year for a very long time. Looking back at the range of historic returns since 1993, the negative 8% return in 2022 experienced by a broad index of what is considered the ultimate safe asset has been painful and extremely unusual, driving yields (the returns from bonds) higher.

Source: Bloomberg Barclays Treasury Index total return by calendar year, with Netwealth calculations. Data to 6th May 2022

The setting

The fear of aggressive increases in interest rates in the US and elsewhere is the direct reason that bond prices have dropped. Sharply rising costs of goods, fuelled by ongoing supply chain disruption and the Russian invasion of Ukraine’s impact on key commodity prices has driven central banks to act.

The fact that the employment picture still looks rosy in the US has given the Federal Reserve the confidence to make borrowing money a bit more costly. Having kept policy very easy with record low rates and quantitative easing (where a central bank buys assets, mainly long-term government bonds), they want to move now in case these inflationary pressures seep into longer-term expectations.

Not as easy as 1, 2, 3

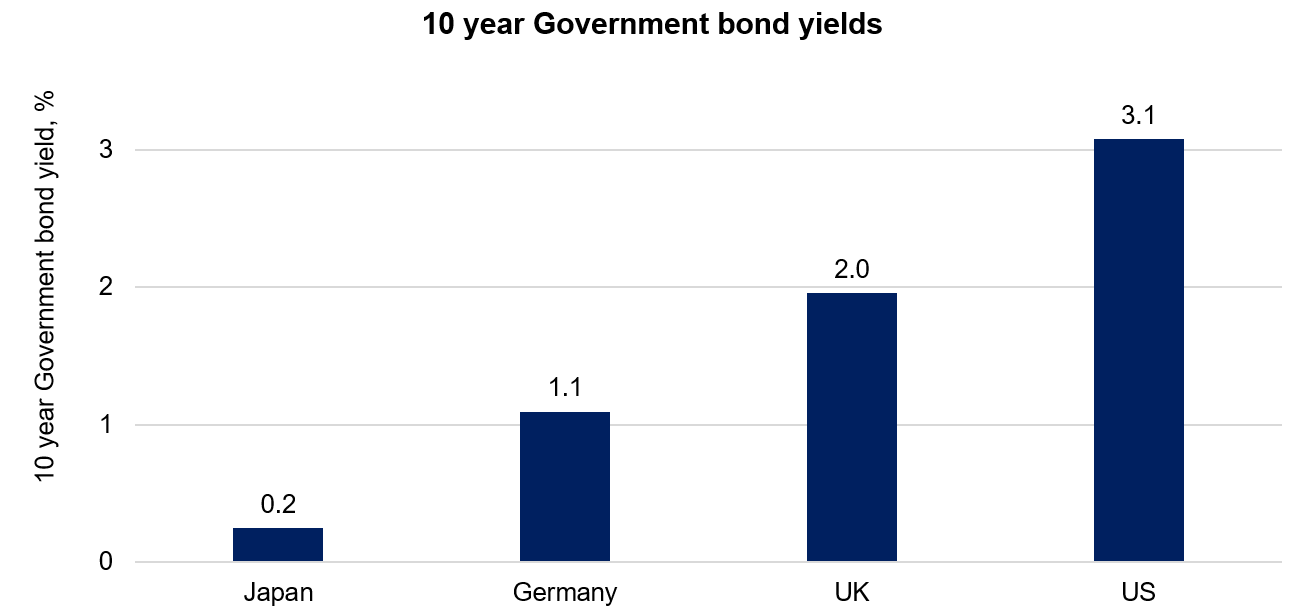

Source: Bloomberg, as of May 6th 2022

While the focus is on the US, other leading economies are also facing pressures. But Japan, the Eurozone and UK are all perceived as more structurally fragile, so interest rates – and therefore most likely bond yields – are not expected to reach the same levels. The interaction between different levels of economic expectation has also been felt in the currency markets, with the US dollar rallying strongly – particularly against the Japanese yen and the Chinese yuan where the growth rate is falling in the face of severe covid lockdowns.

What does this mean for future returns?

