Our Views on the Investment Landscape in 2021

Just as the investment environment is not static, neither is our response to the changes that occur. Our thinking adapts, our actions allow us to adjust to the inevitable challenges and help us to seize the opportunities. This is a summary of our latest thinking, and what that means for investors.

Inflation expectations have increased, and so has uncertainty

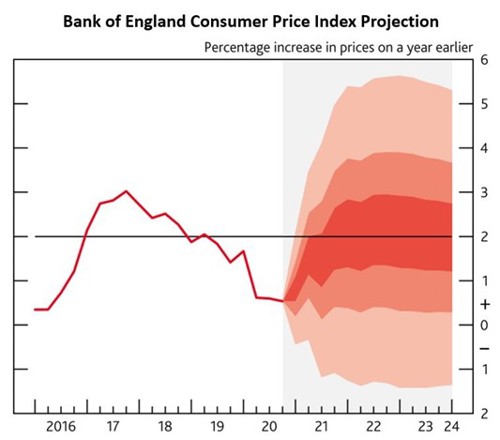

Inflation expectations have certainly increased, and so has the level of uncertainty around its potential path. For example, the Bank of England projects a considerable range of possibilities for the performance of consumer prices in the years to come.

![]()

![]()

Source: Bank of England Monetary Policy Report, Feb 2021

We haven’t seen price increases come through yet and the US Federal Reserve remains relaxed. Yet they must balance confidence in the US recovery with assuring investors that they will see price stability in key markets. Whatever happens with inflation, our job is to make sure that portfolios can accommodate a wider range of different outcomes in the future.

What will provide diversification?

Historically we have relied on and been rewarded by high quality corporate bonds to diversify away from more growth-oriented assets such as equities in our portfolios. While that has been a meaningful position on conservative and balanced portfolios, the prices at the moment offer reduced compensation for the combination of risks that exist.

As we are reducing investment grade corporate bonds in our portfolios and also reducing sensitivity to moves in fixed income as a whole, what will provide the diversification within portfolios?

While gold can be an imperfect hedge for inflation, what we like about gold at this point is that a lot of the exuberance that was priced in through the sharp moves of last year has gradually ebbed away as real yields on bonds have shifted away from their extreme negative levels.

When inflation is running hot, gold tends to decorrelate from the returns delivered by equities, so you get a bit more diversification by including gold in portfolios. That will be an important change for our lower risk to medium risk level portfolios.

For higher risk portfolios to diversify away from equities we have typically held risky credit – either high yield (or rather low quality) US corporate bonds or emerging market debt. Over the past 10 years the returns to US corporate bondholders have been sustained by just enough growth, while it has been a very weak period for commodities.

However, that relationship could be changing – and with high yield debt outperforming commodities in aggregate by about 6% every year over the last two decades, we believe it is now time to adapt to those changes. We are therefore adding commodities to our higher risk level portfolios.

What if inflation ‘disappoints’?

On many occasions over the past 10-12 years people have incorrectly called the turning point for inflation and therefore US interest rates. But what happens if inflation comes in under current expectations again?

We need to think about what is priced in. The difference in yields between very long dated bonds, such as 30-year Treasuries, vs short-dated bonds, such as 5-year Treasuries, have changed. People holding long-dated securities are already indicating they are a little worried about inflation, requiring relatively higher yields in compensation.

Yet if inflation fears subside a little or the Federal Reserve leads the market to think they will need to raise interest rates in the near term, then we expect this relationship to change to some extent.

So having reduced our overall exposure to fixed income, we’re taking slightly more targeted exposure to places where we think that inflationary concerns are already reflected within the market – and we are therefore adding more to long-dated bonds.

Cyclical drivers of returns: the prospects for various regions

What happens in the wider world feeds through to all assets and equity markets are also very focused on whether global growth will reignite.

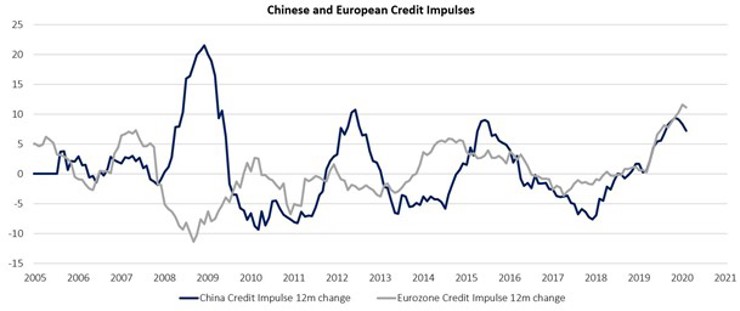

We can get an indicator of this by looking at the rate of change of lending, known as the credit impulse – for example in China and the eurozone.

![]()

Source: Bloomberg with Netwealth calculations

As these lines are moving higher it suggests that the pace of lending is accelerating, which fundamentally should be positive for equities. Lending typically drives economic growth and helps economic activity to pick up.

In the US, the recent stimulus response has been striking in the way it is helping confidence, especially as the economy opens up. The European response has been a little bit slower. Lending should really be accelerating at a faster pace than this and we expect the economic recovery to be a little slower as a result.

Yet the Chinese credit impulse, though meaningful, is not really out of the ordinary compared to other periodic changes. And to us that really reflects upon the way that the Asian economies have handled the recent crisis particularly well and haven’t needed to adopt the type of economic packages seen elsewhere.

Conflicts and opportunities over the short and long term

When we speak about our investment philosophy, we often focus on our strategic approach, thinking about the asset returns we believe will be delivered over the next 7 to 10 years.

At times thinking about those strategic considerations comes into conflict with what we can see on a cyclical basis, so we need to take both those short term and longer-term outlooks into account. Our regional allocations are currently one example of that.

On the one hand we believe that UK large cap equity valuations really offer strong value, and we have benefited from that in the past few months as the UK equity market has performed particularly well.

However, in the immediate term we wonder if stronger growth will come from markets which are less focused on yield. We think that the UK may have a slightly more muted response to this environment in the near term.

On the other hand, the US could be considered one of the more expensive markets both in terms of its relationship with its own history but also relative to other markets. So that might dampen longer-term returns in this market. However, right now we think that the cyclical recovery in the US is building quite strong momentum, chiefly due to the recent massive stimulus package and accelerating vaccine deployment.

We therefore believe that US companies will perform well compared to their competitors around the world and in the short term we think the US is certainly worth focusing on within portfolios.

The result of our adaptive thinking

Let’s summarise the changes we are making to our investment strategy:

We are broadening our portfolio diversifiers

- Smaller allocations to core corporate bonds within portfolios

- Distributing some of that risk to other areas we think will provide effective defensive characteristics

We accept there will be more inflation uncertainty

- We are introducing commodities (including gold) and long-dated fixed income

We have recalibrated where we invest in equities

- Reverting to global emerging markets from the successful Asian bias held through the past year

- Increasing our US equity holdings for the short term

- Reducing our FTSE 100 holding in the short term in favour of the FTSE 250

The above is a summary and a consequence of how we view the world now. Yet things change, and as professional investors we anticipate and respond to the changes on your behalf.

If you have any questions about our portfolios or about how we can help you to invest for your future, please get in touch.

Please note, the value of your investments can go down as well as up.