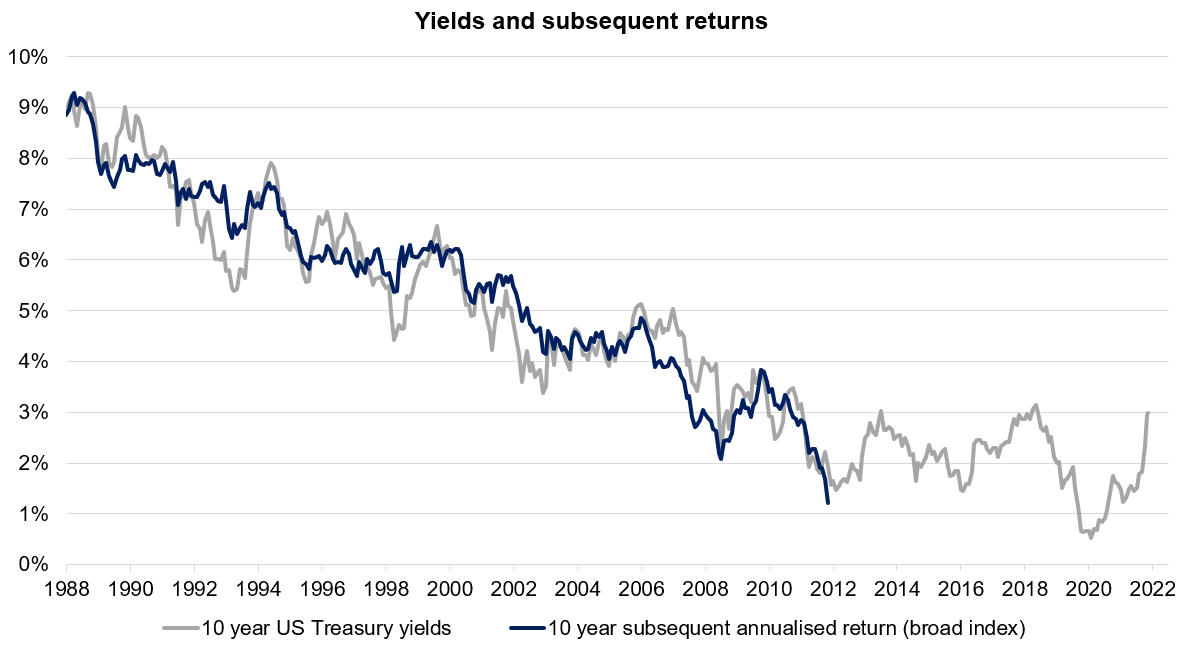

Historically, one of the best guides to future bond market returns has been the prevailing level of yields at any given point in time. In the chart below, we see that the high levels of yields on offer from US Treasuries 30 years ago was very rewarding for investors, with the helpful tailwind of newly independent central bank mandates of inflation control. As the levels of yields have fallen alongside inflation, so have prospective returns. Thanks to a modest starting yield in 2012 and the sell-off this year, the past 10-year return has been the lowest in modern history.

Source: Bloomberg with Netwealth calculations. Data to 30th April 2022

The rise in yields does mean that long-term investors in government bonds can expect a higher total return in the future, as the cushion of a 3% yield will help to offset any more price volatility. However, most investors are focusing on so-called real yields, after the impact of expected inflation has been taken into account. US real yields are only now back into positive territory, with other regions still lagging further behind.

Not a one-way bet

Today’s high inflation readings tell us what has happened to prices in the past, whereas bond markets need to price for the future. How and when inflation subsides from the current sky-high levels will be vital to the returns we see in the coming months and even years.

Bonds have rarely been less popular with professional investors,[1] which is usually a cautionary sign – investor sentiment tends to follow price moves rather than lead them. Should growth levels continue to fade and inflation begin to subside then central banks risk tightening policy (raising interest rates) at the worst possible time, and a slowdown narrative may develop thereby supporting bond prices.

The signals here are mixed, with jobs readily available but consumers around the world are clearly starting to come under pressure. Fiscal tightening from less generous governments and companies who have already built up stocks of their goods to sell will also restrict future growth.

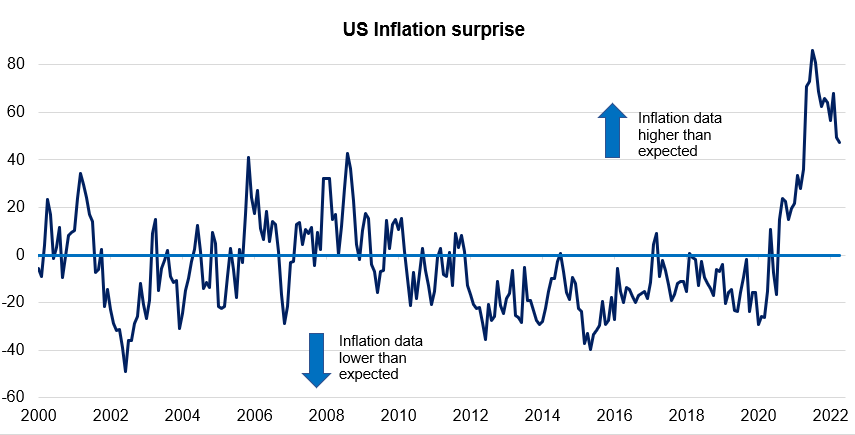

There are also signs that inflation data is becoming less shocking. With the base effects of already expensive resources in place, ongoing price changes need to be of a magnitude larger than those that have caused the inflationary spike so far.

Source: Bloomberg, Citi US Inflation Surprise Indicator. Data to 30th April 2022

Portfolio positioning in bonds

There have been few places to hide in fixed income markets so far this year. But our firm belief is that fixed income assets still have a role to play in diversified multi-asset portfolios.

Lower levels of portfolio duration[2] from strategic changes made to portfolios last year have been beneficial, with higher cash levels on portfolios dampening the impact of bond market volatility. The Netwealth sterling portfolios have also favoured UK government bond exposure over US Treasuries since October last year, believing that the UK economy was unlikely to sustain the pace of change seen by the US, which has had a positive impact in relative terms.

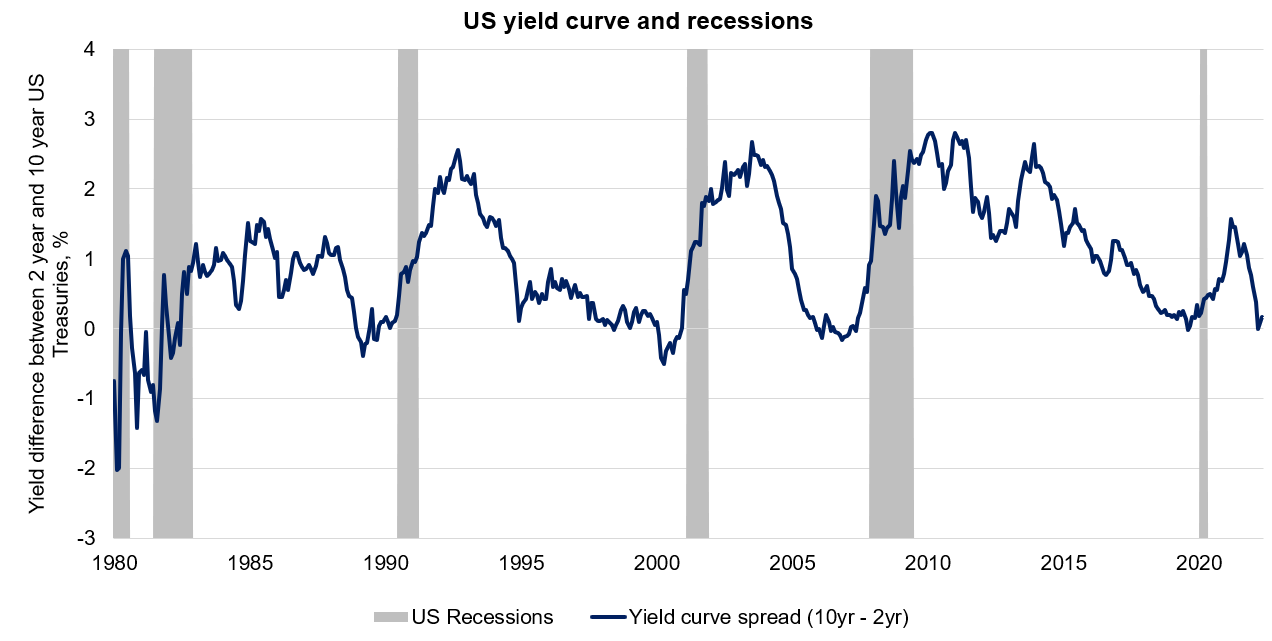

Investing more in long-dated bonds has also been positive. Investors have questioned whether the longer-term outlook for growth can be sustained given the aggressive pace of planned interest rate hikes outlined by the Federal Reserve. Normally, the market requires that longer-term borrowing is compensated for by higher rates, but the compression of relative yields – a flattening of the yield curve – suggests that interest rate hikes can’t be sustained.

What about other assets?

As well as a signal of changing attractiveness of different parts of the bond market, the inverted yield curve (where 2-year bonds briefly yielded more than 10-year equivalents in this instance) is often held as a warning signal for the future health of the economy, with recessions frequently following in due course due to the tightening of liquidity (making it more expensive to borrow) – just as we are seeing today.

Source: Bloomberg

Slower global growth is worth monitoring, but it needn’t necessarily be a negative for all assets in the short term. Equity markets have often produced positive returns in such environments, but overall valuation levels must be watched carefully.

Meanwhile, assets which protect against future inflation are often expensive. Our preferred approach is to consider which exposures will benefit from the likelihood of an ongoing, broadly inflationary environment, rather than relying on instruments which need prices of goods, resources and services to march ever higher.

Longer term, all market participants will need to consider whether there has truly been a step change in the trend growth of the global economy. We will continue to build diversified portfolios, assessing all potential assets on their response to this changing macro environment, but also taking into account fundamentals, valuations, market sentiment and positioning.

If you would like to know more about how a globally diversified and actively managed asset allocation could help you achieve your investment goals, please get in touch.

Please note, the value of your investments can go down as well as up.

[1] Bank of America Merrill Lynch Fund Manager Survey, April 2022.

[2] Duration measures the sensitivity of an individual asset or overall portfolio to changes in bond yields, such that high duration assets benefit more from falling yields than low duration ones.